"Bank of America Corp.'s third-quarter net income fell 32% from a year ago as trading losses, write-downs on a wide variety of loans and soaring reserves for likely future loan losses undermined profit, financial results showed Thursday. The last of the nation's top three banks to report results this week, the company chalked up big charges due to credit-related turmoil, suggesting that the problems in the credit market may yet be closer to the beginning than to the end."

Oh dear! As I mentioned in last night's post, we saw this coming yesterday as C and FITB were signaling problems even as I was incredulous earlier in the morning that the markets in general were glossing over the disastrous report by TMA. Fortunately we saw the signs early (actually way early, as we went to cash earlier in the week) and we were able to just amuse ourselves picking off some high flyers as they broke down.

The BAC report certainly indicates something is breaking down in our economy as profits dropped 32% for the quarter as the bank had to double their provisions for credit losses to $2.03Bn. That's a lot of money people! While BAC may be able to find a Billion dollars by simply turning over the cushions on the couch, I will say again that the regional and local banks are not likely to be as lucky and we may be looking at a series of misses in that sector. 22 analysts, who are paid big money to follow this bank for a living, had thought the bank would earn $1.05 a share, they were wrong by 22% (.82 was expected)! Not one of these Bozos has a sell on this Bank, which is trading just 5% off it's all-time high.

This puts the Fed back on the table which will send the dollar to new all-time lows (it finished yesterday at 78.09) and should reignite our gold plays, which we've been pressing during the recent downturn. Oil should get a lift today on the declining dollar but between BAC and the Beige Book, the majors have nothing to celebrate as the greedy energy industry has finally broken the consumer's back and will now begin to reap what they have sown in the form of demand destruction.

I had planned on doing a long-term virtual portfolio review this morning but we're going to have to do it intraday as the market has become somewhat fluid this morning (but generally in our favor). The Euro looks like is will test $1.43 today and the European markets are plunging while oil heads up to $88 because Turkey is now our number one problem of the month (kind of makes you forget all about a nuclear Iran for a while doesn't it?). Our sponsor, PFE is being no help with a 77% drop in net income, which sounds worse than it is as they took a $2.8Bn charge in pulleing Exubera from the market. That's the big Pharma game, you win some you lose some, we already hold PFE but I'd be a buyer on a dip here.

Buried in today's carnage is an excellent report by NOK, who posted an 85% rise in profits but, like pretty much everyone else, it's international sales that are driving the company with shipments up 26% to 111.7M phones in the quarter even as the average sales price dropped from $180 to $164, something analysts had been worried about. "Nokia strengthened its leading position in the device industry in the third quarter. In a strong market, we simultaneously gained market share and increased our operating margins," said Nokia Chief Executive Olli-Pekka Kallasvuo. "The quality and depth of our device virtual portfolio continues to give us a good competitive edge and we believe our virtual portfolio looks promising for next year." Imagine how well Apple will do when they start selling their phone to foreigners, who actually have spending money!

Jobless rates ticked up 28,000 as well, to 337,000 for the week and HSY posted a 69% drop in net profits, missing estimates by just .03 if you add back the .41 (out of .68) the company lost due to restructuring charges but don't worry, the "Great American Chocolate Bar" company plans to save money by cutting 1/3 of it's existing production lines and building a brand new factory — IN MEXICO!

Speaking of foreign country's: I said in comments yesterday that the China RUMORED plan to merge the Hong Kong and Shanghai shares in an arbitrage of some sort seemed more like a desperate attempt to prevent a bubble from popping than any sort of realistic plan. After US traded ADRs jumped 7-10% yesterday it all amounted to nothing in actual China trading as the Hang Seng rose just half a point and the Shanghai B shares dropped 2% and the A shares (the ones that are restricted to local buyers) dipped 3.5%. This was coupled with a 717-point drop in India and the headline in the WSJ's Asia section reads (and I kid you not) "Regional Indexes Mostly Rebound." Japan did do well but, as we know from the Big Chart – they have a long way to go and we put no credence in anything they do below 17,400.

Chinese stocks traded in the US jumped almost $1Tn yesterday as Bloomberg reported that China may allow arbitrage between stocks of companies that have dual listings on the mainland and in Hong Kong but traders were WAY ahead of themselves as there are many major hurdles to overcome. "Imagine if H shares are convertible to A shares, a lot of funds will buy the discounted H shares and trade out at the A-share market for arbitration," said Ernie Hon, a strategist at ICEA Securities, in a research note. "This will involve huge inflow of funds into China, which is against the government's prevailing intention of channeling funds out of China."

Europe is down sharply (1%) as they are much more worried about a US financial crisis than we've been lately and Putin declared: "The U.S. military campaign in Iraq was a "pointless" battle against the Iraqi people, aimed in part at seizing the country's oil reserves." Gee, it took him this long to figure that out? Putin (whose name has many of the same letters as Polonium by coincidence) just got back from a visit to Iran, went on to say he believes one of the U.S. "goals is to establish control of the country's oil reserves," and that a concrete date must be set for the withdrawal of U.S. troops. Unless such a date is set, he added in an echo of some U.S. war critics, "the Iraqi leadership, feeling [safe] under the reliable American umbrella, will not hurry to develop its own armed and law enforcement forces."

Meanwhile, German and French rail workers may be on strike (it's apparently hard to tell whether they are working or not) and Italian bank, UniCredit, seems to have lost about $1.4Bn in the sales of derivatives.

So lots to watch out for this morning but once again, it will be a fairly bullish indicator if we can hold on to the levels we discussed in yesterday's Big Chart so I'm going to keep the Don't Panic button handy for members who feel the need but, on the whole, this will be a great opportunity to start rolling our callers and set ourselves up for the next expiration period.

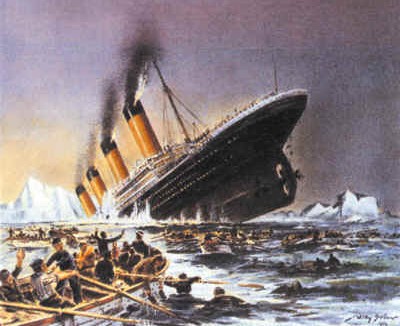

There's always mattress plays to be made but let's not get ahead of ourselves, like yesterday we have to go with the flow and enter the markets without a directional bias. While I may point out various economic issues that surround us I see it more like a river rafting guide pointing out the rocks – just because there are obstacles it doesn't mean we abandon ship, we just need to learn how to steer!

There's always mattress plays to be made but let's not get ahead of ourselves, like yesterday we have to go with the flow and enter the markets without a directional bias. While I may point out various economic issues that surround us I see it more like a river rafting guide pointing out the rocks – just because there are obstacles it doesn't mean we abandon ship, we just need to learn how to steer!