"I generally avoid temptation unless I can’t resist it" – Mae West

We will be sorely tempted this morning.

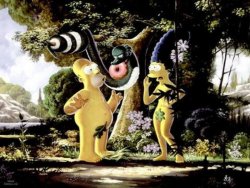

We are being enticed, very fittingly, by the Apple – that low hanging fruit that is so shiny and beautiful that we are willing to give up our garden of cash in order to taste the fruit from the tree of earnings.

We have been told not to eat the apple, we have been told to stay in cash until the market settles down but I see many of our flock are weak, and have already succumbed to the buying frenzy that is suddenly engulfing the markets. They are ignoring the signs:

More Homeowners are Filing for Bankruptcy

More Homeowners are Filing for Bankruptcy- Lenders have stopped writing new mortgages

- American Express increased loss provisions by 50%

- Amex also reported consumers taking on 23% more debt last year – woo hoo!

- TGT lowered sales growth forecasts by 30% (their clients must use Visa!)

- COH lowered outlook (et tu, wealthy shoppers?)

- The Dollar "has further to slide" according to Rich Clarida (former asst. US Treasury Secretary)

- UPS had a great quarter dragged down by "domestic woes as the weak housing and manufacturing markets, on top of high fuel prices, remain a drag on U.S. economic growth."

- GE and others are being blown out of existing deals to buy Chinese stocks due to Chinese regulations that say placements can’t be completed at less than 90% of a stock’s recent trading price on the open market.

There’s more but that’s just from today’s headlines. I’d love to put on my rally cap but, unless we can take out AND hold the levels we were looking for yesterday (see last night’s post), I will only cautiously dip my toe in before I start committing our precious cash to what, so far, is a mere bounce off of last week’s losses.

We’ve got home sales tomorrow (always a party) along with crude inventories, where the November barrels have already been tossed out the window. The November contracts terminated yesterday in a desperate selling frenzy that sent the open barrel count down from 75M barrels scheduled for November delivery as of Friday’s open all the way down to just 36.4M barrels at yesterday’s close. This virtually guarantees and artificial oil shortage for the month of November as America is once again held hostage by the gang of thieves working the NYMEX.

It took an unprecedented amount of rolling to achieve this "shortage" as a record number of barrels were thrown into December, setting the market up for a huge fall but delaying the inevitable for another month. You can see the celebration in the energy sector as the traders pulled off this coup. Once the barrel count fell below the critical 40Mb level, high prices were virtually assured for another month and the entire sector turned around. As I mentioned yesterday, we dumped our puts (other than SU Dec $105 puts) and actually went long on COP as we don’t really care if it’s a scam (our Congresspeople sure don’t) as long as we know which side to play!

Apple is no scam and we’re going to have to play them carefully this morning. My plan is to take advantage of the early excitement by rolling callers that are $30 (roughly) and deep in the money into callers that are $15 and mainly out of the money. If people are dying to taste the forbidden fruit of Apple $200 then I will be happy to sell it to them but, putting on my fund manager’s hat, the stock is up over 35% for the month and, if my target is $200, you can be damn sure I’ll be taking some off the table at $190, while all the latecomers are buying.

Be very, very careful out there – a lot of things look good but I’m going to give it a day. Unless I can’t resist it, of course!