Well, we all held up quite nicely didn’t we?

The Durable Goods reportwas pretty poor and Barry Ritholtz has a very scary unspin on the NAR Numbersthat should please the housing bears but Uncle Ben must have borrowed Cramer’s “BUY BUY BUY” button for the day as he came out whistling “Don’t Worry, Be Happy” in New York.

Bernanke couldn’t get the markets moving despite sticking to my script of hawkish on inflation and enthusiastic about the economy – I think his delivery needs a little work as he always sounds like he’s actually quite worried about something.

Perhaps is was this statement: “A home for which the sales contract is cancelled becomes available for sale once again but is not included in the official data on the inventory of unsold new homes.”

I found that quite shocking. A home which is not sold is not counted as an unsold home… How many homes are we hiding in this country?

So despite Ben’s rah rah speech (and the Italian American Foundation atendees almost fell out of their chairs by the time he was done 45 minutes later!) the markets were unenthusiastic until the old master, Greenspan came to the rescue.

The former Fed Chairman said “that the worst of the housing adjustment was over, and that he was preparing to publish an analysis of the “serious dispute” over the true effect of mortgage wealth on consumer spending,” otherwise known as The Consolation Prize Theory.

You know the Fed is trying to spin the economic data when they coordinate 2 governors, Bernanke and Greenspan to all give the same message on the same day!

Not only that but Paulson took a swing at itover in London by saiying that the US economy is “healthy and a strong US dollar will keep it that way.” I’d like to know where he’s getting his dollars from because the ones I have are looking mighty weak!

All these happy, happy policy makers managed to convince a stunning amount of people to ignore $60 oil and “buy on the dips” enough to give us a positive close across the board.

NYSE advances outpaced declines by roughly 2 to 1 and AMEX up volume outpaced down volume 81% to 17%.

On the whole, the Dow was a slacker with XOM contributing the majority of the 15 point move for the day. We all know I’m no fan of oil-based rallys so we’ll leave it at that but suffice to say that, if you take out oil and didn’t have the talking head all-stars out on a global pumpfest, the day might not have gone so well.

Let’s not get all giddy about a small bounce from yesterday’s drop until we see something resembling a trend:

- Dow 12,072 is not even 12,100.

- S&P 1,386 is acceptable if we hold tomorrow.

- NYSE had a nice 31 point recovery to a critical 8,851

- The Nasdaq closed at 2,412 – better than 2,390 (LOD) is all I can say about that.

The SOX didn’t recover 480 and the transports gave up more ground but held 2,650 by a point and a half (after testing 25 points lower).

Oil once again lost ground to the declining dollar, gaining just a quarter of a point against the dollar’s half point tumble. It did however, take a series of bounces off our $60.32 resistance zone which is starting to form some support.

Gold actually dropped $2.40 to settle at $644 so what’s up with that? You need to think of gold as a fighter you send in to spar with the dollar, whose chart looks like this.

“Come on Gold,” you say “get back in there – a real currency will eat you alive!”

=====================================

Our oil puts got eaten alive today, including some new XOM $72.50s I picked up for what seemed like a bargain at .70 this morning. They finished down .15 at .55 and the pain continues!

In comments I said I expected to take a DD at $75 but I guess I didn’t really didn’t want to as I came back this evening very disappointed in XOM’s $1.69 move today. Is it possible that the entire energy sector, perhaps all commodities, have achieved escape velocity and left the rest of the market behind?

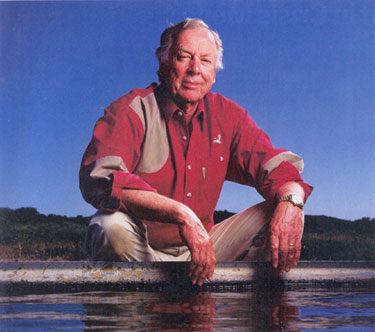

Sure it seems unlikely, even ridiculous. Sure it’s contrary to all logic but T. Boone Pickens told some guys in Arkansas that we hit peak oiland traders jumped all over that while ignoring the CERA report that indisputably proves he’s a senile old pumping coot.

I guess, much like discussions on evolution, it comes down to a case of who do you want to believe – the world’s top energy scientists or a 78-year-old man who has a Billion dollars bet on higher oil prices?

So far T. Boone is kicking our butts so let’s give the devil his due!

==================================

We had to give up our DIA Jan $121 puts this morning for $1.90 (up 80%) as we didn’t want to risk it this morning but I personally didn’t make any other moves (other than throwing more money at XOM) as it was a short day for me.

I know I’m behind on the update but we wrap the month this week and I promise to be all caught up for the weekend!