Have I gotten too bullish?

As I've warned in the past, we've all let ourselves get a little too conditioned to buy on the dips when sometimes markets dip for very good and very long-lasting reasons. Yesterday morning, before the C meeting even happened, I posted this article for members and said: "Maybe not the bullish news people expected at today's meeting!"

I have long said that we won't be able to post a real rally until the financial community steps into the confessional and clears the deck so we can see where the floor is. As we suspected, the confessions we've heard to date have been sugar-coated (to use the very polite term for total BS) and we are not as near the end of this cycle as investors may think.

Perhaps now is a good time to review my 10/10 article where I called a top, detailed the housing crunch and made the statement: "$1.5 Trillion (of suspect sub-prime notes) and no reason to pay. Yet we are celebrating when Citibank writes off $3Bn in bad loans. What about the other $1,497,000,000,0000??? I’ve said before I’m happy to get behind this rally AFTER we hear from the regional savings banks and other lenders as they explain exactly how they think they will be collecting this money." My CONSERVATIVE estimate for sub-prime losses at the time was $200Bn and I said: "Let’s stay aware of the undercurrents that may actually start to matter and watch out for the home related sectors, no matter how beaten down they may look – they are not $200Bn beaten down yet!"

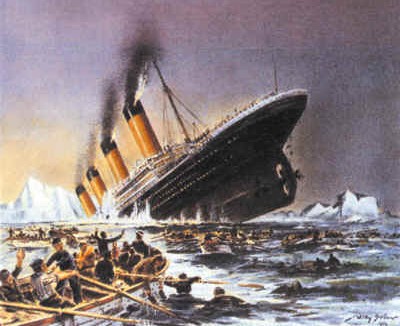

This is what led us to our Nasdaq bullishness for the past two weeks as I decided: "That’s why we have Nasdaq leadership, they’ve got the mix that is least likely to be affected when it all hits the fan. Much like the Titanic, even as one end of the ship begins to fall into the water, the people on the other end start to rise – even reaching "record levels" just as money flows from one part of the market to the other – it’s a temporary effect but, wheeee, what a ride!"

That was the week we had our first great BIDU play and today may be the next one as we went into the weekend with very heavy BIDU puts ($400s) that we doggedly refused to give up on as we rolled all the way up from $360. Speaking of rolling (and other stratgies), a very big group hug must be given to K1, who rolled out the beginnings of "The K1 Project," which is a compilation of the strategies we employ at PSW and is a must-read for new members as he's done an amazing job of condensing months' worth of comments into a neat and easy to follow series of articles that read like a good book. Absolutely fantastic work K1!

Not so fantastic is the performance of the markets this morning as I was woken up right after I went to bed, for a very good reason, by one of my people in Hong Kong who rightly decided we needed to be MORE bearish in the early stages of that market's 5% decline this morning. It's very rare that you see an index test our 5% rule. Hong Kong hit it on the button, finishing at the low of the day (and we know that does not bode well for tomorrow) and the Shanghai A Shares hit our 2.5% rule, also finishing out near the day's low.

The proximate cause of the dip had less to do with Citibank and more to do with China's decision to delay a long anticipated scam plan to allow mainland investors to plow their life savings into the massively inflated Hang Seng bubble (PTR, for example is now "worth" $1.1 Trillion!) in order to allow corporate bagholders to escape at the expense of the Chinese people. Premier Wen Jiabao "Questioned whether mainland investors were fully aware of the risks involved in investing in Hong Kong, noting many investors don't have a strong grasp of the risks inherent in their own, stratospheric markets." Wow, a political leader looking out for the interests of his people – darn those communists!

This deal was supposed to be "in the bag" at the Hang Seng and investors there were licking their lips at the prospect of $2.5Bn worth of "mattress money" coming out of the mainland and into their already red-hot market. The fact that the Hang Seng was up 50% since mid-August only seemed to bother me but suddenly it's going to bother everybody as the massiveness of a 5% sell-off has to be considered when Hong Kong has a "limit-down" policy of 10% on any individual stock (a level that was hit by index members Sinopec and Bank of China) – that means there could be a lot of pent-up selling pressure tomorrow as well. Limit down is different than trading curbs – when a stock goes limit down trading for the day is suspended entirely, whether it comes an hour before the close or a minute after the open…

Also in Asia, Musharraf found it "necessary" to declare a state of emergency, placing the country under martial law ahead of the elections. Fortunately for Musharraf, he is in charge of the Army, which keeps him in charge of Pakistan until the he feels it is safe to release the hundreds of members of his political opposition who were arrested this week. Things have heated up considerable since Musharraf someone failed to assassinate former PM Bhutto in a recent bombing attack. Pakistan has close to 1Bn people and a civil war there will probably not be a good thing! Of course Musharraf is a Bush ally so it will be very interesting to hear how the administration spins this one as the General claims these are necessary steps to clamp down on Islamist extremists. Think about this as each of our own candidates all try to prove they are willing to bend the constitution further than the other in order to combat terrorism.

Opposition crushing is quite the fad this weekend as Japan's opposition leader, Ichiro Ozawa offered to resign (PM Abe resigned 2 months ago) and we need to keep an eye on this as the Yen carry trade hangs in the balance. If anything upsets the very delicate balance between the dollar and the yen, it could be devastating for both economies.

Europe is relatively calm by comparison. with markets over there down about a point. European lenders have been much more forthcoming than their US counterparts (HSBC and Barclays led us off in the summer) and the EU, unlike our Fed, has lots of dry powder they can fire off should the need arise. UBS underwrote $1.2Bn of debt for Dubai International Capital, sending a very strong signal that there are still deals to be done – just not with America! Despite UBS's good gesture, Qatar backed off a $20Bn deal to buy England's Sainsbury (and we know that's a bad sign) and EADS revealed MORE losses, $2Bn worth (no surprise but holy cow, they may as well be building houses!).

Our futures are down huge early in the morning and we're going to have to be really concerned if we break below levels so let's take a look at the Big Chart where, sadly, we have to begin to be concerned about some real breakdowns:

| 10-Day | Must | Comfort | Break | Next | ||

| Index | Current | Move | Hold | Zone | Out | Goal |

| Dow | 13,595 | -81 | 13,000 | 13,300 | 13,500 | 14,000 |

| Transports | 2,980 | -119 | 2,800 | 2,900 | 3,000 | 3,250 |

| S&P | 1,509 | -10 | 1,470 | 1,505 | 1,530 | 1,550 |

| NYSE | 10,052 | 12 | 9,400 | 9,800 | 10,000 | 10,250 |

| Nasdaq | 2,810 | 11 | 2,525 | 2,550 | 2,600 | 2,750 |

| SOX | 457 | -21 | 480 | 490 | 500 | 560 |

| Russell | 797 | -21 | 810 | 830 | 850 | 900 |

| Hang Seng | 28,942 | -391 | 20,250 | 20,750 | 21,000 | 22,000 |

| Nikkei | 16,268 | -90 | 17,400 | 17,700 | 18,300 | 18,500 |

| BSE (India) | 19,590 | 1078 | 13,500 | 14,100 | 14,725 | 15,000 |

| DAX | 7,820 | -15 | 7,300 | 7,600 | 8,000 | 8,200 |

| CAC 40 | 5,679 | -32 | 5,750 | 6,000 | 6,100 | 6,300 |

| FTSE | 6,457 | -73 | 6,400 | 6,550 | 6,600 | 7,000 |

On the whole, the changes aren't all that bad from where they were on 10/24, when we began the pre-Fed rally. Well, the Fed gave us a cut, so what is everyone's problem all of a sudden? As we've worried about for a long time, it's the SOX and the Russell that are leading us down and the SOX were what kept us from committing to the Nasdaq rally as I often tell members it's never a good sign when the Nasdaq forgets it's SOX. We barely hung on to our Comfort Zone levels on the Dow, S&P and NYSE and, if we lose those, shorting the QQQQs will probably give us the most bang for the buck as this very intense run in the Nasdaq has left it with little support for 60 full points!

You can tell it's over for oil when martial law in nuclear Pakistan isn't enough keep prices above $95. Our SU puts should richly reward us today, as well our our XOM and COP puts, but let's be careful in case tensions escalate and prop up the prices. Gold is a better indicator than oil of true international tension so we'll be watching gold carefully as an indicator of how scary things are in Asia. The copper market is falling apart fast as it's simply not precious enough to sustain these ridiculous prices!

If we can't bounce the dollar off of 76 this week and fall below it, there's a very good chance we are looking at yet another 5% decline before we bottom. The good news is that 5% of 76 is just 3.8 so we should hold 72.5ish (cue music: "I'm proud to be an American"). That should be good for 700 Dow points, which will hopefully keep us above the 13,000 line but a dollar bounce while the market is falling will accelerate the market decline and break technical levels we DO NOT want to visit.

So let's be careful of and Fed speak or Paulson comments (I'm not worried about the President, he just blew the last scrap of economic credibility he had crowing about Friday's jobs report proving that his economic policies were working). We've got a nice bunch of data to look at this week with ISM today at 10 – expectations are too high at 55 so let's watch out for a disappointment shock there. Wednesday we have Productivity numbers, which had better be stellar or we're back on inflation watch and we already know Wholesale Inventories are climbing and MA told us consumer credit is going through the roof so that won't be a surprise either. Thursday is jobless claims (yawn) and Friday we get Export Prices and the trade balance for September (oil was "only" $77) along with the fabulous Michigan Consumer Sentiment poll, which will be looked at closely as the holiday's approach.

So let's be careful of and Fed speak or Paulson comments (I'm not worried about the President, he just blew the last scrap of economic credibility he had crowing about Friday's jobs report proving that his economic policies were working). We've got a nice bunch of data to look at this week with ISM today at 10 – expectations are too high at 55 so let's watch out for a disappointment shock there. Wednesday we have Productivity numbers, which had better be stellar or we're back on inflation watch and we already know Wholesale Inventories are climbing and MA told us consumer credit is going through the roof so that won't be a surprise either. Thursday is jobless claims (yawn) and Friday we get Export Prices and the trade balance for September (oil was "only" $77) along with the fabulous Michigan Consumer Sentiment poll, which will be looked at closely as the holiday's approach.

It's going to be an interesting week, hopefully we'll hold up but we are very well prepared if we don't!