I was hoping we could have a nice, relaxing 3 days before the holiday but it looks like I was dreaming as the Dow is off 70 points pre-market.

There are plenty of reasons including LOW's 10% drop in net profit, China FREEZING bank lending to curb "runaway" investment activity, OPEC saying oil is too cheap in dollars, commercial real estate is dropping, GS downgrade C to a SELL and says they may have $15Bn in additional write-downs and Swiss Re took a $900M sub-prime hit.

So, tell us something we don't know! I mean really, no one believed me all summer when I went on and on about this stuff and suddenly it's the gospel. This marks an entire week of GS's assault on the markets, the same markets they said were just fine only a month ago so forgive me if I take this sudden change of sentiment with a grain of salt.

Of that group, I suppose a fall in commercial real estate would be my biggest concern as NO ONE is prepared for the losses that would occur if $100M buildings start defaulting the way $1M homes are. Many local banks put way too much risk into large commercial projects as they can draw lovely, "safe" income projections and chalk off the asset as a viable business but — take out a few tenants, add some utility and tax charges and suddenly you have a very UNviable business that the bank (which lent perhaps $90M for $1M in fees and 7% interest) suddenly stuck with a building that's losing $500K a year that they can only sell for a $20M loss.

This makes banks very nervous and nervous banks make terrible business partners as they start reviewing covenants in contracts that put pressure on their borrowers that can often bring about the very situation the banks are trying to avoid by forcing a landlord to make a tax payment on time rather than, say, fix the heating system, which causes tenants to leave so 3 months later he can't afford the tax payment OR the heating system. This is how things can go very bad very quickly in a tight lending environment so we need to watch this market very carefully.

I love getting all the bad news out in the open as long as we hold the bottom of our range at 13,000, if we can't hold that it's time for cash until we see some kind of recovery shaping up. Asia was weak but not terrible this morning but finished on a down note with the lending freeze dominating the news over there. The Hang send dropped just 154 points and the Nikkei continued into the basement, dropping 112 points to finish at a scary 15,042. A bad day in the US will push Japan below 15,000 and THAT is going to be a problem!

Europe is in a rotten mood with markets over there trading down about a point ahead of our open, led down by the insurance sector following the Swiss Re news. Meanwhile M&A activity is picking up in Europe, fired up by the world's strongest currency. Olympus is buying Gyrus for $1.9Bn, Swiss Life is selling units for $2.3Bn, CELG is buying PHRM for $2.9Bn and SBA Miller is buying Grolsch for $1.2Bn. This is the kind of stuff that used to goose the markets but today investors are in no mood at all.

Meanwhile, money is pouring into hedge funds (woo-hoo for me!) with $164Bn in new asset flows this year already (a record) as there simply aren't any better places to put money. GS is one (actually about 100) of those hedge funds and there is a lot of new money that needs to go to work so is it really any surprise when GS and 1,000 other hedge fund managers go on Corrupt Narrators Bilking Consumers to tell retail shareholders that things are suddenly bad and getting worse. When I want to buy your stock from you it's simply poor negotiating on my part to tell you how great I think it is before we set a price. Well, that's the stock scam in a nutshell – when they're selling, they tell you that you should be buying and when they're buying they tell you that you should be selling. Why go to all the headache of trying to call tops and bottoms when you can engineer them at will?

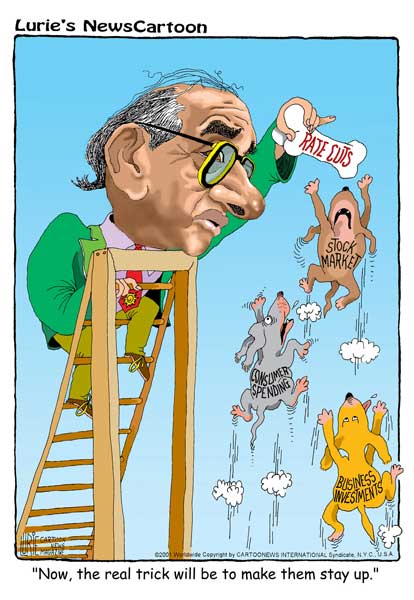

Speaking of money, Greenspan says the dollar's decline is having "no real impact" on the global economy, which officially makes us less important to the world than Brazil was in the 90's so mission accomplished policy boys! “If we can get beyond this housing problem I think we'll do pretty well,'' he said. OK, so it's an IF you can drive an A380 through but I'll take it as a kind word from Uncle Al… Hank Paulson also said he feels good about the economy so now we wait for Bernanke to chime in. I think the desperate attempt to push the markets down may be coming from an anticipation that Thanksgiving shopping and travel numbers will come in strong, so this is the last chance for the bears to wear their scary Halloween outfits before they end up looking like Turkeys.

Speaking of money, Greenspan says the dollar's decline is having "no real impact" on the global economy, which officially makes us less important to the world than Brazil was in the 90's so mission accomplished policy boys! “If we can get beyond this housing problem I think we'll do pretty well,'' he said. OK, so it's an IF you can drive an A380 through but I'll take it as a kind word from Uncle Al… Hank Paulson also said he feels good about the economy so now we wait for Bernanke to chime in. I think the desperate attempt to push the markets down may be coming from an anticipation that Thanksgiving shopping and travel numbers will come in strong, so this is the last chance for the bears to wear their scary Halloween outfits before they end up looking like Turkeys.

Our PSW retail survey is showing surprising strength around most of the country and I urge members to do what they can to help round out our data this weekend. We'll be watching a lot of our favorite stocks to put in bottoms this week but I don't think we're going to jump in and buy much unless we get some good turn signals so call my stance VERY cautiously optimistic for now. Once again, I will restate what I said in the wrap-up: It is the kind of optimism that comes from being 80% in cash while a fire sale is going on.

Data-wise, it's a pretty active week for a short one with the Housing Index today, Retail Sales, Housing Starts and Permits tomorrow along with Fed Minutes. Wednesday we have Oil Inventories, Mortgage Applications, Jobless Claims, Leading Economic Indicators and the Michigan Consumer Confidence Index. Earnings of note are MDT, FMCN and HOQ today, Tuesday will be GME, FRE, BKS, BJ, LTD, WFMI, HOTT, TGT, DHI and SKS and on Wednesday we hear from PLCE, GPS, DE and ANF. None of this will matter AFTER the weekend, when we get a better retail picture for Q4 but expect the market to really punish any missteps this week.

YHOO got an upgrade from MER so let's get rid callers there while the market's down. I'm hoping we hold the line on the morning sell-off but let's all be VERY careful out there!