Fed day, party time, excellent!

Fed day, party time, excellent!

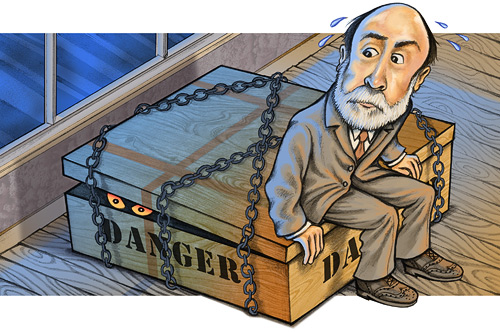

Hopefully the free money party has come to an end. Can Helicopter Ben change his evil ways or will will this groundhog continue to see a recessionary shadow and throw more money down the hole, giving us 6 more weeks (until the June meeting) of high inflation?

I ran down my expectations on key earnings in the Wrap-Up so we’ll move right along to the good stuff (and I’m way behind this morning so I’ll keep this short). CMI came through for us, and, as predicted, FSLR had blow-out numbers and gave good guidance so we’ll ge our shorting opportunity as planned (but let’s stick with Cramer as he sticks another load of bag-holders with this one this evening!). GRMN I was wrong on as they had a miss but profits are up 6% so we’ll stick with them and sell more calls. GM ONLY lost $3.3Bn in the quarter against their $12Bn market cap so they are, of course, up 5% pre market. HES had good numbers and I’m back to being glad we were too scared to short them.

NOV did well but not well enough to worry me on the June $60 puts with a penny beat on record prices. Woe unto these companies if revenues fall off with costs at this level! PG, SI and KFT all did well – what kind of recession is this? TWX was not good but they are spinning off the cable unit and maybe AOL if they find a buyer so they are still flattish, which was our bet.

Actually it turns out we’re NOT in a recession so the pessimists can say we have further to fall but, as I’ve been saying since last Summer, if we can have a $400Bn mortgage crisis and all it does is knock growth to 6%, then everything these bozos in the media are saying is wrong and there are Trillions of dollars on the wrong side of this bet and we could be heading right back to 14,000 (my prediction from 12/31 was a pullback below 12,000 and 14,500 by year’s end). If anyone wonders how we make money, just re-read those predictions when you have the chance and think how much money anyone can make when you get a call that right!

Actually it turns out we’re NOT in a recession so the pessimists can say we have further to fall but, as I’ve been saying since last Summer, if we can have a $400Bn mortgage crisis and all it does is knock growth to 6%, then everything these bozos in the media are saying is wrong and there are Trillions of dollars on the wrong side of this bet and we could be heading right back to 14,000 (my prediction from 12/31 was a pullback below 12,000 and 14,500 by year’s end). If anyone wonders how we make money, just re-read those predictions when you have the chance and think how much money anyone can make when you get a call that right!

Asia had a mild pullback and the BOJ held rates steady at 0.5% (and the Japanese have the world’s highest savings rate!). Generally, they had the same commodity driven sell-off that we did yesterday and we love those so everything looks good over there. Europe perked up considerably on our GDP report and GM’s bright spot was – small cars, which makes global automakers happy and should continue to worry the oil bulls. Only 25% of the mergers in Britain last year were preceded by suspicious stock trading, which sounds awful unless you look at the shenanigans that go on ahead of 75% of our deals while our SEC gently sleeps.

Nothing really matters until the Fed this afternoon but we are muscling back to Monday’s opening level in pre-market so let’s see what sticks.

Have fun out there!