I’m really fed up with oil this morning!

I’m really fed up with oil this morning!

First of all, we have another run at $120 by oil. THEY are pulling out all the stops; Nigerian rebels, Nigerian Strikes, North Sea strikes, shooting at Iranian boats and, now, they have pulled out the big gun – OPEC President Chakib Khelil made a statement that oil could hit $200 – or did he?

I am publicly calling shenanigans on Criminal Narrators Boosting Crude and other MSM outlets who are pushing this nonsense as a story when the facts (which you have to go to Turkish newspapers for) are as follows: "Questioned about a possible rise which would go to $200, the minister did not rule out this eventuality, explaining that this rise is indexed from now on to the fall in the dollar or to the rise in the dollar." El Moudjahid reported. "In terms of fundamentals, stocks are high, demand is easing, supply is satisfactory. Therefore normally, without geo-political problems and the fall of the dollar, the prices of oil would not be at this level." he was quoted as saying. Khelil, a former World Bank official, is also Algeria’s Minister of Energy and Mines.

THIS is the actual story that is being spun by these oil whores (there, I said it) on CNBC as "Oil is seen rising as rising to $200 by OPEC" and is what is driving the NYMEX back up this morning. I urge you to tune into CNBC and listen to how many times they repeat this "story" and note how many ways they try to play off it while keeping in mind the actual, factual statement on which this BS is based – see how disgusted you are by the end of the day!

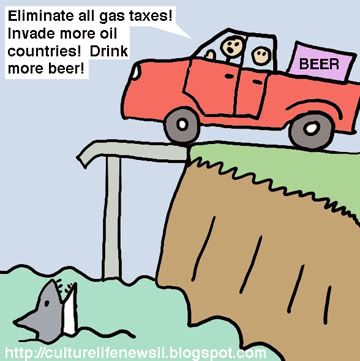

So we have an out of context comment being pushed at every commercial break I’ve seen this morning on CNBC as the story of the day. Could this be pure coincidence on the same week we start to get earnings reports from the majors? This is not just irresponsible journalism, this is a Jingoistic support of oil at all costs, and those costs are currently $2.4Bn a day to the American consumers, courtesy of GE, who stand to make billions of those dollars as they set themselves up as the alternate energy company in a $100 oil world.

So we have an out of context comment being pushed at every commercial break I’ve seen this morning on CNBC as the story of the day. Could this be pure coincidence on the same week we start to get earnings reports from the majors? This is not just irresponsible journalism, this is a Jingoistic support of oil at all costs, and those costs are currently $2.4Bn a day to the American consumers, courtesy of GE, who stand to make billions of those dollars as they set themselves up as the alternate energy company in a $100 oil world.

No one is interesting in spending the Billions GE is charging (and financing) on energy projects around the world if they think oil will slip back to $50 per barrel. Only the constant hype of higher and higher energy prices can get corporations and nations to sign multi-billion dollar contracts for projects that only break even if oil stays over $70 per barrel. Of course, when big business controls the media – what do you expect is going to happen? Sadly, in order for GE to make their share of $100Bn of energy projects that are going into place around the world (the US is one of the only countries on this planet that are NOT investing in becoming less oil dependent), they need US consumers to spend ANOTHER $365Bn on oil this year, over and above the $730Bn a year we’re already paying with oil at $100 a barrel.

For XOM (reporting Thursday) to raise their profits 10% since 2005, oil had to double and the American people had to go from spending $50 a barrel in early ’05 to $100 a barrel in late ’07 (since November 2001 GW Bush has bought 156M barrels for the Strategic Petroleum Reserve at an average cost of $67 per barrel, costing taxpayers an additional $10.2Bn and accounting for 3% of all US oil "demand" since his election). Does XOM need Bush to hit $200 oil to make their next 10% profit increase? When will this end? $400 a barrel? $600? $800?

Bush has been pushing to double the size of the SPR, which would allow him or the next Republican president to put another 700M barrels in the ground (at $100 per barrel, that’s another $70Bn and would account for almost 2 entire years of our imports – 3 years of imports from countries other than Canada or Mexico, who are unlikely to cut us off if we have a war with Iran!). Note that the government’s SPR web-side does not publish anything useful like fill statistics on thier site, instead directing you to fill out Freedom of Information Act forms.

We certainly don’t want to stop XOM or GE from making more profits so if GE’s TV network says oil should be at $200 a barrel, let’s all swallow that BS just like we swallowed the last 100% increase -even though there ACTUALLY were NO hurricanes, NO declines in production (OPEC had to cut 3M barrels of daily production due to oversupply), NO major outages, NO war with Iran, NO cut-off from Venezuela, NO surge in demand, NO ANYTHING that CNBC has been hitting us with day after day for 3 years as part of this endless media campaign to scare the American people into paying 500% more than AFTER 9/11 for the 2nd most abundant liquid on Earth!

We certainly don’t want to stop XOM or GE from making more profits so if GE’s TV network says oil should be at $200 a barrel, let’s all swallow that BS just like we swallowed the last 100% increase -even though there ACTUALLY were NO hurricanes, NO declines in production (OPEC had to cut 3M barrels of daily production due to oversupply), NO major outages, NO war with Iran, NO cut-off from Venezuela, NO surge in demand, NO ANYTHING that CNBC has been hitting us with day after day for 3 years as part of this endless media campaign to scare the American people into paying 500% more than AFTER 9/11 for the 2nd most abundant liquid on Earth!

I still maintain that this is end stage hyperbole as speculators struggle to unwind themselves from crushingly overpriced commodity positions on the eve of a possible cessastion of Fed cuts that can send the dollar climbing 5% and send oil back below $100 along with many other tag-along commodities that are betting the dollar can continue to break record lows on a daily basis.