Will 12,200 hold today or are we heading for a retest of our January lows?

11.700 is "just" 500 points away and, as Stock and Option Trades pointed out last night, a 70-point bounce in the Dow following a 400-point down day (less than 20%) does not inspire much confidence that a correction is over. Yesterday morning I said I wanted a consolidation day and we got one so today I will say "thank you sir, may I have another" because, painful though it may be, we need it!

![[An investor looks at the stock-price monitor at a private-security company in Shanghai Tuesday, as Chinese stocks plunged.]](http://s.wsj.net/public/resources/images/OB-BP214_astox0_20080610054158.jpg) There was no consolidation in Asia this morning as China came back from holiday in a foul mood and the Hang Seng played 1,000 points of catch-up, with that market dropping 4.21% but that was nothing compared to the 7.7% dive on the Shanghai Composite as the effect of the PBOC's increased reserve ratios kicks in. Japan and India each dropped another point but it was all about China and China-connected firms and it's probably a good day to get back into some Japanese exporters like SNE and TM if the dollar continues to strengthen.

There was no consolidation in Asia this morning as China came back from holiday in a foul mood and the Hang Seng played 1,000 points of catch-up, with that market dropping 4.21% but that was nothing compared to the 7.7% dive on the Shanghai Composite as the effect of the PBOC's increased reserve ratios kicks in. Japan and India each dropped another point but it was all about China and China-connected firms and it's probably a good day to get back into some Japanese exporters like SNE and TM if the dollar continues to strengthen.

"Right now I am advising investors to stand well back unless they are already short," said Ben Collett, head of hedge fund sales trading at Daiwa Securities SMBC in Hong Kong. "We have more work to do on the downside." Meanwhile, India's Central Bank is expected to adopt further measures to slow accelerating inflation in the wake of fuel-price rises, a move that could crimp growth in the world's second-fastest-growing major economy.

Amid soaring global fuel prices, India last week trimmed fuel subsidies, raising gasoline and diesel prices by about 10% while also increasing the price of cooking fuel. Such measures are expected to contribute to inflation, with wholesale-price inflation — the measure most-watched in India — already at a 44-month high and forecast by analysts to hit 10% this month.

Over in Europe, the ECB's twice-yearly financial-stability review said the likelihood of further falls in U.S. house prices, the larger-than-expected losses that global banks have taken on troubled assets, and the persistent rise in oil prices were among the factors that had combined to increase risks to financial stability in the currency bloc since December. The ECB is also concerned that the 1.9Tn Hedge Fund industry remains over-leveraged and may have do dump bonds and debt assets to meet margin calls.

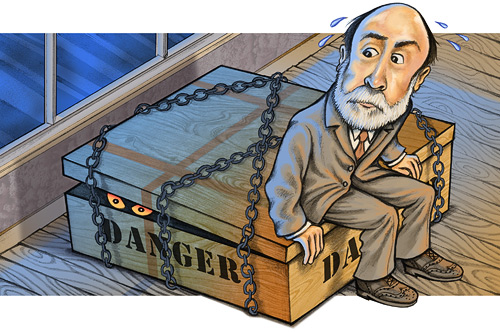

Bernanke says he's not worried and that "The surprising jump in the unemployment rate last month — a half-percentage point — hasn't materially affected the economic outlook." Mr. Bernanke's remarks suggest the jump in the jobless rate to 5.5% in May from 5% in April won't much affect the Fed's interest-rate plans this year. "Despite the unwelcome rise in the unemployment rate that was reported last week, the recent incoming data, taken as a whole, have affected the outlook for economic activity and employment only modestly."

Bernanke says he's not worried and that "The surprising jump in the unemployment rate last month — a half-percentage point — hasn't materially affected the economic outlook." Mr. Bernanke's remarks suggest the jump in the jobless rate to 5.5% in May from 5% in April won't much affect the Fed's interest-rate plans this year. "Despite the unwelcome rise in the unemployment rate that was reported last week, the recent incoming data, taken as a whole, have affected the outlook for economic activity and employment only modestly."

Isn't he just adorable? I seem to remember similar BS about the housing crisis, the mortgage crisis and the credit crisis, inflation and the national debt… I'm pretty sure if aliens came and took over the planet they would be able to keep Bernanke's head in a jar and it would continue to say that the invasion hasn't materially affected the economic outlook.

Newsweek has recession on the cover this week with the headline "Why It's Worse Than You Think." and I love to see that sort of thing on the cover of a magazine because it's often a great indicator that it's over. I stand by my contention that it is all about oil right now and this whole thing can turn around very quickly if we do something concrete to bring down energy prices but, unfortunately, Bush is still in office through January and we may have to wait until then as this administration has effectively done everything possible NOT to reduce energy prices for over 7 years.

Only a drastic series of changes to the way we measure inflation enacted under Reagan/Bush I have enabled this President to hide behind "official" statistics that mask the damage that is being done to this nation as Trillions of dollars are being transferred from the middle class (generously defined as people who earn less than $250K) and up to the top 1% of US wage earners.

Only a drastic series of changes to the way we measure inflation enacted under Reagan/Bush I have enabled this President to hide behind "official" statistics that mask the damage that is being done to this nation as Trillions of dollars are being transferred from the middle class (generously defined as people who earn less than $250K) and up to the top 1% of US wage earners.

There is a fraud being perpetrated on the American people as runaway inflation strips away the assets of the middle class and increases the holdings of the wealthy who have now taken to using their ill-gotten gains to manipulate necessities like food and energy to force the poor to give up what little they have left, now that they have pulled the rug out from the real estate scam, where they put as many people as possible into homes they couldn't afford in order for the wealthy to cash out their land holdings (which they take back later at half the price through foreclosure).

You can't have economic expansion without a middle class and this administration has effectively redefined the middle class they "take care of" as the top 10% of US wage earners while allowing the other 90% of the country to go down the toilet.

Even as I write this RDSA is having yet another "worker dispute" that is leading to a strike that will cause disruption to fuel supply, this time in England. The opening of NYMEX trading has taken oil up $3, back to $137 for the first time since floor trading halted yesterday at $134.12. The strike is just an excuse for MS and GS to continue doing what Congress found they were guilty of last week. This is just the greed of the wealthy, squeezing the last few dollars out of the global consumers by jacking up the price of consumables they are forced to buy, which forces them to borrow and forces them to leverage out the last few dimes of their homes in order to keep the lights on this summer.

Fortunately this year we will be given the opportunity to vote for real change but I'm worried about how much damage will be done over the next 6 months as we live in a country where the price of oil can go up 50% in 6 months and our "leader" hasn't even bothered to get on TV and make a serious speech about it – not even to say "I feel your pain." This is no surprise to the 30% of Hurricane Katrina victims, who have still not been able to return to their homes 3 years after that catastrophe.

Fortunately this year we will be given the opportunity to vote for real change but I'm worried about how much damage will be done over the next 6 months as we live in a country where the price of oil can go up 50% in 6 months and our "leader" hasn't even bothered to get on TV and make a serious speech about it – not even to say "I feel your pain." This is no surprise to the 30% of Hurricane Katrina victims, who have still not been able to return to their homes 3 years after that catastrophe.

As I have often said the past few years, we do not have an economic crisis so much as a crisis of leadership. In the middle of an actual depression, Franklin Roosevelt came on the radio and told Americans "We have nothing to fear but fear itself – Nameless, unreasoning, unjustified terror which paralyzes needed efforts to convert retreat into advance. In every dark hour of our national life a leadership of frankness and vigor has met with that understanding and support of the people themselves which is essential to victory."

We've lived under an adminstration that has used fear and greed to undermine this country for close to a decade and I'm frankly sick of it. Let's remember it's not just Bush though, he has many enablers and many of those people are up for election this November so let's send a real message this time – things can change, this country can be great, we just need leaders who solve problems rather than eleciting weak willed tools of big business who parrot the party line that big Government is the problem. Government is only a problem when you vote for leaders based on issues like abortion or low taxes rather than on the actual ability of that person to LEAD.

We are so used to ineptitude that we celebrate mediocrity in our leaders and it has to stop!

We are so used to ineptitude that we celebrate mediocrity in our leaders and it has to stop!

The markets are currently being driven down by fear on the part of the investing public and greed on the part of the commodity speculators but the reality is that the US economy is not in such bad shape and a simple reversal of the price of oil can send the markets flying again. Our first quarter GDP growth was 0.9%. In 2001, our growth bottomed out at 0.4% and in the great recession of 1980, annualized growth hit NEGATIVE 3.4% – now that's a recession!

Over the past two quarters, the annualized growth rate was about 0.7 percent, almost double the growth rate of the shallowest recession on record. Consumption has been holding up as well. Annualized real consumption growth over the first two quarters of a postwar recession is 0.2 percent. The maximum annualized growth rate over the first two quarters was 2.8 percent, posted during the 1969-70 recession. The minimum growth rate over the same time frame was negative 4.7 percent, which was posted during the recession of 1980.

The annualized growth rate over the past two quarters has been 0.8 percent, not the best on record, but roughly four times higher than the typical post-World War II recession.

So we're going to ride this one out and see where it takes us but, even if we do break down here and head back to 11,700, I'm still a buyer. The worse the economy gets the more likely it is we wil have a major change of leadership in November and that's all it's really going to take to turn this country around because there's nothing wrong with America on the whole, it's just temporarily being run by idiots.