Well it took me a week but I think people are finally getting the message…

Well it took me a week but I think people are finally getting the message…

The sell-off was overdone, the problems we face are fixable, the World isn't coming to an end just because America catches an economic cold! We're not going to go out and start jumping out of airplanes without parachutes just yet but, as I told members this morning, we are right on track with my rotation into tech theory (sorry Cramer) and I was very happy to see SOX leadership today, even if it did fade a bit as the broader Nasdaq took over in the afternoon.

For the past 12 months, the SOX are off 25%, 20% worse off than the other indices and, if we are going to have a turn, it has to involve semiconductors, which are the "oil" of tech. The Russell is our other problem child, and we need to keep a firm eye on them but we are playing them as an LTP play (see late-day comments for details) as they will be great on a recovery.

We made very nice gains today despite a 2% drop in the financials, led down by AIG, who MAY have lost $5Bn, which sounds shocking until you realize they have $1,072,000,000,000 in investments so we decided the $14Bn loss in the company's valuation was a tad overdone and we did a little buying during the day. Specifically, AIG has written $78Bn of CDO's and the audit that is being conducted seems to indicate they should be writing off a bit less than 4% of them. As I pointed out to members today: "Does this stop them from selling $120Bn a year worth of insurance at a $14Bn net profit?"

We are certainly not out of the woods yet but there's nothing wrong with picking up a few breadcrumbs along the way. Our Bargain Basement Virtual Portfolio seems to have made it through it's first month intact and now we can lighten up on the covers next month and hope we get a little run but let's not get too ahead of ourselves – Testy Tuesday looms ahead and we are stil traveling in very rough waters.

Our positions are still well covered and today they seemed over-covered but let that be our biggest problem as we get through the rest of the week! In case no one noticed, the energy sector accounted for 80% of the S&P's gains on the day and that is NO WAY we want to run a rally. XOM somewhat offset AIG's losses in the Dow but the Transports hit a wall at 2,700 and will have a very hard time breaking higher with oil back over $90.

Tomorrow we have the Treasury Budget, which is not a market mover but Wednesday we are full of Data with very scary Retail Sales (and GM gives us their bad news tomorrow morning), Business Inventories (likely to be way up) and Crude Inventories (another big build). Thursday we get the usual Jobless Claims and the Trade Balance, which have us on pace to send $1Tn out of the country this year (because we don't need it I guess). Friday, in addition to being expiration day, is data heavy with possibly inflationary Import and Export Prices, the Empire State Index (probably down), Net Foreign Purchases (the way we get that Trillion back), Industrial Production and Cap Utilization along with the always interesting Michigan Consumer Sentiment Index.

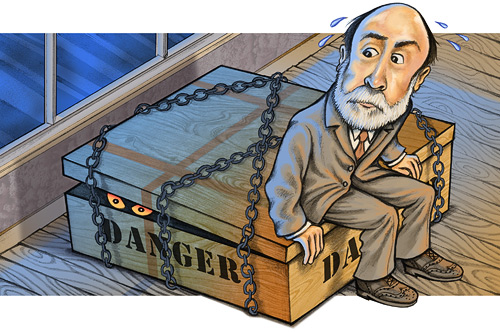

So, still plenty of scary things in the woods ahead of next week's CPI, Housing Starts and Fed Minutes. Bernanke is meeting with the Senate Banking Committee on Thursday. This could be ugly as Paulson and SEC Commissioner Cox will all be called on the carpet with the topic to be: "How the financial regulators missed the credit bubble, and what can be done to make sure the supervisors have the tools — and the will — to watch the markets closer."

So, still plenty of scary things in the woods ahead of next week's CPI, Housing Starts and Fed Minutes. Bernanke is meeting with the Senate Banking Committee on Thursday. This could be ugly as Paulson and SEC Commissioner Cox will all be called on the carpet with the topic to be: "How the financial regulators missed the credit bubble, and what can be done to make sure the supervisors have the tools — and the will — to watch the markets closer."

Nobody on Wall Street wants anybody watching the markets closer (or at all) since they may ask questions about the validity of the ridiculous earnings they are booking before they can cash their bonus checks which are based on the ridiculous earnings that will only be reversed and booked as losses after they have moved on and opened up a hedge fund based on their brilliant performance, as evidenced by the REALLY BIG bonus they got when they worked at that firm before it went bankrupt…

Speaking of hedge funds – I predicted last month that they would be hit hard by this market drop and it turns out that the Greenwich Global Hedge Fund Index (“GGHFI”) fell -2.44% in January, the worst monthly decline since July 2002. Short funds carried the ball with a 6.99% gain on the month but 4% losses were the norm for "Directional" and "Specialty Strategy" Funds. In other words, don't feel bad if you had a bad month, everyone was confused.

We'll try to gain a little clarity ourselves as the week progresses but I maintain a cautiously bullish stance. We'll need to gather some more technical evidence of a recovery before we move off 1/2 cash.