We have lots of good earnings to point to but some scary economic data hitting the markets this week so it will be a great test of the markets to see what investors are really paying attention to.

We have lots of good earnings to point to but some scary economic data hitting the markets this week so it will be a great test of the markets to see what investors are really paying attention to.

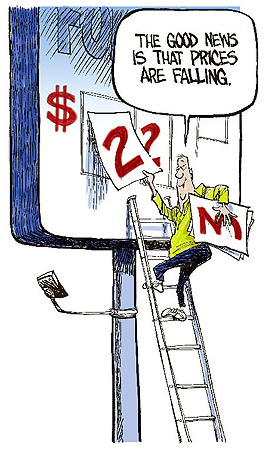

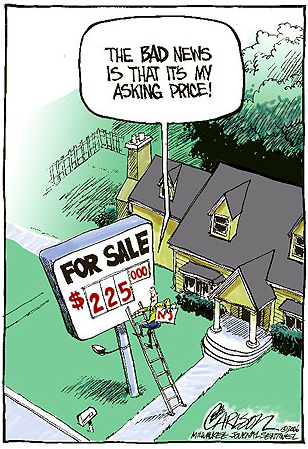

Nothing pre-market but today we have Consumer Confidence (pretty good but down from last month) and Existing Home Sales (how bad will it be?). Tomorrow is a big day with Durable Goods (should be much better), New Home Sales (if there’s no spring uptick – run away!), THE BEIGE BOOK (very big deal) and, of course, crude inventories (temperature moderated, no real driving, airlines grounded – sounds like a build).

Thursday we are hit with Initial Jobless Claims but Friday is the Big Kahuna, the GDP (1.8% expected) with the Chain Deflator and Employment Costs (both have to be up) as well as our beloved Michigan Consumer Sentiment Poll, but it’s just a revision, we already got an 85.3 from them.

Earnings are just too numerous to list but some of the biggies are:

AL – up 30%, AMGN – up 11%, BP – down 17%, BSX – down 64%, COH – up 38%, DD – up 16%, KMB – up 64%, LLL – up 17%, T – up 100%, TXN -down 12% (BTE), WHR – down 1% (but BTE), X – way up but lower guidance?

TGT reported weak sales that would probably really spook the market if it weren’t buried in everything else today and I feel psychic for taking those $60s off the table yesterday but really that’s why we have trading rules – you can’t always know what’s going to happen so we let ourselves stop out and get those profits off the table!

GM blamed the sub-prime meltdown for slow auto sales but TM is up 10% Globally and GM would do well to listen to Toyota’s statement: "Our goal has never been to sell the most cars in the world, we simply want to be the best in quality. After that, sales will take care of themselves." Quality – who’d have thought that would work? Certainly not US auto makers as Toyota gained 12.9% last year, passing DCX and placing the neck and neck with F.

GM blamed the sub-prime meltdown for slow auto sales but TM is up 10% Globally and GM would do well to listen to Toyota’s statement: "Our goal has never been to sell the most cars in the world, we simply want to be the best in quality. After that, sales will take care of themselves." Quality – who’d have thought that would work? Certainly not US auto makers as Toyota gained 12.9% last year, passing DCX and placing the neck and neck with F.

Asian markets finished flat as rising oil prices put a damper on stocks over there but we got a good gain from the BSE, which was lagging the group.

China said they would fight the US on product piracy regulations over at the WTO, which is an interesting place to make a stand as it is their most egregious violation. It’s not so much that China doesn’t acknowledge the problem, it’s that they were under the impression they would be able to work the matter out themselves and they are annoyed at our impatience. YHOO already caught some flack in this as China ruled against them in a suit brought by recording companies, who were awarded fines because Yahoo had links to illegally copied songs. BIDU won a similar lawsuit in November so "ha-ha America."

How great is this market? This market is so great that MS banished famed perma-bear and chief economist, Stephen Roach to China – I told you it was dangerous to be bearish in this market!

That being the case, far be it for me to say something negative about the markets or we may wake up to find out .com taken away and I’ll have to get one of those dreadful .us addresses… Europe started out OK but fell off the table around lunch, still feeling the pain of AZN’s big drop but it was REITs that led the drop. The Yell Group (yellow pages publishers) dropped 21% on news that US revenue growth will slow to 3%, down from 10% expected. Advertising slowdowns are a very bad early indicator of economic malaise.

BP earnings were sharply down as they produced 700,000 barrels a week less than last year, the price of complying with OPEC production cuts. We will hear from the other majors this week and next and it will be interesting to see how much oil they had to take off the table to create this "shortage."

Tech should give us a boost today with good news from TXN and T. Our test results will be simple today, anything down is very bad and anything up will be good but not great until we get back above yesterday’s levels:

|

|

|

Day’s |

Must |

Comfort |

Break |

Next |

|

Index |

Current |

Move |

Hold |

Zone |

Out |

Goal |

| Dow | 12,919 | -42 | 12,468 | 12,600 | 13,000 | 13,500 |

| Transports | 2,901 | -4 | 2,825 | 2,900 | 3,000 | 3,250 |

| S&P | 1,480 | -3 | 1,430 | 1,460 | 1,500 | 1,550 |

| NYSE | 9,660 | -36 | 9,218 | 9,465 | 9,600 | 10,000 |

| Nasdaq | 2,523 | -3 | 2,454 | 2,500 | 2,600 | 2,750 |

| SOX | 484 | -3 | 477 | 490 | 500 | 560 |

| Russell | 827 | -1 | 803 | 820 | 850 | 900 |

| Hang Seng | 20,572 | 16 | 20,200 | 20,600 | 21,000 | 22,000 |

| Nikkei | 17,451 | -3 | 17,400 | 17,500 | 18,300 | 18,500 |

| BSE (India) | 14,136 | 208 | 13,200 | 14,000 | 14,725 | 15,000 |

| DAX | 7,289 | -46 | 6,900 | 7,000 | 7,400 | 8,000 |

| CAC 40 | 5,905 | -12 | 5,650 | 5,800 | 6,000 | 7,000 |

| FTSE | 6,444 | -12 | 6,325 | 6,450 | 6,600 | 7,000 |

If it weren’t for the BSE I would be concerned and I’ll be watching the FTSE closely as they are at a critical level. If we don’t get an uptick in the SOX I will turn bearish fast as we are not going to be getting better news than TXN’s from anyone else who is scheduled to report.

Oil will simply kill the markets if it insists on remaining over $65. So far the average for this month is $64 vs. March’s average $61.50 and February’s $60 (Jan was way down at $55). This is going to come back and bite us in the inflation data and let’s not forget that Brent Crude is up MUCH higher ($69) than WTIC so it’s really worse than you think.

As long as gold stays below $700 there is a ray of hope but it just looks like it’s biding its time to me, waiting for the right moment to make another run at $800. I hope this doesn’t happen because I really don’t think the economy can take it this year (a general commodity run, not just gold).

Let’s put on our Dow 13,000 caps but – VERY CAREFULLY!