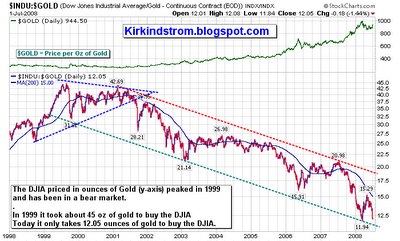

Dramatic comparison of the Dow priced in dollars vs. priced in gold. Courtesy of Kirk Lindstrom. Kirk edits "Kirk Lindstrom’s Investment Newsletter" and provides free content at "Kirk’s Market Thoughts."

DOW In Secular Bear Market When Priced in Ounces of Gold

Using Intraday prices:

Using Intraday prices:Last Market High 10/11/07 at 14,279.96

Last Market Low 06/27/08 at 11,214.37

Current DJIA Price 11,215.51

Decline in Pts 3064.45

Decline in % 21.5%

Max Decline 21.5%

and

Using closing prices:

Date of last high 10/09/07

Last Market High 14,164.53

Date of last low 07/02/08

Correction Low 11,215.51

Decline in Pts 2949.02

Decline in % 20.8%

More DJIA Charts

- This means the correction from high to low has been 21.5% and we are currently 21.5% off the peak.

- The decline in the DOW off the high on a closing basis has been 20.8%

DJIA IN OZ of GOLD

When measured in ounces of Gold, the DOW has been in a secular bear market since peaking in late 1999.

A chart of the DOW Jones Industrial Average (DJIA) priced in gold shows the markets are not as healthy as one might think due to the decline of the US dollar.

- Back in 1999, it took 45 ounces of gold to buy the DJIA.

- Today it only takes 12.05 ounces of gold to buy the DOW!

Cutting the Fed Funds target rate from 6.50% in January 2001 to 1.0% in June 2003 may have inflated the US stock market out of its bear market when priced in dollars but it had consequences that we are feeling today.

Cutting interest rates to get the US out of a recession may have worked but the inflation in commodities and devaluation of the US dollar it caused has caused pain for the US consumer. This pain is often blamed on president Bush who took office just as the DOW/Gold ratio broke out of the "symmetrical triangle" pattern, explained below.