Well another week bites the dust and, thankfully, this was a short one.

Well another week bites the dust and, thankfully, this was a short one.

We have little good to say about this week other than we didn’t break below last week’s lows (yet) and there is nothing wrong with forming what is turning into a month-long solid base at 12,200. There are very few prolonged consolidations that lead to a sell-off so the longer we don’t go down, the better our chances of going up.

We really, really need an easing of energy prices to get us back on track in the broader markets and we will continue to sell any commodity led rally and buy into any commodity based sell-off until somebody wins this tug of war. We bought QID puts on Wednesday morning and QID calls yesterday morning and yesterday afternoon we were back on the puts – buy and hold isn’t even a real possibility for a market that was down 200 last Thursday, flat Friday, up 150 then down 250 on Tuesday, up 250 Wednesday and down 250 yesterday, finishing, as we noted in last night’s Big Chart Review, pretty much right back where we started from.

We got a small break in oil yesterday but much of that has been reversed in thin overnight trading. We had another huge build yesterday and Rowan Menzies, head of research at Commodity Warrants said: "People have got to start being more concerned about demand, especially now that you got the inventories going up and up every week." "Refineries are curtailing output for economic reasons. There’s weak product demand and they are responding by reducing output,” said Tim Evans, an energy analyst at Citigroup Global Markets. Total implied fuel demand is down 1.1% over the last four weeks from a year earlier. Gasoline inventories climbed 1 million barrels to 230.3 million, the highest since February 1994. “Gasoline supplies are near the highest level ever, and crude oil supplies are still gaining,” said Kyle Cooper, director of research at IAF Advisors in Houston.

Asia gave back most of Thursday’s gains into their weekend this morning as Japan cut its assessment of their economy in the face of slowing US demand. Due to rising fuel costs, Japan ran it’s first trade deficit ($739M) in a year and the IMF dropped Japan’s growth forecast from 1.7% to 1.5%. Consumer spending, the biggest chunk of the economy, is "almost flat," the report reiterated. Growth in corporate profits "appears to be pausing." Housing construction "remains at a low level while showing a pickup." "Obviously, we are not out of deflation," a Cabinet Official said.

Europe is fairly flat ahead of the US open and our big decline came on Europe’s close yesterday so we can assume that European traders are buying our markets, even if US traders are not. Oil and gas companies are leading the decliners in Europe so not bad news really and it would be a nice trend breaker if we can have people selling oil into the weekend for a change. LLoyds Bank of England turned in a very good report and showed that banks can make money if they stick to banking and the UK Treasury is completing their takeover of Northern Rock so we can expect the FTSE to provide us with whatever leadership there is to be had as they seem to be the first to straighten out the banking sector.

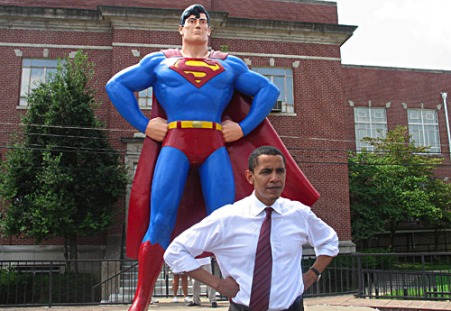

The Clinton/Obama debates were pretty even yesterday but nothing really matters until March 4th, when Texas and Ohio will be decided. Out of 2,025 votes needed to clinch the nomination, Obama has 1,199 to Clinton’s 1,040 with 1,014 regular delagetes still to be assigned by vote and 795 "superdelegates" who will likely cast the deciding votes. Of the superdelegates, Clinton has a 100-point lead in the ones that have committed with about 250 undecided there. I am saying this here because everyone is talking about the process but no one seems to actually understand it and the market does seem to fear Obama winning so we’ll keep an eye on that primary for a possible inflection point.

The Clinton/Obama debates were pretty even yesterday but nothing really matters until March 4th, when Texas and Ohio will be decided. Out of 2,025 votes needed to clinch the nomination, Obama has 1,199 to Clinton’s 1,040 with 1,014 regular delagetes still to be assigned by vote and 795 "superdelegates" who will likely cast the deciding votes. Of the superdelegates, Clinton has a 100-point lead in the ones that have committed with about 250 undecided there. I am saying this here because everyone is talking about the process but no one seems to actually understand it and the market does seem to fear Obama winning so we’ll keep an eye on that primary for a possible inflection point.

The WSJ warns of an "Antibubble" in Treasuries as nervous investors are buying treasuries at any price and atificially depressing the yields, which is allowing the commodity bubble to persist long past it’s logical expiration date. Last time inflation was as high as it is now (4.3% in 1991) Treasury yields were 7%, now they are below 4%. Never have investors been paid so little for their money relative to inflation!

Fear! Fear and terror and negativity entice you to have the bank hold your money for a mere 2% return, even as you can see with your own eyes that there is no way that is keeping up with inflation. Fear of everything is being fed to US citizens by the government and the MSM to make them accept the fact the government can borrow and spend at levels never before attempted in human history while at the same time telling you that inflation is "well contained" as they drop food and energy out of the measurements they use to decide how much money Social Security recipients need to live, even while the government raids that same fund, leaving low-interest IOUs in the place of the massive surplus that used to be there.

While the American public has swallowed this nonsense hook, line and sinker, foreign investors have not and they have begun buying up our assets on the cheap, something I mentioned last night regarding Russia’s decision to invest in FRE and FNM. Still the media will tell you to stay out of these stocks and probably will do so until they retake their highs, at which time they will be added back to someone’s "focus list."

Thank God it is Friday, I’m getting a little sick of this BS!