Well, that was interesting!

Well, that was interesting!

We began this morning looking for clues. So what did we learn today:

- We learned that the markets are VERY rate sensitive

- An early dip in the 10-year rallied stocks and an 11am reversal paused the rally.

- We discovered that the VIX goes up when the Dow goes down

- Does this mean down is the wrong (volatile) direction?

- We found that investors love to ignore bad signs –

- We learned that ANY BS from ANY Fed Governor can rally the markets

All in all it was a very educational day. The Dow has somehow decided to make 13,580 a new resistance point, as you can see from action yesterday and today. We didn’t quite get the 50% retracements we were looking for to get us back in true rally mode but we did have a strong finish so we maintained a "wait and see" attitude for tomorrow.

Oil inventories made everyone unhappy today with a 1.4Mb draw in crude and a 1.2Mb build in gasoline and an 800K build in distillates. From my perspective that’s a net 600Kb build during the 4th of July holiday week when it was very hot around the country so any kind of build is nasty for oil bulls yet they were able to shake off that news about as well as investors shook off the looming lending disaster so what can you do?

Our man Phil Flynn disagrees with us, but he also disagrees with the EIA and anyone else who doesn’t thnk oil is going to $100. He’s really gotten full of himself and declared victory over the oil bears saying: "But oh no! It seems some of my most ardent bearish critics are starting to throw in the proverbial bearish towel and admit that indeed they have been wrong about the price of oil and are now grudgingly staring to become bullish."

Our man Phil Flynn disagrees with us, but he also disagrees with the EIA and anyone else who doesn’t thnk oil is going to $100. He’s really gotten full of himself and declared victory over the oil bears saying: "But oh no! It seems some of my most ardent bearish critics are starting to throw in the proverbial bearish towel and admit that indeed they have been wrong about the price of oil and are now grudgingly staring to become bullish."

Sorry Phil, but its a very different kind of bull we think you’re spouting in your 24/7 multimedia pumpfest that has now attained Blodget-like levels of sleazeball cheerleading. Now you want us to worry about tropical waves? (I kid you not, he cites this as a reason not to short oil) Now you have to resort to: "One must wonder if the head of the Homeland Security has a gut feeling that there is an increased risk of a terror attack the markets must price in that increased risk as well." Come on folks, let’s call this for what it is – the act of a desperate man! What a total and absolute crock this is.

Zman brought this article to our attention this afternoon entitled: "Big Crude Stockpiles Become A Liability As Profits Disappear" which elaborates on the collapsing contango issue we’ve been observing over at the NYMEX since last month. Just Monday I said: "That’s right T Boone – it’s time to put your money where your mouth is and buy those $71.67 Dec 2015 contracts. It should be a slam dunk, right? How about you Phil Flynn of Aleron? If oil is so sure to hit $80 this summer then how many barrels of December crude do you own for $73.01? Contango is slipping folks and that may mean the pumpers are losing control of this market with over 500M barrels of oil scheduled for delivery to Cushing, OK between now and the end of October." I guess that’s what Mr. Flynn interprets as throwing in "the proverbial bearish towel" but if he can be that delusional about the supply and value of oil, I suppose he can misinterpret anything…

People need to cut through the noise and look at the data for themselves. As usual, the front-month NYMEX contracts are holding up better than the longer contracts and the difference between a barrel of oil this August and one in August of 2008 is now just $1.30 – that’s .10 per month per barrel to cover storage costs for speculators. As I said last week, it’s getting very expensive to maintain this charade.

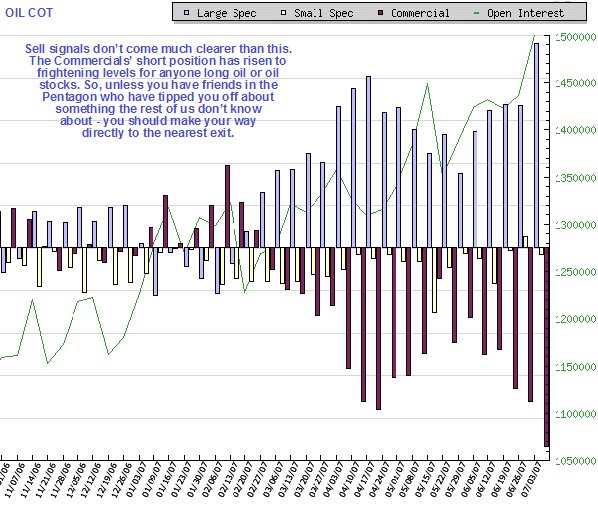

Fortunately, not everyone who writes for 321 Energy is so committed (or should be committed, as the case may be) as Phil Flynn. Clive Maund points out that commercial short positions have risen to "alarming" levels. His take on this signal: "Oil and oil stocks should therefore be sold immediately."

So what do we have here? Speculators are record net positive while commercial buyers of crude (the people who actually use the stuff) are record net short – this is going to be fun!

The dollar gapped down this morning and never recovered, finishing at 80.78, A NEW RECORD LOW, with an imminent test of 80 to come. DBV (a basket of other currencies) is already up 11.54% for the year, which means that any dollar denominated assets you may own (stocks, bonds, cash, your home, your car…) have dropped 11.54% in value in the eyes of 5.8Bn people who don’t live in this country. This will not affect you if you never leave (you hope), but anyone who travels knows how poor we are getting!

The dollar gapped down this morning and never recovered, finishing at 80.78, A NEW RECORD LOW, with an imminent test of 80 to come. DBV (a basket of other currencies) is already up 11.54% for the year, which means that any dollar denominated assets you may own (stocks, bonds, cash, your home, your car…) have dropped 11.54% in value in the eyes of 5.8Bn people who don’t live in this country. This will not affect you if you never leave (you hope), but anyone who travels knows how poor we are getting!

Gold was once again rejected at $666 and oil held $72.94, still 10% below last July’s highs but all this is occurring as global storage hits record levels (remember when Bush asked Congress if he could dig more holes in the ground to pour oil into and they said no?).

While there is clearly a glut of oil being held by speculators there is also a glut of dollars being held by the Chinese, who added $130Bn to their stockpile in just 90 days. Should they decide to cut back on their $1,330,000,000,000 in holdings, we could see that 11.54% loss in our currency’s value double very quickly!

Mega Kudos to Happy Trading for helping us to offset our rapidly declining currency with some excellent picks today. Top of the list was our weekend newsletter pick STP, where our Sept. $35 calls finished at $7.20 and $7.50, up an average of 154% for the week! This is just what we needed to put this whole week firmly in the black: