More on Lehman and the financial sector, courtesy of Mish.

Wild Ride In Lehman, Financials

Note: I will be doing Market WrapUp on Financial Sense every 2nd, 4th, and if applicable 5th Thursday of the month. This was my first one. – Mish

Concerns continue to mount at Lehman, with several to executives on the hot seat. Today Lehman Dropped their CFO and President.

Lehman Brothers Holdings Inc. replaced Chief Financial Officer Erin Callan and President Joseph Gregory after the firm failed to quell speculation about mounting losses and stem a 60 percent plunge in the stock this year.

Chief Executive Officer Richard Fuld has seen Lehman’s ability to remain independent called into question this week after the company posted the first quarterly loss since it went public in 1994 and turned to outside investors for a $6 billion cash infusion.

While Lehman may consider selling a stake to a strategic partner, Fuld is unlikely to sell the whole firm, UBS AG analyst Glenn Schorr said in an interview last week. Many of Lehman’s bigger rivals have also been weakened by the subprime crisis, making it unlikely they could buy the firm, Schorr said.

Credibility Issues

On Monday I stated that Credibility Issues Haunt Lehman. And I continue to wonder what Lehman is hiding on its balance sheet, what its real leverage is, and how much its $29 billion portfolio of commercial real estate is really worth.

Lehman wrote down $3.5 billion and called it "substantial". I call it "peanuts". Earlier this week, in a capital raising effort, Lehman sold 145,000,000 shares at 28. Anyone who bought shares at 28 now has to regret it.

Test of Reaction Low

click on chart for sharper image

That reaction low in March was formed on rumors that Lehman was going to follow Bear Stearns (BSC) into the grave. Lehman more than doubled from that low amidst denials by Lehman that it was in any kind of trouble.

Was there ever any doubt that a retest of that reaction low was coming? Well here it is.

Wild Ride On 5 Minute Chart

click on chart for sharper image

After opening at $21.35 today, the stock quickly rebounded back into positive territory made a successful intraday bottom test, rebounded to positive territory a second time, then collapsed into the close. What a ride!

After opening at $21.35 today, the stock quickly rebounded back into positive territory made a successful intraday bottom test, rebounded to positive territory a second time, then collapsed into the close. What a ride!

Those that bought at 28 are now $6 and 21% in the red.

Dividends Cut Most In Five Years

Cash strapped banks have had no choice but to raise capital, and on increasingly worse terms. Yet many banks and brokers are still paying dividends they cannot afford. It makes no sense to pay dividends while increasing shareholder dilution in capital raising efforts.

Bloomberg was talking about dividend cuts today in U.S. Financial Firms Cut Dividends Most in Five Years. Here are a few highlights:

- KeyCorp (KEY), Ohio’s third- largest bank, chopped its payout in half today — the first decrease in 43 years — and said it must raise $1.5 billion after losing a tax case.

- Goldman (GS), the world’s biggest securities firm, may reduce its dividend by 26 cents to 9 cents, while Bank of America (BAC), the second-largest U.S. bank by assets, may cut its payout by the same amount, to 38 cents, Deutsche Bank AG strategists wrote in a June 10 report.

- Citigroup (C), the biggest U.S. bank, may lower its dividend by 23 cents, the same amount it did in January, to 9 cents, according to the report.

- Washington Mutual and National City each slashed their dividends to close to the bare minimum — a penny.

- Wachovia (WB) dropped 23 percent after the bank cut its dividend in April.

Some banks, especially Citigroup have been way too slow in cutting dividends. Citigroup does not need to reduce its dividend, it needs to eliminate it. It will eventually be forced to.

More Problems Surface In Alt-A

Today the S&P Lowered Ratings on 65 classes of Alt-A Securities. Far more downgrades of Alt-A mortgages are coming. Inquiring minds might be asking "What banks have the biggest exposure to Alt-A?" The answer is Washington Mutual (WM) and Wachovia (WB).

One quick look at the the chart of Washington Mutual shows the bank is on life support.

Washington Mutual Weekly Chart

click on chart for sharper image

WaMu The Killer Bank

WaMu, the killer bank, is back in the news today stating Three Proxy Firms Support Capital Plan.

Washington Mutual Inc., the biggest U.S. savings and loan by assets, said three proxy advisory firms support its plan to raise $7 billion in capital.

Institutional Shareholder Services Inc., Glass, Lewis & Co. and Proxy Governance Inc. recommend shareholders vote for proposals tied to the plan at a June 24 meeting, the Seattle- based lender said today in a statement on Business Wire.

The technicals suggest the company may not survive. I am inclined to believe the technicals.

Unusual Treasury Action Continues

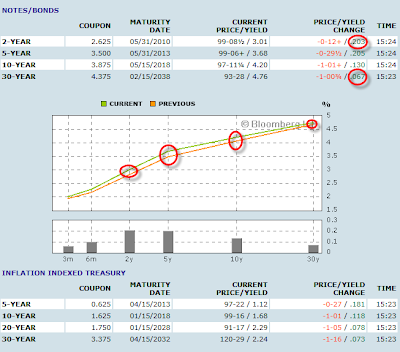

US treasuries were under pressure again today, and in the same unusual pattern as the following chart courtesy of Bloomberg shows.

click on chart for sharper image

While there is nothing unusual about treasury spreads widening, it is unusual for yields on the two year to soar in relation to yields on the 30 year long bond. A four standard deviation event occurred on Monday (see Treasury Curve Steepening Bet Blows Sky High) and there was a continuation on Tuesday. So this makes the third occurrence this week of the yield curve flattening at a higher level.

Such action is not good for financial companies that tend to borrow short and lend long. In fact, it’s not good for the stock market on the whole.

There was interesting commentary today about yields on Minyanville between Todd Harrison (Toddo) and Mr. Practical.

Oh that smell. Can’t you smell that smell?

I was just pinging with Mr. Practical and we had the following exchange. We share it with ye faithful in the spirit of community.

Mr. Practical: Yields are upticking. Fed Fund Futures are implying a rate hike in September.

Toddo: Yeesh, talk about a death knell. That has "foreign influence" written all over it.

Mr. Practical: Central banks may have given notice to Ben that if he doesn’t raise rates, the dollar is toast. We should remind Minyans to read The Pin Prick. It’s as relevant today as it was then. Instead of foreign central banks abandoning the auction, they’re giving him fair warning.

There is no breathing room for the box Bernanke is in. Several Fed governors are in open revolt calling for higher rates, and others are openly questioning the Term Auction Facility (TAF), and Primary Dealer Credit Facility (PDCF). US consumers are getting smoked by rising prices, banks are getting smoked by falling margins, rising defaults, and the need to raise capital. Housing will be further smoked if Bernanke is forced to raise rates and the dollar may be further smoked if he does not.

There is no breathing room for the box Bernanke is in. Several Fed governors are in open revolt calling for higher rates, and others are openly questioning the Term Auction Facility (TAF), and Primary Dealer Credit Facility (PDCF). US consumers are getting smoked by rising prices, banks are getting smoked by falling margins, rising defaults, and the need to raise capital. Housing will be further smoked if Bernanke is forced to raise rates and the dollar may be further smoked if he does not.

Economic Checkmate!