Happy 100% day!

Happy 100% day!

That’s right both our $10,000 Virtual Portfolio and $25,000 Virtual Portfolio doubled today. For the $10,000 Virtual Portfolio that was just 10 trading days to a 100% gain so I’m pretty darned proud of that one and, for the $25,000 Virtual Portfolio, getting to $51,906 was a long march from our 2/19 start date as we had some devastating bad luck along the way.

Never fool yourself, a lot of this is luck and nothing more. We can make the same trade for all the same reasons with all the same signs and one day it works and one day it doesn’t – that’s life in the markets. The trick is to try to live to fight another day. As usual, since our goal in the $10KP is simply to double it so people can move on to the $25KP, where our goal is to get a double – we will be looking to close out both virtual portfolios and start with a fresh $10,000 and $25,000 on expiration day. Congratulations to our members, who played along at home!

Both virtual portfolios greatly benefited from our FSLRfly, which could not possibly have gone better as we made 9 trades in 10 days WITHOUT once day-trading – THAT was the hard part! We did not have an FSLRfly in our DTP and that is up just 24% in the same 10 days, which is probably where the smaller virtual portfolios would be without that one play so, like I said, luck!

One thing we teach at PSW is to appreciate luck and take the money and run so we have $17,455 in cash in the $10KP and $22,946K in cash in the $25KP. We took a big chance and ran naked with our Apples in the afternoon (isn’t that what got Adam and Eve in trouble?) but, other than that, we are fairly well covered.

It was helpful that I was bearish into the weekend but I was on a roll in the morning with my calls:

9:40 – Refiners getting a nice pop, including our SUN play. People forget XOM is a very big refiner, it may take a while but they should turn up this week if oil heads down. CAL doing well but let’s take the money and run. XXX

9:40 – Refiners getting a nice pop, including our SUN play. People forget XOM is a very big refiner, it may take a while but they should turn up this week if oil heads down. CAL doing well but let’s take the money and run. XXX- 9:51 – Market momentum not very good. GOOG hanging tough along with AAPL but I can’t see what’s going to perk up the markets mid-day so I think "gravity" will get them all pretty soon.

- 10:35 – GOOG $560 is my guess on this run down. Depends if $575 holds, which depends on whether 12,500 holds along with 1,385 on S&P and 9,300 on NYSE – real carnage down to 2,475 on Nasdaq if those other guys can’t get keep it together.

And where did the market close? Dow 12,504 (off by 4), S&P 1,386 (off by 1), Nasdaq 2,492 (up 17) and NYSE 9,316 (up 16). Not bad for a call over 5 hours ahead of the close. Oh, and Google closed at $575 exactly and we went bullish at the low of the day and bought calls.

Overall it was a fun day in the markets, we held our levels and made a few bucks – isn’t that what it’s all about? I’m in a totally great mood as this was exactly what we were looking for, a total erasure of the last two days of last week, where we went up for no reason at all other than window dressing for the fundies. Now we get to see what the real market action looks like. Hopefully the financials can shake off today’s S&P downgrade after falling yet another 2% today.

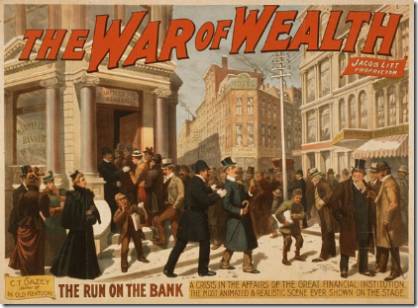

We have to start taking the BKX seriously aswe are now at a 6-year low in the banking sector and the financials can indeed pull down the whole market if we break below 70 but I can’t see how the government, even an administration as hopelessly inept as the one we have now, can let that happen. Still, take this data point VERY seriously as it’s scaring the crap out of foreign investors.

We have to start taking the BKX seriously aswe are now at a 6-year low in the banking sector and the financials can indeed pull down the whole market if we break below 70 but I can’t see how the government, even an administration as hopelessly inept as the one we have now, can let that happen. Still, take this data point VERY seriously as it’s scaring the crap out of foreign investors.

I’ve said it before and I’ll say it again – oil MUST die for the market to survive. Money is, despite the Fed’s efforts to devalue it, a commodity, and there is only so much of it available in the US and in the World at large. Oil is taking far more than it’s fair share and that money is being sucked out of every nook and cranny of the rest of the economy. There is NO magic formula that’s going to allow the market to thrive while the US alone spends $52Bn a month on fuel. That’s a global $2.4Tn a year and it’s $1.2Tn more than we paid last year. It just can’t last!