"That's life, that's what all the people say.

You're riding high in April, Shot down in May

But I know I'm gonna change that tune,

When I'm back on top, back on top in June.

I said that's life, and as funny as it may seem

Some people get their kicks, stompin' on a dream

But I don't let it, let it get me down, 'cause this fine ol' world it keeps spinning around.

I've been a puppet, a pauper, a pirate, a poet, a pawn and a king.

I've been up and down and over and out and I know one thing:

Each time I find myself, flat on my face,I pick myself up and get back in the race."

We know Sinatra was a gambler which is probably why the lyrics to "That's Life" are so appropos for the market of late. He imparts good, solid advice to all of us when he says "I don't let it get me down."

Bulls and bears alike have been whipsawed by the markets these past few weeks and, while it's comforting to point to the "Wall Street Crooks" who manipulate the markets it has often been noted that we never complain when "THEY" are manipulating things our way…

The timing could not have been better this week for Cramer's take on manipulating the markets to snowball as this low-volume rally has all the earmarks of being manufactured but manufactured rallies can often lead to genuine rallies (see oil 2003) that take on a life of their own, whether intended or not by the original manipulators.

I mentioned in my Cramer article how Fibonacci levels can be used to "lure" buyers back into the markets, just in time to trigger relentless sell-offs – this is one of the reasons I'm having a miserable week so far sitting out this "rally" as it breaks out of my 20% "danger zone" and heads right up the the critical 38.2% breakout zone.

I mentioned in my Cramer article how Fibonacci levels can be used to "lure" buyers back into the markets, just in time to trigger relentless sell-offs – this is one of the reasons I'm having a miserable week so far sitting out this "rally" as it breaks out of my 20% "danger zone" and heads right up the the critical 38.2% breakout zone.

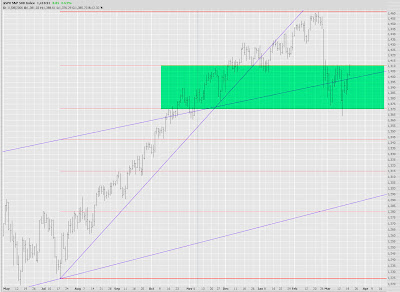

Trade Tim points out that the Russell has been tightly bound by the upper Fibonacci levels and the S&P is, as usual, a textbok example of an index that obeys its trading range:

I've been tracking the opposite retracement levels (from the recent drop) and I called 1,407 a breakout on the S&P but we can see here that we REALLY need to see those extra three points hold in order to get a real comfort level and 1,400 seems like a failure ahead of my 1,391 danger zone.

At least it's not just me being a worry-wart. The Blogger Sentiment Poll has hit it's all-time bearish high at 54% with just 19% of the bloggers polled saying that they have a bullish outlook for the S&P over the next 30 days. I can't say much for the accuracy of this poll as it seems to me that it tracks more reactive than predictive but it is important to understand how quickly the press can change their tune in light of Cramer's ascertations that playing them like a fiddle is part of the fund manager's arsenal.

At least it's not just me being a worry-wart. The Blogger Sentiment Poll has hit it's all-time bearish high at 54% with just 19% of the bloggers polled saying that they have a bullish outlook for the S&P over the next 30 days. I can't say much for the accuracy of this poll as it seems to me that it tracks more reactive than predictive but it is important to understand how quickly the press can change their tune in light of Cramer's ascertations that playing them like a fiddle is part of the fund manager's arsenal.

I'm a fundamentalist and reading bearish takes on the market from Bill Cara and Stephen Roach, who says "Subprime is today's dot-com – the pin that pricks a much larger bubble" is downright frightening but I have to wonder – is it meant to frighten me?

In order for hedge funds to buy, someone has to be selling and if we are really in the Super-Mega-Global-Market Rally I predicted in December then it stands to reason that unscrupulous hedge funds will, from time to time, engineer corrections to shake us out of positions so they can swoop in and pick them up on the cheap.

So the question for the week is "Are we being shaken up or are we being shaken down?"

So the question for the week is "Are we being shaken up or are we being shaken down?"

Remember this correction started when much ado was made about nothing as a correction in the easily mainipulated Shanghai Stock Exchange sparked a huge global sell-off that was met all too quickly with a wave of buying ahead of Fed meeting. Actually, the timing was just ahead of earnings from the brokers that would have, had there not just been a little crash, surely have taken the markets up to new highs.

Asia is bouncing quickly back and, when you think about it, why shouldn't they? A company that is just treading water in China or India will grow 10% a year along with the rest of their economies. CHL just announced a 23% rise in net profits this morning and is making so much cash that they are considering a special dividend – yet, at the beginning of the month, the company lost 20% of it's market cap in panic selling.

Asian markets closed nicely higher again with the Hang Seng adding another point and the BSE picking up almost 2% (the Nikkei is closed for the equinox) but also on low volume. Another factor driving foreign markets is M&A and, as a person who's been involved in quite a few, I can tell you that the timing of the announcement of these protracted deals is completely up to the parties involved who take it under the advisement of their brokers so, once again, all roads lead back to Goldman Sachs.

Europe is trading slightly positive this morning but they will close well ahead of the Fed statement so we will be watching them for signs of sentiment.

We will be watching our local levels closely today and FDX will be putting pressure on the transports with weak guidance but ORCL and ADBE were strong and (no surprise) MS is coming in with strong earnings as well. The Dow needs to break 12,369, the S&P must hold 1,410, the NYSE is well ahead and the Nasdaq must break 2,411:

They've finally started arresting oil company CEO's but not for the right reasons: TOT's Chris Margerie is being held for questioning by the French police in a bribery scandal involving development rights to Iran's South Pars gas field.

No arrests were made at the NYMEX yesterday as the price of the April crude contract was raised by $1.30 in the last 30 minutes of trading and it is unlikely that anyone will be cuffing the various CNBC analysts as they try to create the impression that oil is "back above $60" today without mentioning that this is not the same contract that was at $56.50 yesterday.

We get our inventory reports today and I have a lot of puts on oil companies. I think it will take a VERY bullish report to push prices over $60 because physical delivery only closes once a month and just yesterday they couldn't find anyone to actually take barrels for $57. Again, expect no arrests to be made or even any questions to be asked as roughly 100 people set the price of oil for the other 5,999,999,900 of us.

Zman reports that analysts are expecting a .8Mb rise in crude and a 1.7Mb draw in gasoline along with a 1.3Bm draw in heating oil. If refineries are still operating as close to 82% utilization, I will be surprised it we make those numbers but I do expect a bigger build in crude as I'm fairly certain they fudged the inventory report last week to make it seem like a bigger draw.

Nothing matters more than the Fed and the dollar today but we can watch gold around $660 to see what the traders are predicting:

So fasten you seat belts – it's going to be a wild day! Hopefully we'll finally gain some clarity after the Fed but, then again, I could just be wishing because it's hard to tell a shakeout from a shakedown at the best of times.

Be careful out there,

– Phil

Note to members: In addition to Karmcon's excellent posts on electing "Trader Status." the Street has a couple of little videos here and here that give a nice overview.