Here’s another well-written, colorful commentary from Trader Mark.

It Only Matters When it Matters

As I’ve been saying, now they are trotting out the same reasons that have existed the past few days, weeks, and in fact months for reasons for the selling.

a) Oil is high. As if $132 matters more than $128. That’s the reason.

b) Financials stink. As if they improved substantially the past few days, weeks, months. That’s the reason.

c) The Federal Reserve is beginning to face reality instead of constantly calling for an end of inflation (if we had any) or a 2nd half recovery. That’s the reason. Because until the Fed spoon feeds traders a dose of reality, they can ignore it. And let me be clear, the Fed is still an eternal optimist compared to what is really happening and will be happening down the road. Notice how the Fed is changing their tune slowly but surely, to our view. But only until the evidence is smacking them in the face, to prove their earlier predictions were wrong. And these are our best prognosticators? Yikes. Maybe I need to go work for the Fed. Nah. No fun.

- The Federal Reserve on Wednesday sharply lowered its projection for economic growth this year, citing blows from the housing and credit debacles along with zooming energy prices. It also expects higher unemployment and inflation. (shocker!)

- Fed officials viewed economic activity "as likely to be particularly weak in the first half of 2008; some rebound was anticipated in the second half of this year," the documents stated. (oh still clinging to ‘some’ rebound; down from ‘a hell of a’ rebound, then in fall 2008 they will say, nevermind that rebound thing, it’s coming next year)

- Under its new economic forecast, the Fed said it now believes gross domestic product will grow between just 0.3 percent to 1.2 percent this year. That’s lower than a previous Fed forecast, released in late February, that estimated growth to be between 1.3 percent and 2 percent.

- With economic growth slowing, the Fed projected that the national unemployment rate will rise to between 5.5 percent and 5.7 percent this year. That is higher than the central bank’s old forecast for the rate to climb as high as 5.3 percent. Last year, the unemployment rate averaged 4.6 percent. (not with this government’s reporting methodology – I expect unemployment to be 1% or maybe 0.001% with our reporting – I mean its an election year – we can’t be showing the truth can we?)

- The Fed raised its projection for inflation. The Fed now expect inflation to be between 3.1 percent and 3.4 percent this year. That’s higher than its old forecast for inflation, which was estimated to come in at around 2.1 percent to 2.4 percent. (not with this government’s reporting methodology – I expect inflation to drop to 0.0001% as well! See if we were playing with a serious set of books we’d have unemployment in 11-12% range and inflation in 11-14% range – but since it’s all fiction, does any of this matter? No.)

- The Fed’s documents indicated that their rate-cutting campaign may be winding down.

As I have been saying, once the market turns back down, all the "reasons" they have been ignoring for weeks on end will be trotted out as reasons to sell stocks. The reality is, the backdrop is the same as it was 1 day ago, 1 week ago, and in fact 1 month ago. Only the market attitude is different. So now when the selloff happens, they bring up all the same reasons we’ve been discussing ad nauseam as reasons to sell. So the stock market can be summed up… when the market wants to go up, it will find a reason to go up, despite logic. And vice versa. (my highlighting)

So now we will begin the next drumbeat which should be starting by July – the "everything will be fine in 6 months aka 1st half 2009" – you know, since "2nd half 2008" did not work out so well, now we can bid up stocks to outrageous levels on the "economic and earnings recovery of first half 2009". And once again for months on end we will hear "the market is discounting everything"… and it’s time to buy stocks for the coming recovery. In 6 months. They just never tell you which 6 months.

Again, until reality hits the traders with an overwhelming amount of evidence, the Kool Aid continues. Since no one can think for themselves it appears, when the Federal Reserve induces even a touch of reality that seems to set off panic. No one can think out loud…. hmm, ya think this $132 oil will actually pinch profit margins? Keep in mind – again – Fourth Quarter 2008 PROFIT expectations are 60% HIGHER than Fourth Quarter 2007. The 2nd half recovery party is still alive and well to the analyst community. Sorry to be the rain on their parade.

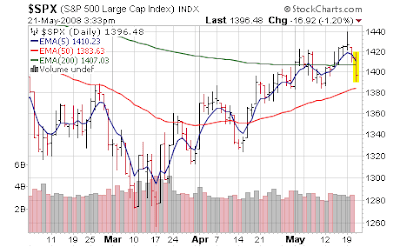

We said last Friday "Risk is High" and it was not a time to press bets. We mentioned Monday that we had the "2nd Intraday Reversal in 4 Sessions" – the market was warning us there was a nasty undertow beneath the surface. Further, speculative rallies in the "worst of breed" stocks were everywhere (even now they continue). All classic signs to get the heck out of Dodge – yes you’re going to miss that last 3-4% move in your stocks, but so what. Capital preservation is job #1. Always.

Technically, I will be looking to pare some short exposure around S&P 1380; I thought S&P 1400 would hold up better than it did. But it cut through like a knife. I expect a bounce off 1380 but won’t trust that first bounce – we’ll have to see how it holds. If we do break 1380 later in the week or next week, the plan is to buy back the short exposure I will be lightening up on on the first "test" of this level. Because that would indicate we could be headed meaningful lower. Despite the "2nd half recovery". Either way, I’ll be heavy in cash and expect to outperform the market and my peers here in periods like this – those who throw caution to the wind and go 100% long because they drink Kool Aid in huge quantities. Weeks like this are when the hedged strategy will benefit us. In fact, we were up yesterday during the sell off. And today. Boo… and Yah.

Conclusion: With unemployment at 0.0001% by 2nd half of 2008, and inflation down to 0.0001% by 2nd half of 2008, this is a great opportunity to buy stocks ahead of the 2nd half recovery. Please do so.