Originally published at ValueWalk.

COULD HYPERINFLATION EVER HAPPEN HERE?

For weekend reading, Louis Navellier offers the following commentary:

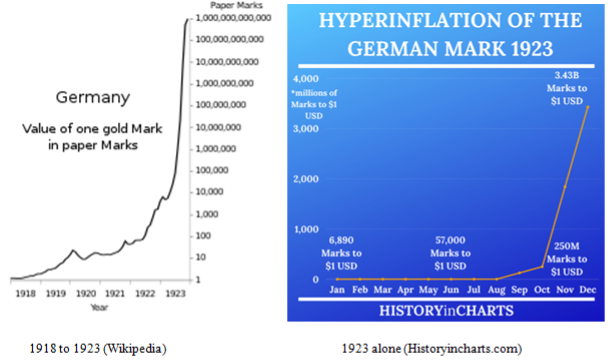

Something insidious began to happen a century ago in Germany – it was something like that proverbial frog getting warmer in a kettle of water over a flame. He didn’t notice when the water warmed, gradually at first. But I’m not talking about frogs (or Frenchmen) here. The German mark, trading at four per U.S. gold-backed dollar in 1914, before World War I, was still worth about 10 marks per dollar in 1921, but in 1922, the erosion began, slowly at first, and then in astronomical leaps and earth-defying rocket launches.

Hyperinflation Has Devasted Savings

This hyperinflation devastated the savings of a generation. Bonds, life insurance, and cash savings were wiped out. You had to cash your paycheck and shop within an hour since cash would be worth half as much within that hour. It’s often said that a “wheelbarrow of cash wouldn’t buy a loaf of bread,” but I always thought that was silly, since nobody owned thousands of small bills. The government just added 13 zeroes to a print run and then you didn’t need no stinking wheelbarrow for a 100 trillion mark note!

As “Adam Smith” (George Goodman) described the scene in his 1982 book, “Paper Money,” Germany’s hyperinflation began June 24, 1922, when fanatics assassinated Walter Rathenau, a “moderate, able foreign minister, a charismatic figure.” That act “shattered the faith of the Germans, who wanted to believe that things were going to be all right,” so they began putting all their cash into “real goods.”

War reparations were another cause: Germany owed impossibly high debts to foreign powers, so the German Central Bank responded by printing boatloads of fiat money. As their currency imploded in November 1923, the country exploded with Adolf Hitler’s failed Munich Beer Hall Putsch. Later, Hitler rode that sense of national unrest to power, as the Nazis won 32 seats in the next election, and the right-wing Nationalist party won 106 seats on promises of 100 percent compensation to the victims of inflation.

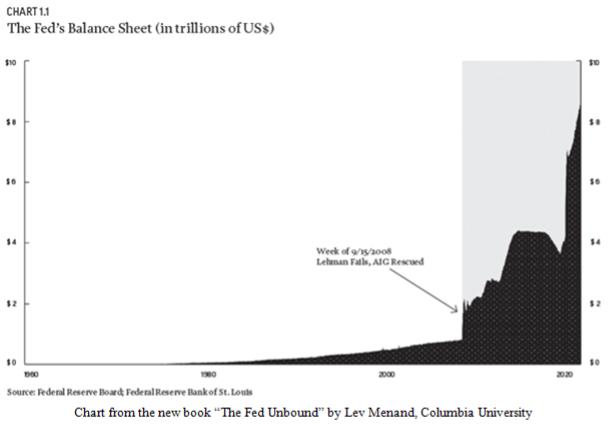

Can it happen here? Probably not, but we crossed a monetary Rubicon in 2008, as explained by Lev Menand, in a new book, “The Fed Unbound: Central Banking in a Time of Crisis.” In essence, the author, an Associate Professor at Columbia Law School, says the Fed has lost control of those areas it ought to manage, while trying to expand its role in those areas it ought not to manage. Specifically, in 2008 it entered the business of bailing out companies – all in an effort to prevent a possible Greater Depression.

In 2008, the new Chairman of the Fed, Ben Bernanke, had been a specialist in studying the Depression years. He had previously honored the great economist Milton Friedman on his 90th birthday (in 2002) by toasting Dr. Friedman, saying, “Regarding the Great Depression. You’re right, we did it. We’re very sorry. But thanks to you, we won’t do it again!” He obviously lived up to that promise, but at great cost.

“In March of 2008, [the Fed] lent $29 billion to prevent the bankruptcy of Bear Stearns… By year-end the Fed had committed $123 billion to save AIG…. The largest loan the Fed had previously made using this authority was $300,000, which it lent to Smith & Corona, the typewriter company, in 1933. Prior to 2008, the total of the Fed’s emergency lending to firms without bank charters in its history was just $1.5 million, all of which it lent during a period, the Great Depression, when nearly a third of the country’s banks closed their doors.”

–From “The Fed Unbound” by Lev Menard

The Fed was chartered to supervise banks. Who gave the Fed power to decide that Bear Stearns should live, Lehman should die, and AIG should live? That’s the “unbound” nature the Fed took on in 2008.

Then, a dozen years later, the Fed more than doubled its balance sheet in a matter of months. This chart, although nowhere near the hyperinflation of 1923 Germany (which was on a log scale) shows a hyper-inflated balance sheet. Only in the Civil War and World War II was there money creation near this scale.

Historic Inflation Rates

No, hyperinflation is not likely to happen on the scale of Germany in 1923, or Hungary in 1946, when an item that cost one Hungarian pengo at the end of World War II in September 1945 cost 2.5 trillion pengo by June 1946. (The inflation rate was 150,000% per day by late June 1946). There were five pengo to the dollar before the war and 460 trillion per dollar in mid-1946. In a twist of fate, the young George Soros, lived through that hyperinflation, which might have turned him into a gifted currency trader later.

The Zimbabwe rate was worse, but took longer, from 1999 (50% a month) to 2008 (500,000,000,000%).

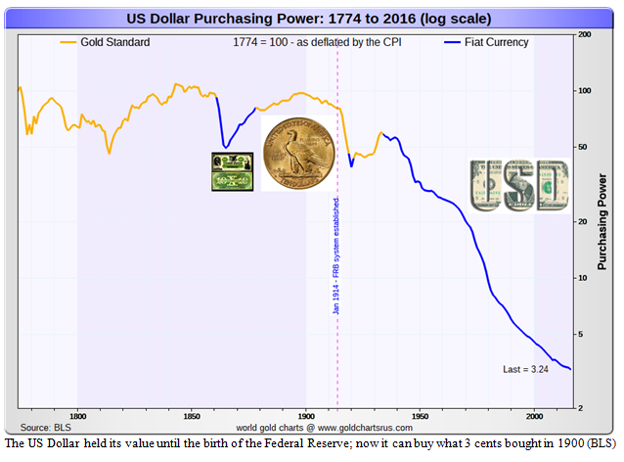

In contrast, something like a slow death happened to the dollar 50+ years ago when President Lyndon B. Johnson took silver out of our coins and President Richard Nixon took any gold backing out of our dollar.

First, on June 23, 1965, President Johnson and his brain trust thought we could over-spend on “guns and butter” (Vietnam and more social spending) if we could run up deficits, so he took silver out of our coins to save money – the first devaluation of our silver coins since 1792. But LBJ quickly added this warning.

“If anybody has any idea of hoarding our silver coins, let me say this. Treasury has a lot of silver on hand, and it can be, and it will be used to keep the price of silver in line with its value in our present silver coin. There will be no profit in holding them out of circulation for the value of their silver content.” –LBJ, 1965

Is that so, boss? Silver’s fixed price was then $1.29 per ounce. It is now over $20, up over 1,400 percent.

Then, on August 15, 1971, President Richard Nixon closed the gold window when gold was just $35 per ounce, and gold is now around $1,775 an ounce – up 5,000 percent in the last 50+ years. Looking through the other end of the telescope, today’s paper dollar is worth just two percent of a gold-backed 1970 dollar.

Inflation may go down to four or five percent by the end of this year, as I predicted at the start of the year, but if inflation still rises by four percent a year, on average, it’s as slow and insidious as that sizzling frog.

Our friend Louis Navellier talked about his daughter finding a one-bedroom apartment near Columbia University costing $5,600 per month. I was just reading the memoirs of the great American composer Aaron Copland at the peak of his fame in 1943. He was upset that his fine room at the Empire Hotel in Manhattan just increased from $8.50 to $13.00 per month, up over 50 percent due to wartime inflation.

No, it’s worse than that. It’s up 65,780 percent in 79 mostly peaceful years. That’s insidious inflation!