Fed Day – Party Time – Excellent!

Well we hope so anyway. What is the Fed really going to say? Raising rates is not an option with housing teetering on the precipice (see TOL earnings) while lowering rates will send the dollar through the floor that is below the floor we fell through in early April. The dollar has been bound by roughly 2% moves so right now we are watching the range between 81.50 and 83 but a breakdown here will take us to a critical failure level at 80 which would be a real Global mess coming into the summer travel season.

So the Fed remains on hold and the market will worry over nuances like who voted and who objected and what word did they use to describe inflation but the reality is that the release of the Fed minutes will be used as an excuse for the market to do what it wants to do anyway so we're going to tighten up our DIA puts and maybe pick up a few calls if we get another nice dip as a strangle would be fun today.

Speaking of strangles – my long standing premise on DNDN has been that the FDA would destroy the callers by asking for more information and delaying their decision and that happened this morning. While we will play it by ear, all of our positions allow for this eventuality but the sell-off in the pre-market is severe as the stock is trading down 60% at the moment (7:30). Our two new plays yesterday were taking the stock for $17.20 and selling the $12.50s for $8.10 and while that may sting at first, I'm hoping for a quick buy-out of our callers on the overreaction and another sell into June to turn this into a nice income producer (sorry Mr. $8.10 caller). Our more complicated play of the day was to buy the $2.50s for $14.65, sell the $12.50s for $8.10 and buy the $7.50 puts for $1.02. I'll be curious to see what the $7.50 puts go for this morning but this trade should be fun to manage as well.

My prediction on this is that the FDA is asking for more information because they want to be able to blame the company for supplying overenthusiastic data if they run into issues after the approval so we'll get there but not fast enough for our May callers. We should have been more concerned yesterday when there was an attempt to float a rumor of a DNDN/NVS deal that amounted to nothing. Rumors like that are often started ahead of a tumble…

There was no tumble in Asia as the Shanghai Composite busted through 4,000, led by "red-chip" stocks. We don't usually track the Shanghai as it's a small, manipulated index that hasn't really gone down since mid 2005 but this move is noteworthy as it comes less than 60 days after the index broke through 3,000 on March 19th. No doubt there are some very pleased Chinese investors, who obviously came back from a week-long holiday in a buying mood.

Banks led the China rally as the dollar continued to decline over there and more money flowed Far East and away from the states. This puts the onus on the Fed to remain hawkish in words, if not in deeds but, on the whole, it was a bold move ahead of the Fed decision indicating that the Asian markets simply aren't that concerned with what we do anymore.

Europe seems moderately concerned and trading over there is mixed this morning. They have to place their final bets hours before our 2:15 Fed release but Brent climbed back over $66 a barrel and that is putting a damper on their markets which are resting at record levels.

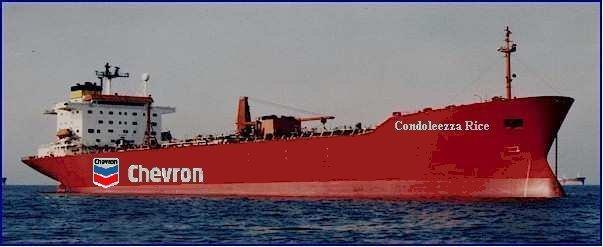

We have our own crude inventories today and ZMan points out that Criminal Narrators Boosting Crude already whipped out the HURRICANE! charts yesterday as the first tropical storm of the year headed for the Gulf. Our transports shrugged off oil's move yesterday as we held below $62.50 and that mark will be critical today as it affects the Fed's outlook on inflation as well as profit oulooks of many corporations. There will be testimony on gasoline price gouging in Washington today but what difference does it really make when the total fine levied against CVX for making billions of dollars of illegal deals with Saddam Hussein is just $25M? Party on Big Oil!

Fun fact: Who was the Chairman of Chevron's Public Policy Committee, responsible for overseeing International programs? Answer: Condoleezza Rice! Could this country possibly look more corrupt? Although the "Oil for Food" program ran from 1996 through 2003 (when we invaded) and Ms. Rice's tenure at Chevron ran from 1991-2001 a Chevron spokesman Kent Robertson managed to claim with a straight face that: "Chevron has reviewed its board minutes and has confirmed that there is no record of the issue of possible surcharges under the U.N. Oil-for-Food Program having been raised with the board during Secretary Rice's tenure as a director."

Fun fact: Who was the Chairman of Chevron's Public Policy Committee, responsible for overseeing International programs? Answer: Condoleezza Rice! Could this country possibly look more corrupt? Although the "Oil for Food" program ran from 1996 through 2003 (when we invaded) and Ms. Rice's tenure at Chevron ran from 1991-2001 a Chevron spokesman Kent Robertson managed to claim with a straight face that: "Chevron has reviewed its board minutes and has confirmed that there is no record of the issue of possible surcharges under the U.N. Oil-for-Food Program having been raised with the board during Secretary Rice's tenure as a director."

Man, we will just believe anything won't we?

In a starling coincidence that should give CVX some sympathy and distract us from the above news, 4 Chevron workers were kidnapped by Rent-A-Rebel off a construction barge. In a funny side story, Nigeria has saved 1.22 Trillion Nigerian dollars this quarter (I don't know the conversion) as they had projected selling oil at $40 and, in fact, have been selling it for $66 so it turns out that knocking out 25% of their production actually boosted net revenues – who'd have thought?

I'll post today's chart but we really don't care what happens until 2:15 so tune in for the intra-day action as we have a lot of balls in the air today:

|

|

|

Day's |

Must |

Comfort |

Break |

Next |

|

Index |

Current |

Move |

Hold |

Zone |

Out |

Goal |

| Dow | 1,309 | -3 | 12,468 | 12,600 | 13,000 | 13,500 |

| Transports | 2,914 | 7 | 2,825 | 2,900 | 3,000 | 3,250 |

| S&P | 1,507 | -2 | 1,430 | 1,460 | 1,500 | 1,550 |

| NYSE | 9,788 | -37 | 9,218 | 9,465 | 9,600 | 10,000 |

| Nasdaq | 2,571 | 1 | 2,454 | 2,500 | 2,600 | 2,750 |

| SOX | 501 | -2 | 477 | 490 | 500 | 560 |

| Russell | 830 | -1 | 803 | 820 | 850 | 900 |

| Hang Seng | 20,844 | 138 | 20,200 | 20,600 | 21,000 | 22,000 |

| Nikkei | 17,748 | 138 | 17,400 | 17,500 | 18,300 | 18,500 |

| BSE (India) | 13,781 | 16 | 13,200 | 14,000 | 14,725 | 15,000 |

| DAX | 7,429 | -13 | 6,900 | 7,000 | 7,400 | 8,000 |

| CAC 40 | 6,029 | -4 | 5,650 | 5,800 | 6,000 | 7,000 |

| FTSE | 6,550 |

-53 |

6,325 | 6,450 | 6,600 | 7,000 |

The S&P must hold and the SOX must get the Nasdaq going again. An inventory build and oil capitulation can rally the transports but I think they need to see a week below $60 before they can poke their heads over the critical 3,000 mark that will give the Dow the green light to 14,000.

In addition to DNDN we have very negative reactions to CSCO and DIS and I'm glad we waited on DIS as today should be a great day to buy. I'm thrilled with CSCO as we took 75% of our calls off the table leaving us heavy in very cheap puts so we should win on both ends of that spread.

Gold should go down ahead of the Fed as it won't break $690 without a good reason but a weak Fed statement could bring us all the way to $700 by the day's end. We'll look for some irrational exuberance around the oil inventories, as there should be at least one big sell-off into June contract expiration next week.

Be very careful out there – it should be another exciting day!