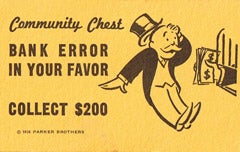

How ironic that on April 1st we have do without our fearless leader…

How ironic that on April 1st we have do without our fearless leader…

Bush is in the Ukraine today, pushing for Ukraine’s NATO membership over Russia’s strenuous objections because the Ukraine is willing to support his war(s). Why Bush is going to spend his last few pennies of political capital pissing off Putin is beyond me but anything that keeps him from going on TV and telling us how good the economy is can’t be a bad thing for the markets.

The date was not lost on the Ukranian papers who said: "All’s well with the American leader’s sense of humor: visiting Ukraine for the first time in his eight-year presidency, Bush decided the visit should take place on April 1 but not everything about the day will be a laughing matter…. Among Ukrainian leftists Bush’s visit is like a red rag to a bull."

Let’s hope Bush’s departure is a red flag for the bull market as we need SOMETHING to get excited about. I already mentioned this weekend that the combination of Congress returning and Bush leaving is being seen as a big positive to international investors, who are looking for reasons to put money back into the US and are currently placing 60% odds that Barack Obama will be the next President of the United States. They are also placing a 70% bet on a US recession this year so, again, any indications that we will skip one during second quarter earnings will be a very big upside surprise to the people who have all the cash (Europeans).

Right before they have at Bernanke this afternoon, Congress will be grilling executives from XOM, CVX, COP, BP and RDSA as to why they should continue to get $18Bn in tax breaks ($1.8Bn/yr) but the timing does not bode well for the energy companies, as many of their Republican supporters will be busy with the Fed chair, so we can expect some very nasty rhetoric from the Dems that should be good for our XLE puts and I still like the May $73 puts. which fell back to $3.15 at yesterday’s close.

Right before they have at Bernanke this afternoon, Congress will be grilling executives from XOM, CVX, COP, BP and RDSA as to why they should continue to get $18Bn in tax breaks ($1.8Bn/yr) but the timing does not bode well for the energy companies, as many of their Republican supporters will be busy with the Fed chair, so we can expect some very nasty rhetoric from the Dems that should be good for our XLE puts and I still like the May $73 puts. which fell back to $3.15 at yesterday’s close.

Let’s all keep mind when the oil guys tell us that 40% of their stock (that’s $4Tn worth of stock) is owned by pension funds and "widows and orphans" that 60% IS NOT – just like the wealth of this nation, 60% of the money is in the hands of 10% of the people and WE, THE PEOPLE, need to stop falling for this BS every time someone questions these guys. Hopefully, today will be the day but maybe I’m just a fool for hoping…

Our futures are looking very bright this morning, let’s hope they are not fooling us again – The Hang Seng and the Nikkei traded up about a point despite very low confidence numbers from Japanese manufacturers but Shanghai could not shake off China’s tight-money crackdown plus some weaker-than-expected earnings in early reporting, taking the index down 4%. China’s central bank reiterated late Monday that it will "decisively" implement a tight monetary policy, and added that curbing overly rapid price increases is a key task this year.

Europe is up nicely this morning despite UBS announcing another $19Bn in write-downs and DB announcing $4Bn in Q1. It is very important to understand why UBS is UP 3% on this news. The bank is writing off $19Bn in real estate assets FULLY, which ELIMINATES risk from their remaining assets and they put those real-estate assets into a separate business unit that will explore options as to how best to maximize the value. UBS meanwhile, can take a much cleaner balance sheet to investrors, free from the stigma of sub-prime and CDOs and they can get on with their business of moving $2Tn in other assets around from which that bank derives an average of $100Bn in annual revenues.

Investors are already starting to see the good in banks’ attempts to put these lending mistakes behind them. A write-down does little to impune a large-cap financial’s day-to-day operations. We discussed this weekend how it is fear and manipulation that have been taking down our financials. Those XLF Apr $25 calls should do very well today in the DTP and LTP players will be very happy with the leaps we picked up last week. C is still a wildcard, we like them in the leaps but we’re going to keep a stop on our short-term profits – better to be a fool who takes a 30% gain too early than one who lets it slip away!

Investors are already starting to see the good in banks’ attempts to put these lending mistakes behind them. A write-down does little to impune a large-cap financial’s day-to-day operations. We discussed this weekend how it is fear and manipulation that have been taking down our financials. Those XLF Apr $25 calls should do very well today in the DTP and LTP players will be very happy with the leaps we picked up last week. C is still a wildcard, we like them in the leaps but we’re going to keep a stop on our short-term profits – better to be a fool who takes a 30% gain too early than one who lets it slip away!

Microsoft said "no soup for you" to YHOO and will NOT be raising their offer, this should be good for our MSFT calls and we could get a very nice run if they break $29 today. The $27.50s make a nice momentum play at $1.30 (yesterday’s close) and the May $29s are also attractive at $1.15. AAPL is also attracting attention with Piper Jaffray suddenly deciding Apple can sell 45M IPhones NEXT YEAR ALONE! This is a near doubling of expectations and comes coupled with a report that Mac sales grew 37% in 2007, also double the PC industry’s rate of expansion. You would think we couldn’t want any more Apple as it’s our largest virtual portfolio holding but it may be time to buy MORE APPLE! If you have it now, or even if you don’t, it’s time to add a layer of higher calls like the Jan $150s at $22.50 (more this morning) or the 2010 $150s at $36.10. There should also be some interesting spreads and we’ll check them out in the morning.

With a position like our July $125s, which are up 60% from our 2/6 purchase, we buy an equal number of Jan $150s, which are well covered by the existing 3/4 sell of $145 callers and, if Apple keeps going up, we roll the callers to 2x the May $155s but if Apple drops, we stop out the $125s, taking that profit off the table and leaving ourselves with a well-covered and easy to roll spread.

With a position like our July $125s, which are up 60% from our 2/6 purchase, we buy an equal number of Jan $150s, which are well covered by the existing 3/4 sell of $145 callers and, if Apple keeps going up, we roll the callers to 2x the May $155s but if Apple drops, we stop out the $125s, taking that profit off the table and leaving ourselves with a well-covered and easy to roll spread.

It’s going to be a very exciting day but we have to get past ISM and Construction Spending at 10 am. We also need oil to stay below $100 for the day, which will give consumers a nice $150M a day break vs. last week’s prices – that’s a lot of IPhones!