While we are hoping for a "No Thump Thursday" we certainly aren't counting on it.

While we are hoping for a "No Thump Thursday" we certainly aren't counting on it.

We were able to spot the EXACT top of the market yesterday by following my 10:36 instruction: "If GM is going up then the market is going up, good rule of thumb for the day as there is NO justification for putting a penny into that company." GM was indeed an excellent leading indicator for the Dow, turning down sharply at 12:04 and heading into a confirmed downtrend at 12:20.

The Dow topped out at 12,695 yesterday but we covered into the last stage of the rally based on my 11:26 strategy: "Market looking hesitant here, smells like profit taking to me and post Bernanke was a disaster last time so make sure everything is at least 1/2 covered (and I remind you that my uncovered 1/2 is covered by Index puts) and let the market prove to us that it’s a mistake but tomorrow is Thursday and then it’s Friday (weeks are funny that way) and there is NO way we are going naked into the weekend so a cover now is a good thing."

Staying ahead of the market is a good thing, we had extensive discussions over the past two days about rolling and adjusting callers and having those skills allows us to make an educated guess once in a while without too much fear of "missing" a rally. As I said the other day, Tuesday WAS the rally, it's the same rally we've now had in 4 of the past 5 weeks so how many times are we going to let greed overtake our good sense and simple pattern recognition?

We took our first puts of the week in the afternoon, lots of oil puts as $105 was ridiculous (I mean really, are we having the first recession in history where demand for commodities goes up?) and I was very relieved to move mainly to cash in our small virtual portfolios with the 25KP now at $34,000 with $18,000 in cash and the $10KP at $14,400 with $8,500 in cash. This is a huge relief coming off our worst start ever for our small virtual portfolios!

Now we're back in "wait and see" mode for the market. I will be sad to have to cover more of our remaining positions but we haven't gotten any real movement on the housing front or G7 action on the dollar and oil is persistently pumped up despite all logic to the contrary (and an 8M barrel build yesterday) so we don't have any of our bullish catalysts in place to make us want to take chances into earnings.

The commodity boom continued overnight in Asia as oil and metal stocks led the Nikkei up 200 points and the Hang Seng up 392, both about 1.5% for the day and both putting in strong finishes despite growing concerns about a US recession. Europe's markets are down about half a point ahead of the US open. Nato nixed the Ukraine, despite Bush's massive efforts, further highlighting the loss of US prestige on the World stage. Prices in the EU rose 5.3% in February over the prior year, more than double the ECB target rate and EU finance officials are meeting on Friday ahead of the April 11th G7 meeting in Washington. We can expect to face a strongly unified EU next week, who are likely to read us the riot act if we don't get our currency/debt/economy in order.

The whole world is edgy and keeping a wary eye on the US economy and international investors were very put off by Bernanke's recessionary statements yesterday. The Fed has quietly placed "monitors" on site at GS, MS, LEH, MER and JPM in order to prevent (hopefully) another BSC-type blindside that will force them to come to the rescue of another financial institution that makes them look like they are asleep at the wheel. Will this inspire investor confidence or fear and panic?

The whole world is edgy and keeping a wary eye on the US economy and international investors were very put off by Bernanke's recessionary statements yesterday. The Fed has quietly placed "monitors" on site at GS, MS, LEH, MER and JPM in order to prevent (hopefully) another BSC-type blindside that will force them to come to the rescue of another financial institution that makes them look like they are asleep at the wheel. Will this inspire investor confidence or fear and panic?

There is a housing relief package making its way through the Senate but, at $15Bn, it's sort of a joke and does nothing to address the real issues facing the 7,000 families a day that are losing their homes while these people debate banking reforms. Of the $15Bn in this bill, $6Bn is a tax break for home builders and there is an additional $7,000 tax credit for people who buy a foreclosed home – who exactly are we helping here?

Mutual funds were helping no one last quarter, with the average fund LOSING 10.6% according to Lipper, Inc. That was WORSE than the 7% drop in the Dow and WORSE than the 9.4% decline in the S&P so I will take this moment to say how totally thrilled I am that the Stock Club is finally launching and my hedge fund is also getting ready to launch as I'm feeling more than a little confident that we can do better than that!

![[Image]](http://s.wsj.net/public/resources/images/IF-AA023C_QUART_20080402194347.gif)

Fidelitiy's $39Bn Magellan fund, one of the World's most widely held mutual fund, lost 12.4% in the first 3 months of the year and 11 ETFs were forced to shut down in February as money is moving out of those funds as well. On the bright side, we can see from the above chart, we haven't had 3 consecutive down quarters in a decade so let's hope that's one economic record Bush DOESN'T break.

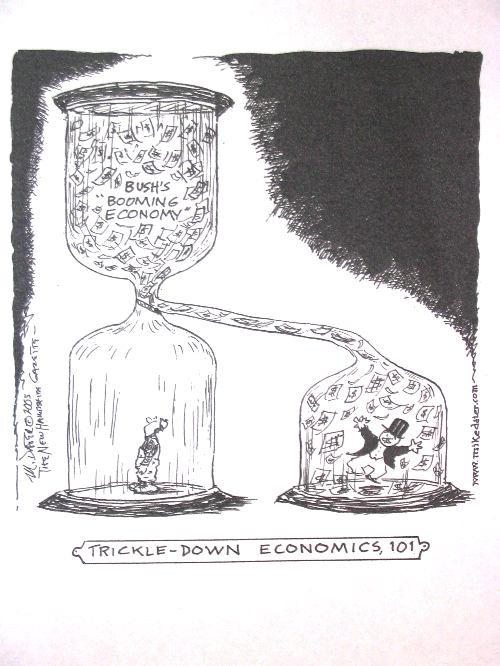

It's still all about the oil and we are not going to have economic prosperity when every single day global consumers are taking $9Bn and burning it – that works out to $3.3Tn a year, just over 5% of our global economy and does not include refining and retail mark-ups on fuel that push the total closer to $5Tn of wealth that is transferred from the many to the few on an annual basis.

It's very simple, you (and I'm talking to just 5,990,000,000 out of 6Bn of you so don't worry if you are one of the 10,000,000 who benefit from this) spend 10% of your wealth EVERY SINGLE YEAR on consumables like food and energy, and the 10M people who ultimately get this $7Tn use that money to buy up the world's assets, including your home, which they lend you money to buy and charge you interest. How many years does it take before they own all the assets and you owe all the interest?

This is trickle down economics in action – vote while you still can!