Finally we may start addressing our problems!

Finally we may start addressing our problems!

I'm thrilled about this as we've been worried about them for months while the market partied on. It's a lot easier to be a stock picker when other people start examining fundamentals rather than just jumping into whatever some analyst tells you to BUYBUYBUY with no regard as to the true value of the stock.

Surely we can expect a .5% bounce off our indexes as they've all finished down at the 2.5% rule for the day. If they don't bounce, we begin to short heavily! That means we'll be looking for the Dow to test 13,400 but until they break 13,500 there's no way we can say it's even close to coming back. I'm more concerned with the S&P, which MUST hold 1,470 and needs to get all the way back to 1,505 to get back on track. Let's also watch the Russell, which will give us a good sign over 800 but without the small caps retaking 790, I really don't care what the Dow does.

Barry Ritholtz has a great article today called "Financials: Worse than they look ?" which does a very nice job of summing up the issues there. The question is, with the XLF down 20% since June (and looking very ugly on the charts) is it enough? The BKX is down closer to 25% and is, as Trader Mike points out, back to Spring 2004 levels.

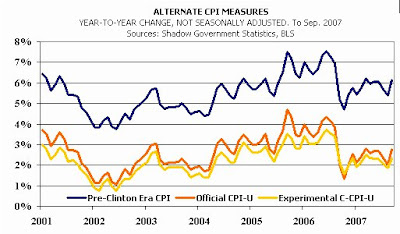

Mike had 2 great links this morning, one was a nice Wall Strip summary of our TRMP play. Wall Strip with a budget has really gotten more interesting but, sadly, still no actual stripping… The other link I liked was for Technically Speaking's article on Bernanke's Economic Lesson, which has a nice set of charts illustrating how the Fed's irresponsible policies have doomed the dollar. That led me to Shadow Government Statistics, which had this fascinating chart and a lot of other things I'll be reading this weekend:

Gee, we thought those CPI numbers were a little light but WOW! Imagine if the government had to give COLA adjustments based on the real CPI… Like the main picture says, this could all be just the tip of the iceberg folks!

The unsinkable Asian market ship hit at least a reef this morning as the Hang Seng gave up 3% (948 points) and the Nikkei dropped 2% (325 points) and the Shanghai ran right into the 5% rule (285 points), finishing at the low of the day. That's two 5% down days this week. We discussed the Shanghai's limit-down policy on Monday and it does occur to me that if limit down is 10%, then a 5% market drop means 1/2 the stocks on the market could have been halted and the rest stagnant and that would be a 5% drop so we're going to have to keep an eye on Shanghai to see if that bubble may finally be popping.

Issues in Asia include: Toys contain dangerous drugs, Bhutto calls for citizens to rise up against Musharraf, China is having a very difficult time controlling the oil market.

BHP offered to buy RTPfor $109Bn, which is LOWER than their current $114Bn market cap and RTP just said no to that deal but that didn't stop their stock from jumping 30% in overnight trading. This is going to make RTP a very exciting short this morning if $463 holds up through the open. Much like Kirkorean's bogus offer for TSO, I think BHP is just trying to goose the market. Unfortunately, RTP options only go up to $400 as no one in their right mind ever considered this stock going to $463 this year.

BHP offered to buy RTPfor $109Bn, which is LOWER than their current $114Bn market cap and RTP just said no to that deal but that didn't stop their stock from jumping 30% in overnight trading. This is going to make RTP a very exciting short this morning if $463 holds up through the open. Much like Kirkorean's bogus offer for TSO, I think BHP is just trying to goose the market. Unfortunately, RTP options only go up to $400 as no one in their right mind ever considered this stock going to $463 this year.

As expected, the BOE and ECB kept rates on hold, which saved the dollar from going below 75 (for now) but the BOE did boost reserve targets, a subtle way of improving liquidity as British banking is still reeling from the Northern Rock debacle. European markets have turned up from a bad open.

At home, the retail sales reports were pretty much exactly what I said they would be Tuesday at 11:52 with some on the high-end continuing to hold up the sector and the rest looking pretty grim. COST looks like they have good numbers but 110% of their sales increase came from gasoline sales which is a loss-leader for the discount club. SKS and TGT were the stars but JWN was weak and M was nothing to write home about.

AIG came through for us with pretty good earnings so let's take out that caller in the LTP and give them a chance to move further up. MS also had lower than expected write-downs but it still remains to be seen what the true value of these "assets" are when someone actually tries to sell them.

AIG came through for us with pretty good earnings so let's take out that caller in the LTP and give them a chance to move further up. MS also had lower than expected write-downs but it still remains to be seen what the true value of these "assets" are when someone actually tries to sell them.

CSCO had great earnings but didn't raise guidance and got hammered last night and that's a BUYBUYBUY for me, perhaps the Jan '09 $30s but we need to see what the prices are this morning. Although they left their guidance intact, CEO Chambers said US tech spending would be "lumpy" in the near future, which sent the Qs into a tailspin. TOL kept it real with awful numbers, down 36% AGAIN!

I want to buy too but let's remain calm until we see a real trend, of course we're going to get a bounce after a 360-point drop but look how hard I have to work to break your conditioning to "buy on any dip," think about all those poor people out there who have no one to tell them there just may not be a Santa Clause before they hike up to the North Pole without their SOX.