Mish has been amazing in keeping up with the administration’s and the Fed’s actions, and in this article presents more horrors, as if we haven’t seen enough. The story Mish comments on towards the bottom, from the Washington Post, A Quiet Windfall For U.S. Banks is particularly outrageous. I highly recommend reading the whole article. If you have any illusions left that the process isn’t entirely corrupt, this article should dispel those.  – Ilene

– Ilene

Battle Over Bazooka Point Lending

Paulson asked for and received the right to do damn near anything he wanted with the $700 billion bank bailout money appropriated by Congress. His next step was to cram money down banks’ throats whether they wanted it or not, at conditions that did not make a lot of sense to several banks.

For a refresher course on that sequence of events, please see Compelling Banks To Lend At Bazooka Point written October 15,2008.

My opening gambit in the above link was "For now, you can force banks to take money, but you can’t force them to lend it."

The operative words in that sentence were "For now".

Because of rising unemployment, rising credit card defaults, rising foreclosures, and the need to increase loan loss reserves, banks are sitting on the money or using it for mergers. Clearly that is a quite a rational thing to do. However, the FDIC will have none of it.

The Washington Post is reporting U.S. to Push Banks To Step Up Lending.

The Treasury Department plans to spend $250 billion to buy stakes in financial firms as part of its mammoth $700 billion financial rescue program. Lawmakers, however, have complained that institutions that have accepted the government investments have been spending excessive amounts to reward their shareholders and top officers instead of increasing lending.

In drafting guidance for financial firms, federal banking agencies have wrestled over how to goad them into lending without compelling them to make bad loans. The Federal Deposit Insurance Corp. wants stronger language that would pressure institutions to lend, while other regulators have argued that that could expose the banks to more losses, the sources said on condition of anonymity because the document has not been released publicly. The disagreement at one point threatened the effort.

My Comment: It’s too bad they resolved the dispute.

"Any suggestion that the guidance will tell banks not to lend to creditworthy customers is not correct," said Kevin Mukri, a spokesman for the Office of the Comptroller of the Currency. In the economic downturn, people most eager to borrow increasingly are considered the most risky.

My Comment: That impeccable logic escapes complete dunces like Sheila Bair at the FDIC, who wants to see lending for lending sake.

"These loans must not be used to acquire healthy banks, hoard in their coffers, or pay shareholder dividends," Sens. Charles E. Schumer (D-N.Y.) and Robert Menendez (D-N.J.) wrote in a letter to Treasury Secretary Henry M. Paulson Jr. last week.

My Comment: While I agree on dividends the rest is ridiculous. Heaven forbid banks do anything rational like acquiring a healthy banks or holding the cash as loan loss reserves.

The Treasury Department has said it wants some banks to use the money to buy troubled rivals. For example, the government refused to invest directly in National City, whose acquisition last month instead was made possible by giving money to PNC Financial Services Group. That has raised concerns that other banks will use the money for acquisitions, which economists generally regard as having little positive impact on the economy.

My Comment: Will acquiring healthy banks help the economy? No, but it won’t hurt it either which is what a bunch of reckless lending will do.![[GIVING+MONEY+AWAY.gif]](http://1.bp.blogspot.com/_GtNyUifKkAs/R6WUX9nCJ0I/AAAAAAAAANU/5RbtoFBZZIk/s1600/GIVING%2BMONEY%2BAWAY.gif)

The Bush administration has defended the use of the rescue money to pay dividends to shareholders. The Washington Post reported that banks may pay shareholders more than half the amount they receive from the government over the next three years, basically passing on money that might otherwise support new lending. White House officials say that giving money to shareholders also is important for the economy.

My Comment: "Giving money to shareholders is important to the economy." Besides fighting needless wars, that sentence sums up the entire Bush Administration philosophy. And Republicans have the gall to worry about what Obama will do. Sheeesh.

Industry groups have criticized efforts to impose restrictions on banks that accept government investments, arguing that many of these firms are healthy and yet are being pressure to participate in the rescue program for the sake of the economy.

My Comment: When an industry group starts bitching about receiving $250 billion, you know it has to be a majorly flawed plan.

The American Bankers Association, the largest industry trade group, has said Treasury officials should either make the program voluntary or eliminate restrictions.

I have a better idea. Scrap the plan and save taxpayers $700 billion dollars.

A Quiet Windfall For U.S. Banks

Unfortunately, there’s still more to the story. With Attention on Bailout Debate, Treasury Made Change to Tax Policy, resulting in a A Quiet Windfall For U.S. Banks.

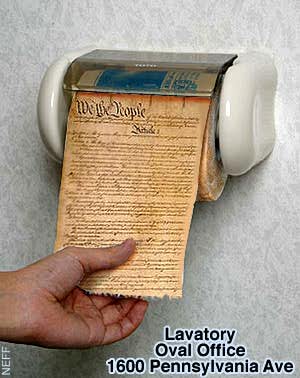

The financial world was fixated on Capitol Hill as Congress battled over the Bush administration’s request for a $700 billion bailout of the banking industry. In the midst of this late-September drama, the Treasury Department issued a five-sentence notice that attracted almost no public attention.

But corporate tax lawyers quickly realized the enormous implications of the document: Administration officials had just given American banks a windfall of as much as $140 billion.

The sweeping change to two decades of tax policy escaped the notice of lawmakers for several days, as they remained consumed with the controversial bailout bill. When they found out, some legislators were furious. Some congressional staff members have privately concluded that the notice was illegal. But they have worried that saying so publicly could unravel several recent bank mergers made possible by the change and send the economy into an even deeper tailspin.

"Did the Treasury Department have the authority to do this? I think almost every tax expert would agree that the answer is no," said George K. Yin, the former chief of staff of the Joint Committee on Taxation, the nonpartisan congressional authority on taxes. "They basically repealed a 22-year-old law that Congress passed as a backdoor way of providing aid to banks."

The story of the obscure provision underscores what critics in Congress, academia and the legal profession warn are the dangers of the broad authority being exercised by Treasury Secretary Henry M. Paulson Jr. in addressing the financial crisis. Lawmakers are now looking at whether the new notice was introduced to benefit specific banks, as well as whether it inappropriately accelerated bank takeovers.

The change to Section 382 of the tax code — a provision that limited a kind of tax shelter arising in corporate mergers — came after a two-decade effort by conservative economists and Republican administration officials to eliminate or overhaul the law, which is so little-known that even influential tax experts sometimes draw a blank at its mention. Until the financial meltdown, its opponents thought it would be nearly impossible to revamp the section because this would look like a corporate giveaway, according to lobbyists. …

Fed Uncertainty Principle In Action

Long time readers will note this is yet another instance of the Fed Uncertainty Principle in action.

Corollary Number Two: The government/quasi-government body most responsible for creating this mess (the Fed), will attempt a big power grab, purportedly to fix whatever problems it creates. The bigger the mess it creates, the more power it will attempt to grab. Over time this leads to dangerously concentrated power into the hands of those who have already proven they do not know what they are doing.

Corollary Number Four:

The Fed simply does not care whether its actions are illegal or not. The Fed is operating under the principle that it’s easier to get forgiveness than permission. And forgiveness is just another means to the desired power grab it is seeking.

All you have to do is substitute Treasury for the Fed in the above paragraphs and you have it. In case you didn’t notice, they are in cahoots.