ISRG Review & Analysis by my friend David Gordon:

Saved by the bell!

But how likely will ISRG be to hold these levels, and not turn lower once again? Remember that the shares have merely reversed, at worst temporarily, and not broken above any levels of resistance. For that preliminary answer, we investigate how strong are the hands that buy and own the stock at this level…

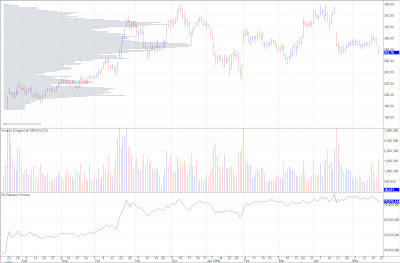

[click on each chart to enlarge]

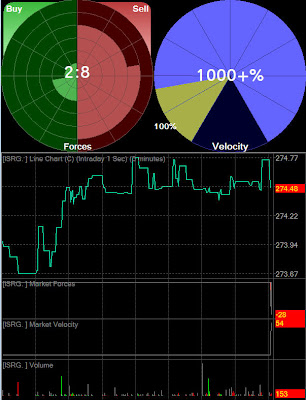

[click on each chart to enlarge]

The chart above shows volume at price (left scale) and on balance volume (bottom scale), two technical studies that measure the accumulation or distribution of the total volume. Neither study involves price, etc, which makes each study an excellent secondary analysis. (Explanations of these studies and how to use them can be found in this blog’s archives, or elsewhere on the web.) For the record, I see accumulation, despite the past 8 months of sideways price activity.

For a closer-in look of the activity this morning, I use…

… which also betrays steady and powerful accumulation. Contrary to yesterday’s rumor, comes this real news…

Cowen says that presentations at the American Urological Assn this week point to expanding use of Intuitive Surgical/ISRG‘s da Vinci system for more types of surgery, potentially raising addressable U.S. urology procedures by 23% and the total addressable U.S. mkt by 6%. Cowen analysts also saw strong interest from urologists in broadening daVinci use beyond prostatectomy, increasing their confidence level in their 63% and 49% procedure growth ests for 2008-09. Firm sees potential upside in their 2008 sales est, and reits their Outperform on ISRG.

New investments of Intuitive Surgical/ISRG, even at ~$280, could prove timely; perhaps equally as timely as my recommendation to buy during the last primary base at ~$85.

Full Disclosure: Long Intuitive Surgical/ISRG

Comment Section:

David:

Reuters/Forbes continues to issue a "news" release stating that a Cowen analyst is reporting lower revenue guidance by ISRG. This information was supposedly disseminated at a company conference. They released again Sunday. ???

http://seekingalpha.com/article/…? source=reuters

![]() Good morning, Daniel,

Good morning, Daniel,

I am unfamiliar with Donald Johnson. I checked his website (http://www.businessword.com/) rather than SA to confirm no transcription error occurred; none did.

1) I share Johnson’s concern re tighter credit conditions as a potential disruptor to ISRG’s revenue stream;

2) I mentioned the rumor (re revenues) in my post;

3) That rumor of lower revenue guidance of ~$850 million (vs $873 million) began during a Citigroup conference call; Eli Kammerman, the Cowen analyst uttered nothing even remotely similar. Meanwhile, ISRG continues to guide gross margins to be in the 69% range;

4) Later that morning, Deutsche commented on the rumor that the company reduced guidance, noting that ISRG did not change guidance and the consensus estimates have always been above the company’s guidance. (Emphasis mine – dmg) After Duetsche’s comments hit the wires, ISRG’s share price stabilized, and even began to climb… only to fall back into the close and a near breach of support.

I do not share Donald Johnson’s perception that "the daily and weekly charts of ISRG shares are bearish"… even if the share price were to decline to $240. Heck, I see primary (L/T) up trend support at $235-225, anyway, although I prefer multiple levels of support at ~$275 continue to stem a deeper decline to maintain the sanctity of the internal up trend, and the (presumed) intermediate term base.

Thank you for sharing your thoughts. I hope my reply helps.