![[Cleaning Up]](http://s.wsj.net/public/resources/images/MI-AQ804_SWAPS__20080609182919.gif) Apple did not save the markets.

Apple did not save the markets.

Now the question is – can anything? The Dow closed positive but it was mainly CVX and XOM with MCD and AA both up on one-day news boosting what was mainly a weak session. Just like the "great" retail sales numbers from the discounters last week, hearing that MCD had a huge jump in sales does not make me think the economy is going great.

The financials got off to a great start but then fell to 5-year lows after NY Fed President Geithner called 17 major financial firms and hedge funds on the carpet and announced they would be tightening the regulatory noose on credit derivatives. Swaps contracts have been written on over $62 trillion worth of bonds and loans. These contracts are like insurance policies: one firm agrees to compensate another firm if a bond defaults, in exchange for regular payments. "These changes to the infrastructure will help improve the system’s ability to manage the consequences of failure by a major institution," said Geithner

So the financials hate being regulated and they’ve got Congress threatening to take away the punch bowl in commodity trading – no wonder they are trading down, if this keeps up they are going to have to start earning money honestly, and they haven’t done that since Reagan took office!

Speaking of honest business, another member of Republican Congressman Curt Weldon’s staff has admitted to accepting payments from "an arms-control group with ties to top security officials in the Russian government." The Weldon inquiry is significant in part because it is an element of a broader U.S. Justice Department probe into what officials suspect are efforts by Russian-backed firms to gain influence or gather information in Washington. Prosecutors also are looking into Mr. Weldon’s involvement with a Russian-owned natural-gas company with alleged ties to organized crime. Oh yeah, thank goodness the GOP was in charge of our national security!

Speaking of honest business, another member of Republican Congressman Curt Weldon’s staff has admitted to accepting payments from "an arms-control group with ties to top security officials in the Russian government." The Weldon inquiry is significant in part because it is an element of a broader U.S. Justice Department probe into what officials suspect are efforts by Russian-backed firms to gain influence or gather information in Washington. Prosecutors also are looking into Mr. Weldon’s involvement with a Russian-owned natural-gas company with alleged ties to organized crime. Oh yeah, thank goodness the GOP was in charge of our national security!

Mr. Petrosyan, who was the "general secretary" of the group, "met frequently and sought official action from" then-Rep. Weldon, the Caso plea statement alleges. Mr. Weldon directed Mr. Caso to seek U.S. government backing for projects involving biological and chemical weapons and he "made presentations to various executive branch agencies, including to high-level officials in the Departments of State and Energy and the National Security Council."

In addition to International Exchange Group, federal investigators are looking at Mr. Weldon’s actions on behalf of a natural-gas company, Itera International Energy LLC, which has longstanding connections to alleged Russian organized-crime figures, according to U.S. law-enforcement officials. Itera, which has offices in Jacksonville, Fla., has sought to cultivate relationships with others in Congress and official Washington. In 2002, Mr. Weldon sought to enlist former CIA Director James Woolsey to help burnish Itera’s reputation, but Mr. Woolsey declined to join its board. Itera gave Mr. Weldon’s daughter Karen a $500,000 lobbying contract.

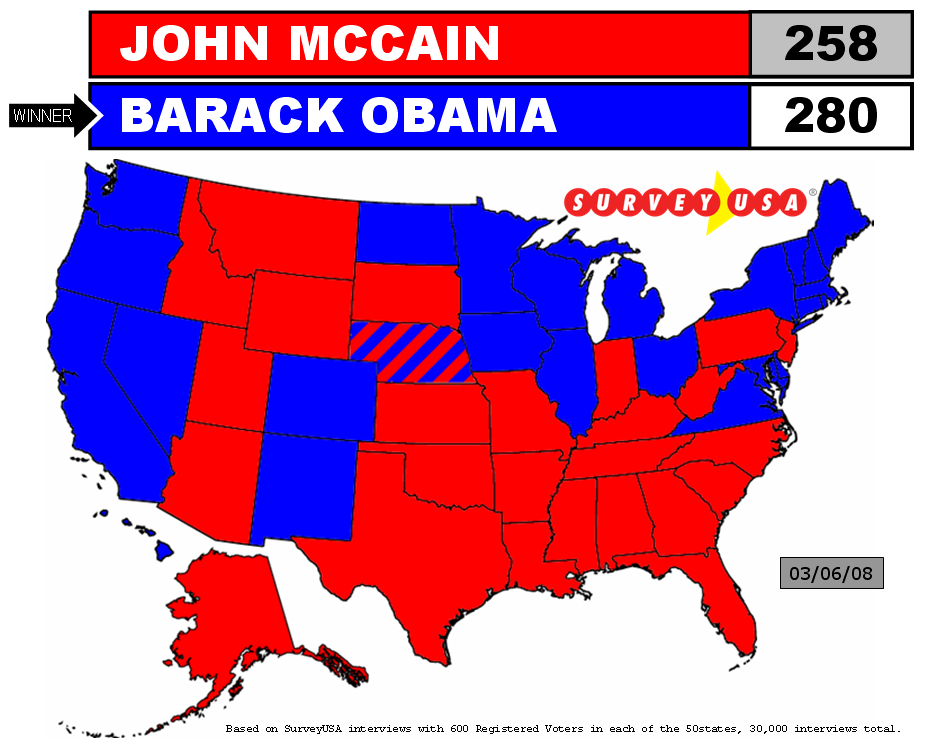

Slowly but surely, THE House is literally being cleaned but the infestation runs very deep indeed. The issues are so widespread that both McCain and Obama have issues in their campaigns so it should be an interesting election.

Slowly but surely, THE House is literally being cleaned but the infestation runs very deep indeed. The issues are so widespread that both McCain and Obama have issues in their campaigns so it should be an interesting election.

Speaking of corrupt, oil came down nicely today, falling over 2.5% for the day, which hopefully indicates another 1.25% at least tomorrow, which should give us a retest of $132.50 but, a day ahead of inventory, it’s hard to hope for better than that.

We talked about the EIA this morning and now the IEA (I know, confusing) has come out and lowered their estimates yet again, dropping another 1.2% off the growth forecasts. The IEA predicted U.S. oil demand would contract by up to 2.5% this year to 20.3 million barrels a day. "Airlines are cutting flights. … Consumers are protesting and politicians’ statements reflect that mood," the report said. Lower fuel taxes or higher subsidies (McCain’s "plan") would, the agency said, be "absolutely the worst response."

Paulson and Bernanke teamed up to save the dollar from a retest of the April lows but we stopped at a very pathetic 73 and it remains to be seen if more empty rhetoric will do the trick this time. We ended the day expecting a tech bounce and took out our Apple callers near the bottom, hopefully we won’t have to re-cover before they get back to $185 at least.