Here’s a comprehensive summary, by Gary Dorsch, of the interplay between the central banks of different countries and the resulting effects on the world economy, commodity prices and inflation.

When Central Bankers Clash, Stock Markets can Crash

Courtesy of Gary Dorsch; Gary writes Global Money Trends, a respected investment newsletter covering global asset markets.

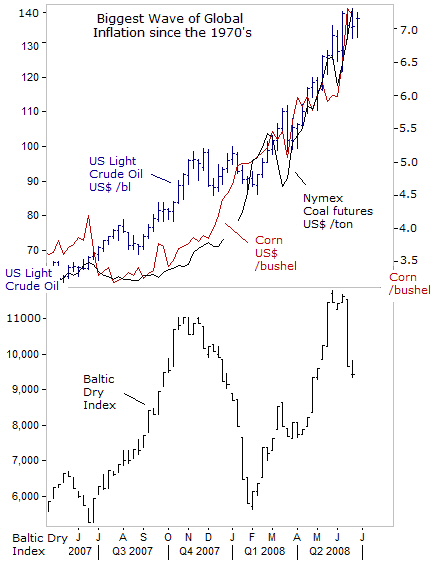

Hyper-inflation in the commodities markets is rivaling the US housing collapse and the global banking crisis as the biggest threat to the world economy. Finance ministers from the United States, Canada, Japan, France, Germany, Italy, Britain, and Russia, have expressed their alarm over the doubling of agricultural, energy, and key raw material prices from a year ago, which is pushing inflation rates around the world, to their highest in three decades.

Crude oil briefly touched $140 a barrel, and the price of corn used to make ethanol hit $8 /bushel. Chinese steelmakers agreed to pay 96% more for iron ore from Australian miner Rio Tinto (RTP), a five-fold increase since 2003. Steel prices have soared almost 50% this year, as coal and iron ore prices continue to climb and global demand shows little sign of abating. Dow Chemical (DOW) is raising prices on a wide range of its products by 25%, due to sharply higher energy and raw material costs.

Sharply higher shipping costs, driven by rising oil prices, have increased the cost of transporting a standard 40-foot container from Shanghai to the east coast of the US from $3,000, when oil was priced at $20 per barrel, to $8,000 today, with crude oil around $135 /barrel, according to CIBC World Markets analysts Jeff Rubin and Benjamin Tal. The Baltic Dry Index, which monitors merchant shipping costs on forty major export routes for dry commodities, is 50% higher from a year ago.

South Korea’s President Lee Myung-bak noted on June 16 that inflation was the biggest challenge the global economy has faced in 30 years. “It’s no overstatement to say that the world is faced with the gravest crisis since the oil shock of the 1970’s, with oil, food and raw materials prices skyrocketing,” he said.

A week later, Myung-bak switched his government’s top policy goal to fighting inflation, and within hours, the Bank of Korea (BoK) sold US$1 billion from its foreign currency stash to bolster the Korean won against the dollar, to help keep import costs down.

Smaller-tier central banks are moving to combat inflation pressures with tougher monetary policies. The Reserve Bank of India [RBI] raised its key lending rate by a half-point to 8.50%, it’s highest in six years, and increased the ratio of deposits banks keep with it by 50 basis points to 8.75%, to fight inflation, now raging at 11 percent. The Bombay Sensex index fell below 14,000 points for the first time in 10 months after the RBI tightened it monetary policy. The Indian stock market has lost more than 30% in 2008, one of the worst performing Asian indices this year.

Beijing lifted retail gasoline and diesel prices by 18% last week, the first hike in eight months and the biggest ever one-off rise, which could push the overall inflation rate to 9% next month. A week earlier, the People’s Bank of China (PBoC) hiked the bank reserve ratio by a full-percent to 17.5%, soaking up 422 billion yuan, and knocked the Shanghai stock market 14% lower over the next four-days.

“Surely higher energy prices will put some pressure on the CPI, so we may need a stronger policy against inflation,” warned PBoC chief Zhou Xiaochuan on June 20.

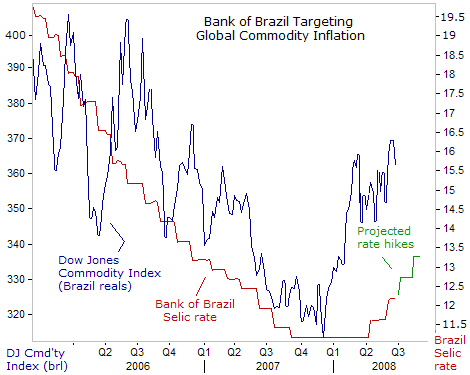

Brazil’s central bank hiked its overnight Selic rate by a half-point rate to 12.25% on June 5, to bring inflation down from a two-year high in Latin America’s commodity powerhouse. The latest half-point rate hike pushes the real interest rate, adjusted for inflation, to 7.25%, the highest among the world’s 52-leading economies. On June 19, Brazil’s central bank chief Henrique Meirelles signaled a third rate hike to bring inflation down from a two-year high in Latin America’s largest economy.

Futures contracts in Sao Paulo project a 1% Selic rate hike to 13.25% by year’s end.

“It’s necessary to slow domestic demand in order to balance the whole equation and to avoid the pass-through of the wholesale price increases as a result of the raw materials component to retail prices,” Meirelles warned.

Inflation in Brazil climbed from an eight-year low of 3% in March 2007 to 5.9% in the 12 months to mid-June, and above the bank’s 4.5% upper target for a sixth month.

Brazil’s central bank expects the inflation rate will accelerate further to 6.3% in the third quarter of 2008. The Brazilian real strengthened to 1.591 to the US$, a nine-year high, and is +9% higher this year, the biggest advance among the 16 most-traded currencies against the dollar. The central bank is utilizing a stronger currency to hold down import price inflation, and appears to be adjusting its overnight loan rate in reaction to trends in global commodity markets.

South Africa’s central bank hiked its overnight repo rate by 50-basis point to 12%, to counter surging inflation, extending a tightening cycle that has lifted the lending rate 500-basis points higher since June 2006, to a 5-year high. South Africa’s CPIX inflation hit 10.4% year-on-year in April, and producer prices are 12% higher. Eskom, the electric utility, is raising electricity rates by 27% due to a doubling of coal prices from a year ago. RBSA chief Tito Mboweni is warning the markets of higher interest rates ahead, and “Yes, it will be painful,” he said on June 23.

ECB and Fed in Game of High Stakes Poker

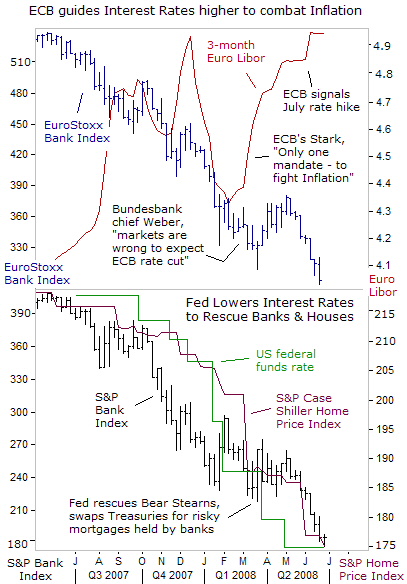

Central bankers of fast-growing emerging economies are navigating through the stormy seas of commodity inflation by tightening monetary policies. But the “Group of Seven” central bankers have acted in a different fashion. The British, Canadian, and US central banks are focused on the global banking crisis, and the slide in US home prices, and have lowered their interest rates, while the Bank of Japan has stood motionless. But the European Central Bank was moving in the opposite direction, and guided Euro-zone money market rates to their highest in 7 years.

And when powerful central bankers clash – moving in opposite directions – nasty accidents can happen in the global stock markets. Tighter monetary policies in the emerging economies is an interesting side-show, but what is really rattling the global stock markets these days, is the looming battle of wits between the two most powerful central banks, the Fed and the ECB, which hold diametrically different views over how to cope with the twin-evils of the “Stagflation” trap.

“The world has been staging a run on the greenback, with damaging results if it continues,” warned former Fed chief Paul Volcker on April 9. “Concerns about recession are rife, and the Fed will be tempted to subordinate the fundamental need to maintain a reliable currency, to the impulse to shore up a flagging economy. The danger is that you lose both battles, as in the 1970s, and wind up with ‘Stagflation’ – the twin evil of a stagnating economy plagued by high and rising inflation."

Since the sub-prime mortgage debt crisis erupted into full bloom last summer, the Fed has chosen to counter the “Stag” part of the equation by slashing the Fed funds rate 325 basis points to 2% and far below the inflation rate. American consumer confidence has plunged to a 16-year low in June, largely due to a 18% erosion in home prices since the middle of 2006, which has slashed $4 trillion in household wealth, or more than $50,000 for each US homeowner.

However, the ECB wasn’t deterred by a plunging Euro-Stoxx banking sector, and instead, stayed focused on fighting commodity inflation and curbing double-digit money supply growth. The ECB guided the three-month Euro Libor rate to 4.95%, its highest in seven-years, and utilized a stronger Euro to partly shield the Euro zone from the “Commodity Super Cycle,” which is wrecking havoc in the US-dollar linked economies from Hong Kong, the Persian Gulf, and to the United States.

Meanwhile, the Fed’s aggressive rate cuts couldn’t stop the bleeding in the US banking sector, nor end the slide in US home prices. The Fed’s “super-easy” money policies are bound to fail, in the opinion of the ECB, since only a “sound money” policy is the bedrock for a healthy economy. “Challenging as the present global economy may be, the rules for monetary policy-making are not altered,” said ECB chief Jean Claude Trichet on June 3. “Inflation is a monetary phenomenon in the long term and price stability is the responsibility of the monetary authorities.”

“In demanding times of significant market correction and turbulences, it is the responsibility of the central bank to solidly anchor inflation expectations to avoid additional volatility, in already highly volatile markets,” Trichet said on Jan 23.

“In this new financial landscape, monetary policy has a stability dimension that central banks simply can no longer ignore,” said Bank of Italy chief Mario Draghi on June 11. “Central banks need to consider persistently rapid growth of money and credit aggregates as early warnings of financial imbalances, and thus to monitor a wider set of indicators, and not just inflation statistics,” Draghi declared.

Is the ECB Hijacking Fed Policy?

Crude oil prices have multiplied seven-fold since 2001 and surged 40% since January, to now stand above $135 a barrel. Yet the hyper-Inflationists at the Bernanke Fed and US Treasury – the “Plunge Protection Team” – didn’t recognize that their cheap dollar policy was backfiring on the US economy and stock market, until crude oil prices jumped $16 per barrel in two-days, on June 5-6.

The “crude oil vigilantes” are energized on heavy dosages of steroids, flexing their muscles, and ready to jack-up oil prices, whenever the Bernanke Fed shows a willingness to devalue the US dollar. Recognizing that the devaluation game had run its course, Fed chief Bernanke did a 180-degree turn on June 3 and vowed to defend the dollar, as Mr Volcker had advised nearly 2-months earlier.

“We are attentive to the implications of changes in the value of the dollar for inflation and inflation expectations,” Bernanke told the International Monetary Conference in Barcelona, Spain. “The Fed’s commitment to price stability and maximum employment will be key factors insuring that the dollar remains a strong and stable currency,” he said, signaling an end to the Fed’s rate-cutting campaign.

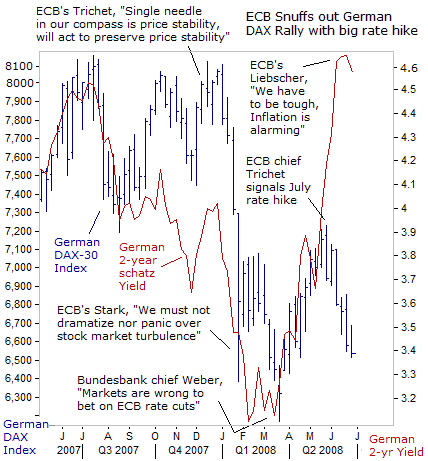

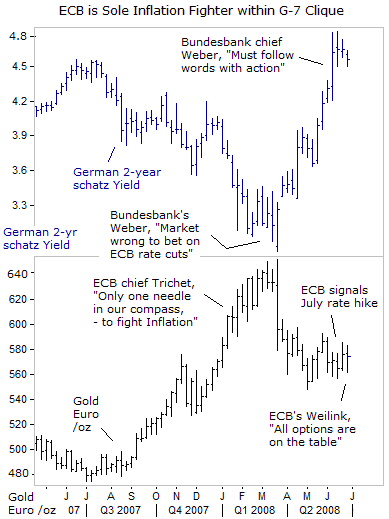

However, the ECB hawks seized upon Bernanke’s vow to defend the US dollar to telegraph a baby-step 0.25% rate hike to 4.25%. The ECB hawks have been itching for months to lift the repo rate, anxious to combat inflation, which is raging at a +3.7% annual clip in the Euro zone, its fastest in 16-years. “We could decide to move our rates a small amount in our next meeting in order to secure the solid anchoring of inflation expectations,” said ECB chief Trichet on June 5.

“The ECB is not split, we have sent a clear message to the markets about what to expect in the near future, we have to let deeds follow words,” said Bundesbank chief Axel Weber on June 5. The benchmark 2-year German schatz yield soared by 80-basis points to a seven-year high of 4.80%, after Weber’s warning, and snuffed out the German DAX rally at the 7,200-level. The ECB isn’t afraid to pay the price of weaker Euro-zone stock markets, in order to keep inflation under control.

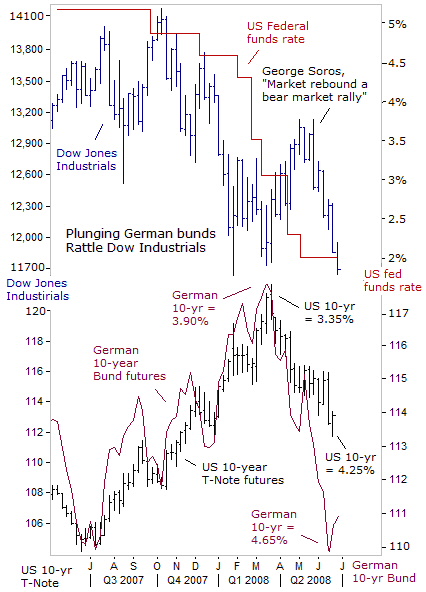

The ECB’s rate hike signal jolted the German 10-year bund market, which plunged into a free-fall to its lowest levels since July 2007, lifting its yield to 4.65%. Given the close synchronization in the G-7 bond markets these days, the tremors erupting in the Frankfurt are also felt in Tokyo and New York, where government bond markets came under attack by the global inflation vigilantes.

The downward spiral in the German bund market widened the Euro’s interest rate advantage over the US dollar, leaving the greenback on shaky ground and vulnerable to speculative attack. Bernanke would be under heavy pressure to match a second ECB rate hike to 4.50%, to defend the value of the dollar. In essence, the ECB could hijack US monetary policy and force the Fed to guide the federal funds rate higher in order to shake-out speculators in the crude oil and commodities markets.

The US Treasury’s “Plunge Protection Team” [PPT] has fought a relentless campaign to prevent a bear market from materializing in the Dow Jones Industrials. The PPT has unleashed its total arsenal – the largest Fed rate cuts in 25 years – negative (real) interest rates, swapping Treasuries for risky mortgages, $165 billion in tax rebates, and intervention in stock index futures. The PPT also convinced the Bank of Canada and England to lower their lending rates, to provide artificial life support for the US dollar against the Loonie and the British pound.

But the PPT’s safety net for the Dow Jones Industrials was ripped by the ECB hawks, plunging 1,00-points, led lower by the plummeting German bund market. US 2-year T-note yields jumped 65-basis point to 3.05%, the largest weekly increase in 26-years. To put out the fire, the Fed leaked word to syndicated columnist Robert Novak on June 16 that Bernanke wouldn’t be bullied into rate hikes by the ECB.

“Speculation that the Fed is about to begin inflation-fighting interest rate increases appears to be dead wrong. Bernanke disagrees more with the European position than is reflected by his public statements,” Novak wrote.

Furthermore, the “Fed chairman feels high oil and gasoline prices threaten contraction more than inflation. The depressing impact on the oil-driven American economy is especially menacing in his view,” Novak added. Yet sky-high energy prices can inflict more damage to the US economy and the stock market, than a few baby-step Fed rate hikes to stabilize the greenback.

The point of maximum stress could unfold if the ECB carries out a second rate hike to 4.50% in September. That would put enormous pressure on Bernanke to hike US interest rates to defend the dollar. On June 13, the godfather of the US sub-prime debt crisis, “Easy” Al Greenspan, said, “If you’re going to keep inflation rates down, the Fed is going to have to put increasing pressure on the money supply and reserves, and as a result we’re going to see interest rates rising,” he warned.

On June 25, Trichet held his cards close to the vest. “I didn’t say that we envisage a series of rate increases. That being said, of course, we never pre-commit. The observers in the market know that pretty well.” However, the central bank chief of the Netherlands, Nout Weilink ,said tackling inflation must take precedence over slowing growth. “It is way too early to judge on what should happen in the second half of this year. This means all options should be kept open,” he said.

Bank of Japan is Inflating the Crude Oil “Bubble”

Venezuela’s energy minister Rafael Ramirez and OPEC chief Abdullah al-Badri agree that oil markets are well-supplied, and that sky-high oil prices have nothing to do with global production levels. “The US economy is in a crisis that is devaluing the dollar and boosting the price of oil and food around the world. Financial speculators are migrating to futures contracts, which are considered safer than other investments,” Ramirez explained.

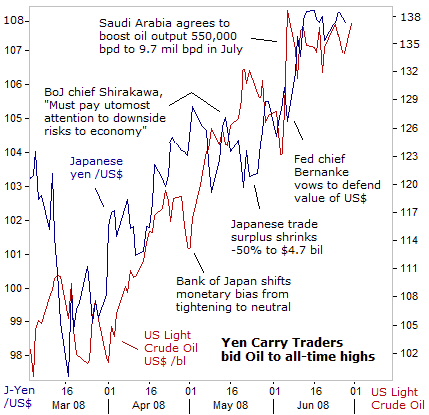

While the weak dollar against the Euro gets most of the blame for the sky-high price of crude oil, the dollar’s strength against the Japanese yen is also elevating the energy markets these days. The Bank of Japan (BoJ) has kept its overnight loan rate pegged at 0.50% for sixteen months, which is nurturing inflation worldwide. Global “carry traders” are borrowing Japanese yen at 1% or less and converting the yen into US dollars in order to purchase energy futures in New York.

In his first major blunder, rookie BoJ chief Masaaki Shirakawa scrapped his predecessor’s policy of gradually raising Japan’s borrowing costs and signaled a green light for “carry traders” to bid oil prices higher. “The outlook for economic activity and prices is highly uncertain. It is not appropriate to predetermine the direction of future monetary policy. We need to pay utmost attention to the downside risks to the economy,” he said on May 12, switching to a neutral policy.

Now the BoJ’s super-low interest rates are boomeranging on the Japanese economy. Wholesale prices for petroleum, coal, and gasoline prices are up +28% from a year earlier. Japan’s oil import bill soared 53% to $12 billion in May, and soaring steel and iron ore prices are hammering Japanese carmakers, such as Honda and Nissan, whose operating profit might drop 32% this year. Japan’s total import bill is up +12% from a year ago, narrowing its trade surplus by 46% to 485 billion yen ($4.7 billion). A half-point BoJ rate hike to 1% is necessary to shake-out the “yen carry” traders in the energy markets. Don’t count on it anytime soon.

Can the ECB Subdue the Gold Market?

On June 25, Warren Buffett told CNBC television viewers that “inflation in the US is exploding and really picking up. Whether it’s steel or oil, we see it everyplace,” he said.

A few hours later, the Fed halted its aggressive rate-cutting campaign, leaving the fed funds rate unchanged at 2%, but signaled it’s in no hurry to rein in hyper-inflation: “Uncertainty about the inflation outlook remains high.” However, “the FOMC expects inflation to moderate later this year and next year.”

The Fed is admitting that its hands are tied by the banking crisis and the slide in housing, and is afraid to lift the fed funds rate ahead of the US elections. The Fed thinks the “Commodity Super Cycle” is a speculative bubble ready to burst under its own weight. Therefore, corrective action by the central bank isn’t required. The Fed is letting inflation seep deeper into the economy in order to support Wall Street bankers, and has squandered the last ounce of its anti-inflation credibility.

That’s good news for gold bugs, who put were on the defensive by Bernanke’s bluff about defending the dollar. The Bernanke Fed is holding the fed funds rate far below inflation. In the 1970s, this condition stoked hyper-inflation, and the Bernanke Fed is repeating the same blunder. Still, a psychological barrier that is blocking a spirited gold rally is the ECB’s move to ratchet German interest rates higher.

The ECB is the solo inflation fighter within the G-7 clique. The ECB has guided the German schatz yield to seven year highs, but so far has only knocked the European gold market about 8% lower. The ECB’s anti-inflation efforts are thwarted by the “super easy” money policies of the BoJ and the Fed, while the Bank of Canada and England show no inclination to reverse their rate cuts anytime soon. However, the ECB is starting to get some back-up support in the battle against inflation from central banks in the emerging world.

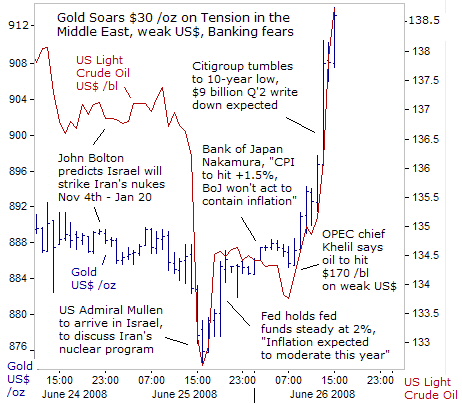

Geopolitical events can overtake the ECB’s battle with the simmering gold market. US military chief Admiral Michael Mullen is expected in Israel this week, amid speculation of a possible aerial strike aimed at Tehran’s nuclear weapons program. “Obviously, when Chairman Mullen speaks with the Israelis, they will no doubt discuss the threat posed by Iran,” said Pentagon spokesman Geoff Morrell on June 25. “The US is committed to resolving the nuclear threat posed by Iran through diplomacy and international sanctions, while at the same time holding out the option of a military strike, if necessary,” he warned.

Speculation about a possible Israeli strike heated up this week after former UN ambassador John Bolton told London’s Daily Telegraph that Israel could strike Iran’s nuclear sites between the November 4 election and January. “According to Israeli security sources, Iran will have an operable nuclear weapon by 2009. That’s not a very long time,” said CBS consultant Michael Oren on June 25.

Gold prices jumped by $30 /oz amid a perfect storm, in early New York trading on June 26, with investors attracted to the yellow metal’s “safe haven” status. Citigroup (C) shares fell to their lowest level in nearly a decade after Goldman Sachs said the largest US bank might take $8.9 billion of write-downs in the second quarter. OPEC chief Chakib Khelil predicted, “Oil prices will probably be between $150-170 during this summer. The devaluation of the dollar against the Euro will probably generate an $8 rise in the price of oil,” he told France 24 television.

About Global Money Trends: Global Money Trends newsletter provides an "insightful analysis and predictions of the future for the (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and related gold mining and oil company indexes (3) Foreign currencies (4) Libor interest rates, global bond markets and central bank monetary policies, and (5) Central banker "Jawboning" and Intervention techniques that move markets." For more information, click here.