Here’s another informative article by Mish. And yes! it’s working.

Deflation In A Fiat Regime?

I was asked by professor Lance Lewis (and many others) to reply to on a post by Doug Noland called Setting the Backdrop for Stage Two. Before reviewing Noland’s post I would first like to comment on this statement made by Professor Lewis: " I have never been one to believe you can have a true deflation with a fiat currency."

Before we can begin any discussion, it is imperative to agree on the meaning of terms. I happen to believe in Austrian economics and the definition I use when I speak of inflation is a net increase in money supply and credit. Deflation is the opposite, a net decrease in money supply and credit. For more on those definitions as well as rationale for discarding seven other definitions, please see Inflation: What the heck is it?

Deflation In Japan

Assuming that there is agreement as to what inflation and deflation are, it is quite easy to refute the idea that deflation cannot occur in a fiat regime. Japan was in deflation for a decade.

However, some still argue that Japan never went through deflation. One basis for that argument is that "money supply" as measured by M1 or base money supply never contracted over a sustained period. The other argument is that prices as measured by the CPI never fell much. Those are flawed arguments (at least from an Austrian economist point of view) given the focus on consumer prices and money supply alone as opposed to money supply and credit.

Although Japan was rapidly printing money, a destruction of credit was happening at a far greater pace. There was an overall contraction of credit in Japan for close to 5 consecutive years. Property values plunged for 18 consecutive years. The stock market plunged from 40,000 to 7,000. Cash was hoarded and the velocity of money collapsed. Those are classic symptoms of deflation that a proper definition incorporating both money supply and credit would readily catch. Those looking at consumer prices or monetary injections by the bank of Japan were far off the mark.

Yes, there was deflation in Japan. Furthermore, if deflation can happen in Japan, then there is no reason why it cannot happen in the US as well.

Economist Paul Kasriel Weighs In

I discussed how a Japanese style deflation might occur in the US in an Interview with Paul Kasriel.

Mish: Would you say that consumer debt in the US as opposed to the lack of consumer debt in Japan increases the deflationary pressures on the US economy?

Kasriel: Yes, absolutely. The latest figures that I have show that banks’ exposure to the mortgage market is at 62% of their total earnings assets, an all time high. If a prolonged housing bust ensues, banks could be in big trouble.

Mish: What if Bernanke cuts interest rates to 1 percent?

Kasriel: In a sustained housing bust that causes banks to take a big hit to their capital it simply will not matter. This is essentially what happened recently in Japan and also in the US during the great depression.

Mish: Can you elaborate?

Kasriel: Most people are not aware of actions the Fed took during the great depression. Bernanke claims that the Fed did not act strong enough during the great depression. This is simply not true. The Fed slashed interest rates and injected huge sums of base money but it did no good. More recently, Japan did the same thing. It also did no good. If default rates get high enough, banks will simply be unwilling to lend which will severely limit money and credit creation.

Mish: How does inflation start and end?

Kasriel: Inflation starts with expansion of money and credit.

Inflation ends when the central bank is no longer able or willing to extend credit and/or when consumers and businesses are no longer willing to borrow because further expansion and /or speculation no longer makes any economic sense.

Mish: So when does it all end?

Kasriel: That is extremely difficult to project. If the current housing recession were to turn into a housing depression, leading to massive mortgage defaults, it could end. Alternatively, if there were a run on the dollar in the foreign exchange market, price inflation could spike up and the Fed would have no choice but to raise interest rates aggressively. Given the record leverage in the U.S. economy, the rise in interest rates would prompt large scale bankruptcies. These are the two "checkmate" scenarios that come to mind.

Deflation Is Here Now

The interview with Kasriel was in December of 2006. On March 17,2008 in Now Presenting: Deflation! I stated "Deflation is here and it is now." A followup post was called Why Do Oil Prices Keep Rising? The key idea from the latter article is as follows:

A Weak Dollar Is Masking Deflation!

Right now what we have is deflation with a weak dollar. That weak dollar, in conjunction with peak oil, has caught nearly everyone off guard to the point they are screaming about oil prices and bond bubbles, while missing the far more important deflationary forces of foreclosures, bankruptcies, and massive writedowns in credit.

Setting the Backdrop for Stage Two

Week in and week out Noland writes a great column. Stage Two made "Best of the Web" on Dollar Collapse. I happen to agree with that "best of" designation because Noland took a viewpoint and argued it well. However, let’s take a look on a point by point basis:

Noland: I hear pundits still referring to a “deflationary Credit collapse.” Well, the U.S. Credit system implosion was largely stopped in its tracks last month. The Fed bailed out Bear Stearns; opened wide its discount window to Wall Street; and implemented unprecedented liquidity facilities for the benefit of the marketplace overall. Central banks around the globe executed unparalleled concerted market liquidity operations.

Mish: Technically the Fed bailed out JP Morgan (JPM) not Bear Stearns (BSC). The Fed was very afraid of a derivatives cascade, and the Fed made JP Morgan whole on swaps it was holding on Bear Stearns. At $10 per share its pretty tough to argue Bear Stearns was bailed out. Employees darn near lost everything. However, Noland is correct that Central banks around the globe executed unparalleled concerted market liquidity operations. In that regard, Noland has the key idea correct.

Noland: Here at home, the GSEs’ regulator spoke publicly about Fannie and Freddie having the capacity to add $200 billion of mortgages to their balances sheets, with the possibility of increasing their guarantee business as much as $2 TN this year (certainly including “jumbo” mortgages).

Mish: In practice there is little market for Jumbos. Where there is a market, interest rates are sky high because of credit risk. Jumbo rates are currently 2 points higher than conforming loans, and even higher in distressed areas. Furthermore, jumbos often require a larger down payment to boot. Liquidity on jumbos is more imaginary than real according to my contacts. In addition to the problem in jumbos, there is practically no market for condos. I discussed this situation in Condo Credit Squeeze. That squeeze is going to cause a wave of bankruptcies at regional banks for reasons cited.

Noland: The Federal Home Loan Bank system was given the ok to continue aggressive liquidity injections and balloon its balance sheet in the process. And now (see “GSE Watch” above) we see that the Federal Housing Administration (with its new mandate and $729,550 loan limit) is likely to increase federal government mortgage insurance by as much as $200bn this year, while Washington’s Ginnie Mae is in the midst of a securitization boom.

Mish: It is likely to do no such thing. The reason is the $729,550 loan limit is temporary. And because it expires at the end of the year, and because Fannie (FNM) and Freddie (FRE) have provisions in distressed areas like California, few deals are getting done. Banks are unwilling to do deals because they do not want to get stuck holding paper they cannot sell to Fannie after the end of the year. I have discussed this situation with mortgage brokers and this upping the limit is more show than reality. Perhaps Congress will remove that temporary restriction but as of now, not much is happening. One final point about jumbos: Fannie Mae and Freddie Mac will not refinance loans that are underwater. That alone will put a halt to GSEs rapidly expanding balance sheets on account of jumbos.

Noland: It is, as well, worth noting that JPMorgan Chase expanded assets by $80.7bn during the first quarter (20.7% annualized) to $1.642 TN, with six-month growth of $163.3bn (22.1% annualized). Goldman Sachs expanded its balance sheets by $69.2bn during Q1 (24.7% annualized) to $1.189 TN, with half-year growth of $143.2bn (27.4%). Even Wells Fargo grew assets at an almost 14% pace this past quarter. And we know that Bank Credit overall has expanded at a 12.6% rate over the past 38 weeks. Meanwhile, GSE MBS issuance has been ramped up to a record pace. And let’s not forget the Credit intermediation function now being carried out by the money fund complex – with assets having increased an unprecedented $371bn y-t-d (41.3% annualized) and $900bn over the past 38 weeks (47.7% annualized). It is also worth noting the $184bn y-t-d increase (29% annualized) in foreign “custody” holdings held at the Fed. Sure, the Credit system remains under significant stress, with additional mortgage and corporate Credit deterioration in the offing. But, at least for now, policymakers have successfully stemmed systemic deleveraging. The Credit system is simply not in deflationary collapse mode.

Mish: Technically Noland is correct. However, I ask the question: at what pace did Wells Fargo (WFC), Citigroup (C) , JPMorgan (JPM) etc, expand credit if that credit was marked to market? Is bank credit marked to market expanding or contracting? I suggest it is contracting. One of the ways it is being masked is by hiding garbage in Level 3 assets that were Level 2 assets last quarter. Another way it is being masked is by pretending that the collateral the Fed is swapping with banks and brokerages is somewhere close to full value.

I am quite certain that marked to market credit is contracting. However, I cannot prove it. I talked about this in Night of the Living Fed. "Several people have asked me recently if I have been changing my tune on a Fed bailout. The answer is no. I long ago predicted the Fed would try all sorts of things to stop a deflation threat. But I also have also said, these measures would not work and indeed they haven’t. What is happening is the Zombification of Banks, that is exactly what happened to Japan as well."

Zombification does not halt deflation, it prolongs it. That is the main point I believe Noland misses.

Noland: When the Fed and Washington radically altered the rules of U.S. finance last month, they placed in jeopardy huge positions that had been put in place to hedge against and profit from systemic crisis. With the end of “Stage one” arises a major short squeeze in the Credit, equities, and derivatives markets. And when it comes to contemplating the scope and ramifications of today’s “hedging” activities, we’re clearly in Uncharted Waters. It is not beyond reason that a disorderly unwind of “bearish” Credit market positions could incite a mini bout of liquidity, speculation, and Credit excess that exacerbates Global Monetary Instability – while Setting the Backdrop for Stage Two of the Crisis.

Mish: I certainly can agree with the idea of Global Monetary Instability and one reason is counterparty risk on credit default swaps..

Credit Default Swaps Soar

Bloomberg is reporting Credit Swaps Top $62 Trillion in Rush to Hedge Losses.

Credit-default swaps worldwide expanded to cover $62.2 trillion of debt in 2007 as investors rushed to protect against losses triggered by the collapse of the U.S. subprime mortgage market. Contracts outstanding rose 37 percent in the second half of 2007 from $45.5 trillion in the first half, the New York-based International Swaps and Derivatives Association said today.

Using data from the Bank for International Settlements, ISDA estimated the gross market value of all outstanding derivatives contracts is about $9.8 trillion. That would be the amount owed to banks or investors if the contracts were liquidated. Subtracting off-setting payments owed between trading partners, that number would fall to about $2.3 trillion, the group said.

Postponed Is Not Prevented

I agree with Noland that an immediate deflationary collapse was prevented when the Fed bailed out JP Morgan. However, that does not negate the ongoing deterioration of bank balance sheets and a slow deflationary process, just like happened in Japan. Looking ahead, I do not believe the Fed will be able to engineer another huge bailout in swaps when the need arises, which it will.

Citigroup is coming to market with an 8 3/8% preferred. Merrill Lynch announced an 8 5/8% preferred. That capital is being raised for one reason only: They have to, over and over. Credit is rapidly being destroyed and Bernanke cannot prevent it.

Too Big To Bail

Professor Sedacca made some interesting comments in The Moral Hazard Club.

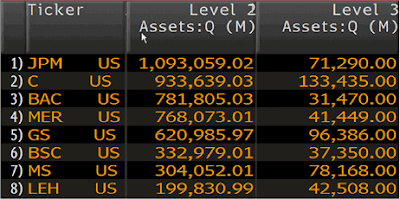

When you add up all the Level II assets by just the eight largest holders in the U.S: JP Morgan (JPM), Citibank (C), Bank of America (BAC), Merrill Lynch (MER), Goldman Sachs (GS), Bear, Morgan Stanley (MS) and Lehman Brothers (LEH), it comes to a staggering $5 trillion – nearly half the size of the economy. Level III assets are nearly $600 billion.

Is the Fed big enough to bail out all these assets? My best guess is probably not, and more firms will fail. If the loans and economy both don’t start performing, these failures will happen more quickly, which is why my firm continues to avoid credit risk. It’s not hard to envision an acceleration of this process if the market starts to believe the special loan facilities and other funding processes artificially created to deal with this mess cease to work.

The Fed is slowly becoming the dumping ground for dealers and banks – members of the ‘Moral Hazard Club.’ It’s is running out of capital, and quickly.

The problem assets (at least the ones we know about) are way too large for the Fed to completely absorb. It’s waiting and hoping the economy and credit markets stabilize before it runs out of ammunition.

What Cannot Be Paid Back Will Default

Debt that cannot be paid back will be defaulted on. And if one believes like I do, that the above chart shows a situation that is too big to bail, then default it is. Although the Fed is willing to break the rules to the point of taking illegal actions (See Fed Uncertainty Principle Corollary Number Four) it would be a mistake to think the Fed would purposely cause hyperinflation.

The reason is simple: Hyperinflation would end the game and whatever power the Fed had. With that backdrop, there are huge constraints on the Fed. One of them is the US dollar. Another one is wages. It does no good to force home prices up if people are out of work and cannot pay the bills.

Besides, the Fed clearly cannot force home prices up. If they could, they would have done so already. Yes, the Fed can cheapen the dollar, but the Fed cannot force banks to lend or force companies to hire. Without jobs and without rising wages, the Fed can lower interest rates to 0% and it will not stop a destruction of credit.

Noland gives far too much credit to the Fed. Postponed Is Not Prevented. It took three lending facilities, interest rates at 2.25%, and a rescue of JP Morgan to stabilize the markets. The cost was zombification of banks. Bernanke will soon have to face option arms, increasing numbers of walk-aways, a commercial real estate implosion, rising unemployment, mounting global tensions, and European displeasure over the Euro.

What will Bernanke do for an encore? Some suggest the answer will be to print. On that score I actually agree. But where will the money go? Will zombified banks be willing to lend? To who? I will address the issue of printing in a followup post.

In the meantime I am sticking with my story right now. The Fed is clearly not printing, and marked to market destruction of capital and credit is happening at a stunning rate. That combination equals deflation regardless of what the price of commodities is.

The mad scramble by some corporations to raise capital, the scramble by others to play "hide and seek" with level 3 assets, and the scramble by virtually everyone to play swap-o-rama with the Fed supposedly just to prove the process works tells the real story. The real story is deflation.