Here’s an article on consumer confidence, courtesy of Alan Brochstein, AB Analytical Services.

Consumer Confidence Plunges: Buy!

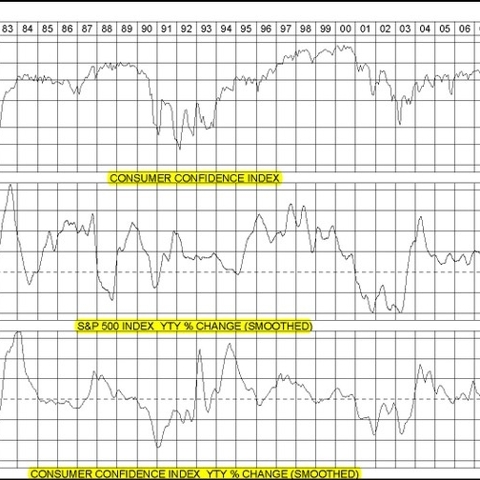

Falling consumer confidence tends to lead to a falling stock market, but once it is "low", it tends to signal a buy opportunity. Take a look at the 30 year history of the Consumer Confidence Index. You will see that yesterday’s print of 57.2 is the lowest level since the early 90s and represents a decline of over 42% from a year ago.

The top panel is the index itself. The middle panel is the one-year percentage change in the S&P 500.

It seems pretty clear to me that a year after a spike down in confidence, stocks have offered positive returns. Note that the last big drop occurred after the bottom of the bear market bottom in late 2002. Confidence was weak in the early 90s, but note that returns were positive shortly after the indicator first breached 60. Looking back at the early 80s, confidence plunged in 1980 but didn’t seem to hurt the market. As the indicator fell in 1982, the market was crunched. While I don’t think we are sowing the seeds again for the greatest bull market in our lifetime (1982-2000), we all know that 1982 turned out to be a great time to buy.

I put the last panel on the chart to show how useless the index is: It repeats the obvious. Note the high correlation between the 1 year change in stock prices and the 1 year change in confidence. Is it surprising that people lose confidence when stocks are declining? It’s not a perfect fit and certainly not the only factor to explain consumer sentiment, but stocks are a great leading indicator.