What an amazing week that was!

We had by far our best virtual portfolio advances of the year thanks to some very nice gyrations from BIDU, GOOG and RIMM, who went up and down like stocks on a trampoline, shaking out our callers and putters alike as we were able to ajust our spreads to bring in some amazing profits.

The week started out innocently enough, in last week's wrap up I noted that we had so many open calls we had to open additional cover plays in the LTP. Fortunately, our two covers were XOM and BIDU puts and, although the Dow got off to a nice start, gaining 100-points on Tuesday, BIDU stayed flat at $325 and our 30% rule turned it into a key position. We put a roll plan into effect, selling the October puts against longer puts and constantly rolling both positions up until the opening jump on Thursday caused us to make a radical move, blowing off buying more callers and collapsing our time advantage in order to roll our position up to the current $360 puts. This could have easily gone the other way (in which case we would have retreated to a bull put spread) but we hit the jackpot with a drop that came so quickly we actually ended up employing a mattress strategy on the way down.

Since we had taken BIDU combinations in several virtual portfolios, the impact was tremendous and we were very lucky to be in the right place at the right time and (at least for those of you comfortable with all the terms in the previous paragraph) we were prepared to take advantage of it. Keeping the virtual portfolio largely in cash was also key as was having a generally balanced virtual portfolio that let us spend 3 straight hours focused almost exclusively on one stock that was making a shocking (but not entirely unexpected) move.

Since we had taken BIDU combinations in several virtual portfolios, the impact was tremendous and we were very lucky to be in the right place at the right time and (at least for those of you comfortable with all the terms in the previous paragraph) we were prepared to take advantage of it. Keeping the virtual portfolio largely in cash was also key as was having a generally balanced virtual portfolio that let us spend 3 straight hours focused almost exclusively on one stock that was making a shocking (but not entirely unexpected) move.

Although I've already extensively detailed the trade itself in Thursday's post, I think it's very important to remind members what it takes to get there. We practice creating balanced virtual portfolios each quarter, starting with the $10KP, then a $25KP until we have enough cash to play our regular short-term and long-term positions as the members advance along the lines. We balance out those positions and work ourselves up to a level where we have some "mad money" to throw into speculative plays like BIDU (winner), RIMM (winner) and XOM (losing so far). With any luck, all that hard work we put in at the beginning puts us in the right place while we wait for the right time to come along.

When the right time does come, there is a very intricate combination of luck and skill that come into play and we either take advantage of the situation or we don't. One of the key things we need to do as traders is to learn to recognize when the trade is over. We're done with BIDU, we're done with BEAS, we're done with RIIMM (until next time they get overbought or oversold) and we're back to 70% cash, waiting for the next opportunity (Google earnings anyone?). It's kind of like playing right field in baseball. Most of the time you just watch the action but, once in a while, a play comes your way and you need to be just as ready as a shortstop or you can blow the whole game.

"The general who wins a battle makes many calculations in his temple ere the battle is fought. The general who loses a battle makes but few calculations beforehand. Thus do many calculations lead to victory, and few calculations to defeat." – Sun Tzu, the Art of War

Trading is like war, we prepare to do battle we look for opportunities to strike and, once in a while, we catch a lucky break along the way. This is why Warren Buffett's rule number one of trading is "Don't lose money." As long as we have money, there will always be another opportunity, as long as we have the patience to wait for it. Our strategies with both RIMM and BIDU were similar, taking each loss as an opportunity to move ourselves into a better position for the next battle, something I learned from Sun Tzu as well as we use the gains from the puts we sold to roll our own puts to higher levels each time:

"Bring war material with you from home, but forage on the enemy… use the conquered foe to augment one's own strength."

Both Option Sage and I follow the philosophy that almost any trade can be saved if we still feel it is worth pursuing. We turn a bad contract into a calendar spread or a ratio backspread or a bull put spread or a bear call or we roll the position or straddle or strangle using our original position as a backstop… Patiently waiting for the rest of the world to come around to our view of a stock. As we like to say: There's always an option!

"In all fighting, the direct method may be used for joining battle, but indirect methods will be needed in order to secure victory. In battle, there are not more than two methods of attack – the direct and the indirect; yet these two in combination give rise to an endless series of maneuvers. The direct and the indirect lead on to each other in turn. It is like moving in a circle – you never come to an end. Who can exhaust the possibilities of their combination?"

– Sun Tzu

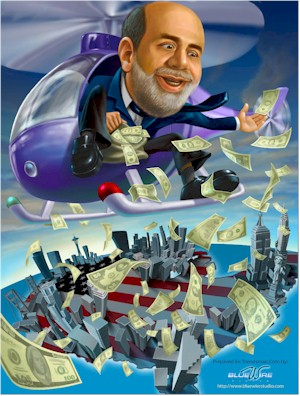

So it was a fantastic week, what a way to break on the new web site! Coming off last week's theme of "What doesn’t kill us, makes us stronger," we started the week off with a big dip on the Hang Seng on Monday morning, which led to what I termed "a very mild dip" on Monday. By Tuesday the Fed came to the rescue as their minutes gave the bulls enough Ammo to rally the markets 100-points. That was our first big break of the week as my lead comment on Tuesday was "Fed Minutes at 2pm. That's it on my take for the markets!"

So it was a fantastic week, what a way to break on the new web site! Coming off last week's theme of "What doesn’t kill us, makes us stronger," we started the week off with a big dip on the Hang Seng on Monday morning, which led to what I termed "a very mild dip" on Monday. By Tuesday the Fed came to the rescue as their minutes gave the bulls enough Ammo to rally the markets 100-points. That was our first big break of the week as my lead comment on Tuesday was "Fed Minutes at 2pm. That's it on my take for the markets!"

We went with that flow on Tuesday but decided the rally was overdone and sold short into it, setting up some of our winning plays. We were rewarded with a great sell-off on Wednesday, based on oil company warnings we had been looking for all quarter. We also got news of weakness in the commercial real-estate sector, which led us to press our bets on VNO and BXP puts we had started last week. The Dow dropped 150 points at the low and finishing back at Tuesdays open.

By Wednesday night we were back in "party like it's 1999" mode as the morning news did not kill us and we geared up for a stronger Thursday. Thursday came on too strong and we went back short by mid-day (11:30 actually, I was a little early with the call as the Dow peak came at 1:15). On Thursday morning I pointed out that "there is no sense of reality to these levels" and playing the market with a grain of salt was just the ticket to get us through a wild, wild day when we were able to cash in our puts, notably BIDU.

After Thursday's plunge we called for a "Flip Flop Friday," which we got (and went back to 70% cash) and here we are! Very, very happy to have steered through a very complicated week…

As I mentioned, we had shockingly good performance from our virtual portfolios, which is to be expected when a single position makes as much money as you started the year with. As I often say, the gains are luck; the skill is knowing where to stand when the luck comes around. They say even a broken clock is right twice a day and as long as we get a play like this once a quarter, even if we just tread water the rest of the time it's all worthwhile. The week's performance was:

-

Short-Term Virtual Portfolio up 143%, 892% for the year.

Short-Term Virtual Portfolio up 143%, 892% for the year.

- Long-Term Virtual Portfolio up 14%, 242% for they year.

-

We opened up 3 new virtual portfolios for the quarter (3 weeks ago):

- The $10,000 Virtual Portfolio is now the $18,190 Virtual Portfolio

- The $25,000 Virtual Portfolio is now the $40,354 Virtual Portfolio

- Our $100K Dow Virtual Portfolio is up to $115,675

- The Happy 100 Virtual Portfolio is now up 3.7%, just warming up!

- Our Stock Virtual Portfolio did well too, up 4% for the week, 41% for the year

- Complex Spreads jumped 103% (thank you Google!), 461% for the year.

Overall we closed 78 positions on the week for an average gain of 159% thanks to some very low basis positions being cashed out as well as a string of 9 BIDU positions which gained from 90 to 585%. Our gain on cash invested was a more reasonable (but still nice) 69%.

All this was set up from last week when I said: "22 of our 83 closed positions were losers but they averaged a 30% loss and were mainly the losing ends of spreads, which is why our remaining positions are in such great shape!" Turns out they were in even better shape than I thought but that's why we raced back to cash at the week's end. Any time your virtual portfolio doesn't do what you expected it to, even if it is in the form of great gains, it is best to take a step back and reassess your position. If you can make outsized gains, you are probably vulnerable to outsized losses so it's best to hedge a bit more before you are put to the test! Getting back to more cash and getting a feel for how your remaining mix of positions is holding up on a go-forward basis is key as many traders make their biggest mistakes after making large gains.

Our $10KP made most of it's gains off the RIMM condor we took back on the 4th but it wasn't the condor itself that made money, it was the adjustments, including rolling up the puts this week the day before RIMM dove well below my target price of $110. The $25KP also did well with RIMM buy also had great gains with SYX (cashed) and LVS (unrealized).

We are back at a pretty comfortable 67% cash position in the STP with just 16 open calls remaining which are evenly matched in number and balance by 16 puts along with 36 spreads. Next week should also be a good week as the premiums on the calls and puts we've sold wind down – if nothing else, it should put a great deal more cash in our pockets as we roll to November sales.

We are back at a pretty comfortable 67% cash position in the STP with just 16 open calls remaining which are evenly matched in number and balance by 16 puts along with 36 spreads. Next week should also be a good week as the premiums on the calls and puts we've sold wind down – if nothing else, it should put a great deal more cash in our pockets as we roll to November sales.

The LTP is 59% cash and has 14 open calls but they are dwarfed by our very large block of XOM Jan $95 puts – I don't expect a BIDU-like drop but I do expect poor earnings and guidance from the integrated majors. Next week is a big earnings week as well as expirations so it should be very exciting but we will be concentrating on setting ourselves up for next month as we reposition our spreads:

|

Description |

Basis |

Open |

Sale Price |

Sold |

Gain/Loss |

% |

| 10 JAN 52.50 AMGN CALL (AMQAZ) | $ 3,010 | 9/10 | $ 6,490 | 10/9 | $ 3,480 | 116% |

| 10 JAN 52.50 AMGN CALL (AMQAZ) | $ 4,010 | 9/10 | $ 7,090 | 10/12 | $ 3,080 | 77% |

| 10 JAN 52.50 AMGN CALL (AMQAZ) | $ 4,010 | 9/10 | $ 6,490 | 10/9 | $ 2,480 | 62% |

| 20 OCT 105.00 BA CALL (BAJA) | $ 310 | 9/28 | $ 4,990 | 10/10 | $ 4,680 | 1510% |

| 5 OCT 105.00 BA CALL (BAJA) | $ 85 | 9/26 | $ 1,290 | 10/10 | $ 1,205 | 1418% |

| 40 OCT 07 100.00 BA CALL (BAJT) | $ 4,810 | 10/10 | $ 7,990 | 10/10 | $ 3,180 | 66% |

| 20 JAN 45.00 BBY CALL (BBYAI) | $ 8,110 | 4/27 | $ 11,990 | 10/12 | $ 3,880 | 48% |

| 10 OCT 270.00 BIDU PUT (BDUVW) | $ 480 | 10/2 | $ 3,290 | 10/10 | $ 2,810 | 585% |

| 50 OCT 07 320.00 BIDU PUT (BDUVC) | $ 20,510 | 10/11 | $123,240 | 10/11 | $ 102,730 | 501% |

| 15 OCT 07 310.00 BIDU PUT (BDUVA) | $ 7,960 | 10/11 | $ 22,490 | 10/12 | $ 14,530 | 183% |

| 40 OCT 07 330.00 BIDU PUT (BDUVE) | $ 16,010 | 10/10 | $ 43,990 | 10/11 | $ 27,980 | 175% |

| 20 OCT 07 360.00 BIDU PUT (BPJVL) | $ 43,870 | 9/12 | $104,690 | 10/11 | $ 60,820 | 139% |

| 30 OCT 07 290.00 BIDU PUT (BDUVY) | $ 13,210 | 10/11 | $ 29,750 | 10/11 | $ 16,540 | 125% |

| 40 OCT 07 280.00 BIDU PUT (BDUVX) | $ 14,010 | 10/11 | $ 27,990 | 10/11 | $ 13,980 | 100% |

| 40 OCT 07 360.00 BIDU PUT (BPJVL) | $ 87,730 | 9/12 | $169,990 | 10/11 | $ 82,260 | 94% |

| 10 OCT 340.00 BIDU CALL (BDUJG) | $ 7,610 | 10/2 | $ 14,490 | 10/10 | $ 6,880 | 90% |

| 10 OCT 320.00 BIDU CALL (BDUJC) | $ 18,010 | 10/2 | $ 20,390 | 10/10 | $ 2,380 | 13% |

| 10 OCT 250.00 BIDU PUT (BDUVJ) | $ 1,410 | 10/2 | $ 180 | 10/10 | $ (1,230) | -87% |

| 80 OCT 07 50.00 BTU PUT (BTUVJ) | $ 3,930 | 9/12 | $ 5,190 | 10/12 | $ 1,260 | 32% |

| 20 NOV 07 50.00 BTU PUT (BTUWJ) | $ 3,730 | 10/9 | $ 4,290 | 10/11 | $ 560 | 15% |

| 160 OCT 07 50.00 BTU PUT (BTUVJ) | $ 11,530 | 9/12 | $ 12,790 | 10/12 | $ 1,260 | 11% |

| 20 JAN 75.00 COF CALL (COFAO) | $ 7,210 | 11/28 | $ 7,190 | 10/8 | $ (20) | 0% |

| 10 OCT 47.50 COH CALL (COHJW) | $ 110 | 10/5 | $ 1,290 | 10/12 | $ 1,180 | 1073% |

| 20 OCT 07 65.00 CROX CALL (CQJJM) | $ 4,010 | 10/8 | $ 9,490 | 10/11 | $ 5,480 | 137% |

| 10 NOV 32.50 CSCO CALL (CYQKT) | $ 1,210 | 10/4 | $ 1,490 | 10/8 | $ 280 | 23% |

| 10 NOV 32.50 CSCO CALL (CYQKT) | $ 1,210 | 10/4 | $ 1,490 | 10/8 | $ 280 | 23% |

| 300 OCT 07 140.00 DIA PUT (DAZVJ) | $ 15,010 | 10/8 | $ 35,990 | 10/11 | $ 20,980 | 140% |

| 400 OCT 141.00 DIA PUT (DAZVK) | $ 44,010 | 10/5 | $ 49,990 | 10/10 | $ 5,980 | 14% |

| 20 NOV 07 40.00 EBAY CALL (XBAKH) | $ 2,510 | 10/1 | $ 3,890 | 10/12 | $ 1,380 | 55% |

| 20 NOV 07 40.00 EBAY CALL (XBAKH) | $ 2,510 | 10/1 | $ 2,590 | 10/9 | $ 80 | 3% |

| 10 JAN 65.00 EDU CALL (EDUAM) | $ 2,410 | 7/13 | $ 8,090 | 10/9 | $ 5,680 | 236% |

| 10 JAN 12.50 FLEX CALL (QFLAV) | $ 410 | 10/3 | $ 510 | 10/10 | $ 100 | 24% |

| 20 JAN 12.50 FLEX CALL (QFLAV) | $ 810 | 10/3 | $ 990 | 10/10 | $ 180 | 22% |

| 20 JAN 22.50 GLW CALL (GLWAX) | $ 7,610 | 5/16 | $ 9,190 | 10/11 | $ 1,580 | 21% |

| 30 DEC 40.00 GM CALL (GMLH) | $ 6,160 | 9/26 | $ 9,590 | 10/11 | $ 3,430 | 56% |

| 30 OCT 37.50 GM CALL (GMJU) | $ 8,260 | 9/26 | $ 5,690 | 10/11 | $ (2,570) | -31% |

| 10 OCT 35.00 GM CALL (GMJG) | $ 5,010 | 9/27 | $ 2,740 | 10/11 | $ (2,270) | -45% |

| 10 JAN 570.00 GOOG CALL (GOPAQ) | $ 29,580 | 9/12 | $ 72,490 | 10/9 | $ 42,910 | 145% |

| 20 OCT 07 620.00 GOOG CALL (GOOJD) | $ 40,010 | 10/9 | $ 39,490 | 10/11 | $ (520) | -1% |

| 6 OCT 600.00 GOOG CALL (GOOJT) | $ 15,010 | 10/8 | $ 12,440 | 10/11 | $ (2,570) | -17% |

| 20 OCT 115.00 IBM CALL (IBMJC) | $ 7,410 | 10/4 | $ 6,990 | 10/8 | $ (420) | -6% |

| 20 OCT 120.00 IBM CALL (IBMJD) | $ 3,810 | 10/8 | $ 3,390 | 10/10 | $ (420) | -11% |

| 5 OCT 47.50 JPM CALL (JPMJW) | $ 251 | 9/27 | $ 465 | 10/8 | $ 214 | 85% |

| 10 OCT 47.50 JPM CALL (JPMJW) | $ 510 | 9/27 | $ 590 | 10/12 | $ 80 | 16% |

| 50 OCT 18.00 MOT CALL (MOTJS) | $ 5,510 | 9/21 | $ 2,490 | 10/12 | $ (3,020) | -55% |

| 80 OCT 45.00 NEM CALL (NEMJI) | $ 6,010 | 10/8 | $ 11,990 | 10/9 | $ 5,980 | 100% |

| 20 OCT 07 80.00 OII CALL (OIIJP) | $ 3,210 | 10/10 | $ 6,390 | 10/10 | $ 3,180 | 99% |

| 40 OCT 07 75.00 OII PUT (OIIVO) | $ 3,530 | 10/8 | $ 1,590 | 10/12 | $ (1,940) | -55% |

| 5 OCT 07 195.00 PTR PUT (PTRVV) | $ 1,010 | 10/11 | $ 990 | 10/12 | $ (20) | -2% |

| 500 OCT 52.00 QQQQ PUT (QQQVZ) | $ 22,040 | 10/5 | $ 17,460 | 10/8 | $ (4,580) | -21% |

| 200 OCT 51.00 QQQQ CALL (QQQJY) | $ 34,010 | 9/15 | $ 14,590 | 10/11 | $ (19,420) | -57% |

| 5 OCT 105.00 RIMM PUT (RULVL) | $ 235 | 10/4 | $ 5,840 | 10/8 | $ 5,605 | 2385% |

| 20 OCT 07 110.00 RIMM PUT (RULVB) | $ 4,310 | 10/4 | $ 9,990 | 10/11 | $ 5,680 | 132% |

| 5 NOV 115.00 RIMM CALL (RULKU) | $ 2,060 | 10/4 | $ 4,440 | 10/8 | $ 2,380 | 116% |

| 5 NOV 115.00 RIMM CALL (RULKU) | $ 2,060 | 10/4 | $ 4,365 | 10/10 | $ 2,305 | 112% |

| 10 OCT 07 110.00 RIMM PUT (RULVB) | $ 4,210 | 10/4 | $ 4,990 | 10/11 | $ 780 | 19% |

| 5 OCT 100.00 RIMM CALL (RULJT) | $ 4,510 | 10/4 | $ 3,040 | 10/11 | $ (1,470) | -33% |

| 5 OCT 110.00 RIMM PUT (RULVB) | $ 2,700 | 10/4 | $ 990 | 10/8 | $ (1,710) | -63% |

| 3 JAN 7.50 SCI CALL (SCIAU) | $ 655 | 11/15 | $ 1,670 | 10/8 | $ 1,015 | 155% |

| 15 NOV 150.00 SHLD CALL (KTQKU) | $ 7,510 | 10/4 | $ 10,940 | 10/9 | $ 3,430 | 46% |

| 50 OCT 105.00 SLB PUT (SDBVA) | $ 13,010 | 9/28 | $ 11,240 | 10/10 | $ (1,770) | -14% |

| 20 OCT 50.00 SNE CALL (SNEJJ) | $ 2,310 | 10/4 | $ 2,490 | 10/8 | $ 180 | 8% |

| 120 OCT 95.00 SU PUT (SUVS) | $ 20,410 | 9/19 | $ 35,960 | 10/10 | $ 15,550 | 76% |

| 10 DEC 20.00 SYX CALL (SYXLD) | $ 2,360 | 9/24 | $ 4,490 | 10/8 | $ 2,130 | 90% |

| 5 OCT 115.00 TM CALL (TMJC) | $ 210 | 9/24 | $ 1,490 | 10/12 | $ 1,280 | 610% |

| 10 OCT 50.00 TSO PUT (TSOVJ) | $ 1,110 | 9/30 | $ 2,040 | 10/9 | $ 930 | 84% |

| 10 OCT 50.00 TSO PUT (TSOVJ) | $ 1,110 | 9/25 | $ 2,040 | 10/9 | $ 930 | 84% |

| 10 NOV 07 47.50 TSO PUT (TSOWX) | $ 1,060 | 10/9 | $ 1,490 | 10/10 | $ 430 | 41% |

| 10 NOV 07 47.50 TSO PUT (TSOWX) | $ 1,060 | 10/9 | $ 1,490 | 10/10 | $ 430 | 41% |

| 20 OCT 35.00 TXN CALL (TXNJG) | $ 2,810 | 9/24 | $ 4,330 | 10/9 | $ 1,520 | 54% |

| 15 OCT 80.00 UTX CALL (UTXJP) | $ 1,810 | 9/21 | $ 2,990 | 10/10 | $ 1,180 | 65% |

| 20 OCT 07 65.00 WFR CALL (WFRJM) | $ 610 | 10/8 | $ 3,990 | 10/12 | $ 3,380 | 554% |

| 10 OCT 07 65.00 WFR CALL (WFRJM) | $ 310 | 10/8 | $ 1,990 | 10/12 | $ 1,680 | 542% |

| 200 OCT 75.00 XLE CALL (XBTJW) | $ 27,410 | 10/5 | $ 26,190 | 10/10 | $ (1,220) | -5% |

| 30 OCT 90.00 XOM PUT (XOMVR) | $ 2,560 | 9/28 | $ 3,890 | 10/8 | $ 1,330 | 52% |

| 200 OCT 07 90.00 XOM PUT (XOMVR) | $ 5,010 | 10/8 | $ 5,990 | 10/11 | $ 980 | 20% |

| 30 JAN 08 30.00 YHOO CALL (YHQAF) | $ 4,660 | 10/9 | $ 5,240 | 10/11 | $ 580 | 12% |

| 20 OCT 27.50 YHOO CALL (YHQJY) | $ 2,710 | 9/28 | $ 1,850 | 10/12 | $ (860) | -32% |