Here’s a trading idea, courtesy of my friend, stock-trader Allan, who posts various ideas almost daily on his blog.

DUG

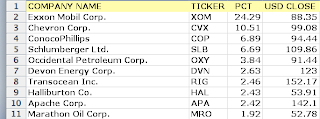

The table above represents the top ten (by weight) holdings of the Dow Jones US Oil & Gas Index. As a group, they collectively sport some very weak Daily and Weekly charts. Can’t short all ten of these big cap stocks?

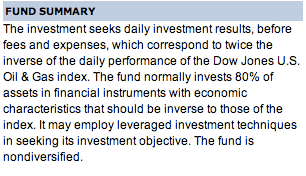

Enter DUG, an ETF named Ultra Short Oil and Gas Pro Shares, described as follows:

Those top ten listed stocks in the table above represent 64.08% of DUG. They are leveraged 2-1, so that for every one percent the Dow Jones US Oil & Gas Index drops, DUG rises 2%. Those stocks above will constitute 64.08% of the movement of DUG.

If so, one would think that if these stocks are breaking-down, then DUG must be breaking-out.

Let’s see:

DUG DAILY

That big white candle, the most recent candle on this chart, represents DUG running up about 6% on Wednesday. Any follow through will be a break-out on the Daily chart.

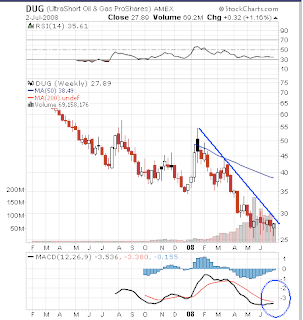

WEEKLY CHART

A break-out on the weekly chart will require DUG to close above about 28.5 this week, a little lower next week. The MACD looks like it wants to cross and the MACD momentum is about to cross-over above the zero-line.

A break-out on the weekly chart will require DUG to close above about 28.5 this week, a little lower next week. The MACD looks like it wants to cross and the MACD momentum is about to cross-over above the zero-line.

THE TRADE: DUG is very, very close to breaking out on the daily chart, it could happen Thursday, or next Monday. On the weekly chart, the breakout could occur this week, more likely next week. This is where forecasting is more of an art then a science. Is the evidence compelling enough now to go long DUG and thus shorting with double leverage those ten stocks above all in one simple Buy?

Remember, the signal has not yet been triggered, but I will be watching DUG closely on Thursday and will buy DUG if I am convinced the break-out is happening, or at least inevitable.

If DUG breaks out, it looks to me to be at least a double from current levels.

A