Trader Mark’s thoughts on where we can most afford to eat and shop lately.

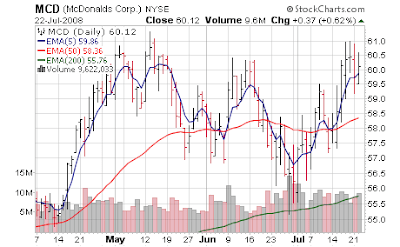

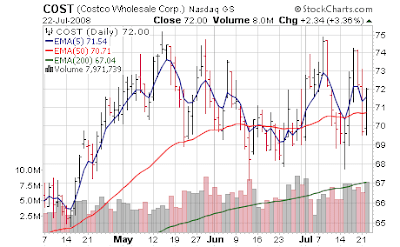

Costco (COST) Warning & McDonalds (MCD) Continuing to be Dinner of Choice for Pooring Americans

Now that’s a bit of a shocker – this was one of the "safe" havens in retail. But that’s okay folks, because past results are backwards looking and one must "look ahead" – and as we look forward to an era of $3.40 gas the consumer will be back, stronger than ever. 😉

- Costco Wholesale Corp. said Wednesday fiscal fourth-quarter and full-year profit will miss Wall Street expectations, as the warehouse club operator expects higher energy costs to crimp its bottom line.

- For the fourth quarter, analysts polled by Thomson Financial expect $1 per share in profit, and Costco said it expects earnings "well below" this estimate. Analysts expect full-year earnings of $2.99 per share, according to Thomson.

- "Factors negatively affecting our fourth quarter earnings outlook arise largely from inflation, particularly as to energy costs," Costco Chief Financial Officer Richard Galanti said in a statement. (inflation? what inflation – we don’t need to worry about energy or food because it doesn’t count – the government tells me this)

- The outlook reflects weakness in the company’s gasoline operations and slightly lower-than-planned merchandise profits as the company holds back on price increases to drive sales. (so you are saying inflation is a tax on all things, producer and consumer – and if producer cannot pass along costs to consumer, than producer profit margin gets crunched which leads to lower stock price. Hmmm, I’ve read that somewhere)

- "This move is highly unexpected," said Brian Sozzi, an analyst at Wall Street Strategies. "Consumers are drilling down to ask, ‘Do I need that big container of 10 pound soup?’"

Meanwhile McDonalds (MCD), one of our top 2 choices for Pooring of America 101 (along with our friends at Walmart) continues to hum along as more of the middle class is forced to eat there for economic reasons along with the "Americanization" (i.e. exporting obesity) to the rest of the world 😉 [<— video enclosed on how Japanese government is fighting this trend]

- McDonald’s Corp (MCD), the world’s largest restaurant chain, posted a higher-than-expected second-quarter profit on Wednesday, boosted by strong overseas sales, sending its shares up 2.6 percent in premarket trading.

- McDonald’s overseas sales have outpaced domestic results for some time, and its emphasis on low-priced menu items, and its Dollar Menu have helped it weather the economic downturn, luring cash-strapped consumers away from higher-priced, sit-down restaurants.

- Revenue rose 4 percent to $6.07 billion, helped by a 6.1-percent increase in global same-store sales.

- Same-store sales, which track sales at its locations open at least 13 months, rose 7.4 percent in Europe, while they were up 8.8 percent in the Asia/Pacific, Middle East and Africa segment.

- The United States posted comparatively modest growth of 3.4 percent in same-store sales. (now that’s strength! Anyone who can show growth in the U.S. now has the holy grail)

- But investors are beginning to get more jittery about an overseas slowdown as higher costs for food and fuel put more pressure on consumers around the world.

- Yum reported in its most recent quarter that rising inflation had dampened profits from China, a key growth driver. Analysts said McDonald’s has fewer outposts in China than Yum, so it is less exposed to troubles there.