Write up for TV tomorrow:

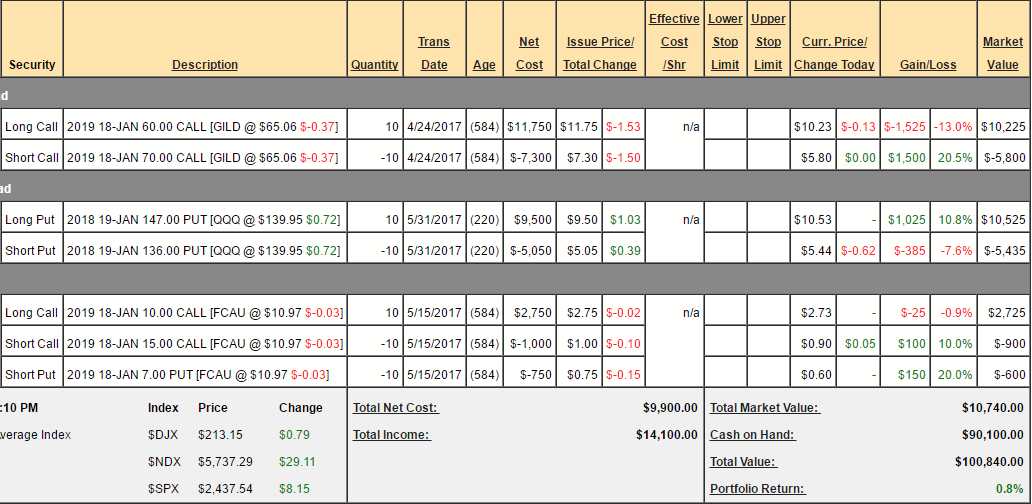

So far, in our new educational series, we've put $10,100 to work and we're up $840 (8%) in our first two months.

Last time I was on (5/30) we talked about hedging the Nasdaq Futures using /NQ as it crossed the 5,800 line with tight stops ($100 loss) and again at the 5,900 line and the first time it didn't work and we lost $100 and the 2nd time it didn't work, and we lost $100 but the 3rd time, at 5,900 - it did work spectacularly well and we got a 200-point drop that paid $4,000 per contract for a net $3,800 per contract gain:

We also discussed using a bear put spread on the Nasdaq ETF (QQQ), buying 10 Jan $147 puts for $9.50 ($9,500) and selling 10 Jan $136 puts for $5.05 ($5,050) for net $4,450 on the $11,000 spread.

QQQ fell about $4 since the 30th and the spread is now net $5.50 ($5,090) for a $640 gain (14%) so far against the 2.5% drop in the Nasdaq. That's one example of getting good leverage.

We wanted to discuss leverage today so let's talk about how we can limit our risk while still having good upside with a speculative play on the Pharmacy play, Zynerba Pharmaceuticals (ZYNE).

ZYNE makes transdermal delivery systems (skin patches) for cannaboid therapeutics (pot) to help treat epilepsy and they are conducting a Phase II trial that, if it goes well in August, could lead to explosive growth. Or it could fail and they die - so it's the kind of play where we want to limit our losses.

Rather than buying the stock for $18, we can instead go past our expected August event and buy a bull call spread that limits our downside risk:

- Buy 4 ZYNE Nov $15 calls for $7.50 ($3,000)

- Sell 4 ZYNE Nov $22.50 calls for $5 ($2,000)

That puts us in the $3,000 spread for net $1,000 and our loss is limited to the $1,000 we put in yet our upside potential is $2,000 (200%) at $22.50.