Well I chickened out!

Even though I called the day's move within 8 points (I predicted a .75 rate cut would give us a 150-point pop over the 12,250 consolidation point I noted in the morning post), the actual Fed statement and the drastic .75 move in the discount window made me wonder if there was yet another big financial shoe to drop on the markets:

So, according to the Fed, the economy is worse, credit conditions are getting worse, housing is worse and they expect the problems to continue for the next few quarters. Inflation is up and they admit they are uncertain about their 10th consecutive assumption (and they are 0 for 9 so far) that it will moderate on it's own, even as they drop $100Bn out of a helicopter every week or so. Could it be that they are finally catching on to the cause and effect of inflation or are they only simply seeing that cutting rates from 5.25% to 2.25% hasn't done a damn thing so far?

I shouldn't complain, we had another really great day but so did oil and that is NOT how we are going to fix the economy as this Fed action is aimed at bailing out the rich at the inflationary expense of the poor. It's the basics that are flying up in price – food, energy, clothing… at the same time as the value of most families' savings, which is pretty much their home, is either declining or totally wiped out. We are sitting here fretting about the solvency of the bondholders and the solvency of the investment houses yet 270M out of 300M people in this country don't have a penny in either of those things and there are just 800,000 people on this planet who subscribe to the Wall Street Journal so we are in a very rarefied group if we are concerned about whether or not BSC goes under.

The Fed is doing exactly what it was designed to do, bailing out rich folks – but what happens if screwing over the poor people has finally become a bad idea. Even the Roman armies had limits on how much they would pillage because they recognized that there were long-term benefits to leaving the conquered lands intact, so they could eventually become productive parts of the empire. The rich in this country have been on a slash and burn campaign since the first Bush tax cut transferred it's first Trillion to the top 1% and they have carpet bombed the poor and the middle class to the brink of bankruptcy since then. Who will be left to rob if we lose the middle class?

I wrote about this in detail in my article on the "Dooh Nibor Economy" so I won't rehash it all here but the WSJ has an excellent PowerPoint detailing exactly how the administration's policies were the direct cause of this "crisis" even as their lack of policies now are exacerbating the situation. These things don't happen by accident, you can't love your administration and think they are wise policy makers and sharp economists and then give them a mulligan for causing the greatest financial disaster in our nation's history by saying "who could have seen that coming?" THEY COULD HAVE, that's who! It's what we pay them for…

I wrote about this in detail in my article on the "Dooh Nibor Economy" so I won't rehash it all here but the WSJ has an excellent PowerPoint detailing exactly how the administration's policies were the direct cause of this "crisis" even as their lack of policies now are exacerbating the situation. These things don't happen by accident, you can't love your administration and think they are wise policy makers and sharp economists and then give them a mulligan for causing the greatest financial disaster in our nation's history by saying "who could have seen that coming?" THEY COULD HAVE, that's who! It's what we pay them for…

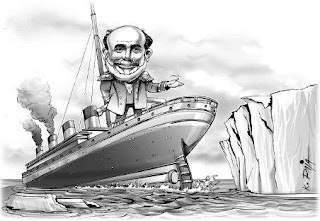

So should my disgust at the Fed's rate actions and statement yesterday cloud my investment decisions? Yes! I am a fundamentalist, not a TA guy. That means I invest based on the short and long-term conditions I see and what I saw in the above statement and the stream of BS I see coming from Bush and Paulson over the past week is that they are doing nothing more than saving their friends, effectively using what little is left of our government's spending power to do what is effectively giving the last lifeboats on the Titanic to the first class passengers only.

Now that doesn't mean I am giving up on the markets, just that yesterday's Fed action was little more than rearranging deck chairs on the Titanic while anyone not actually on the ship (foreign investors) can clearly see that we have struck and iceberg and are taking on water and no matter how many free pina coladas Bernanke hands out, all the 2nd class passengers are still going to die an icy, cold death.

So, until we see some better numbers from the financials, which we WILL get this Q, and until we get a pullback in commodity prices, I am going to be cautious at the top of each 5% market move and yesterday's 3.5% gain put us up a neat 6% off of last Monday's bottom and just a bit over the Dow's 50 dma at 12,358, a level we've been rejected from 3 times this year. When my ship hits an iceberg (Jan 22nd) and the captain and crew bail out the water, I may believe them once but then the ship sinks further (2/11) and they bail out more water but then we sink further (3/10) and we get to a certain point where I feel better putting on a life preserver until we get to calmer waters.

We're going to watch and see if we can hold that 5% line (12,317) on tomorrow's pullback as well as watch the 50 dma, just 40 points above it. We are still going to need follow-up action that truly addresses the housing crisis as well as some real inflation fighting and dollar stability. Once we have those items in place, then we are ready to go gung-ho bullish but, until then, I'd rather lock in those gains as they come to us.

Keep in mind that just 4 months ago, Jimmy Cayne has supposedly lost the LEAST amount of money in this group.