Cassandra writes about the Hedge Fund Model. Courtesy of Cassandra Does Tokyo.

Will The Hedge Fund Model Prove to Be Broken

Separating the shills from the bona fide proponents of hedge funds has never been easy. Nor has it been facile to distinguish the secretly-jealous critic from the legitimately, even altruistically concerned. In an interview with Bloomberg’s Tom Keene, the articulate David Goldman, former Chief Strategist at Asteri Capital, posits in no unequivocal terms, that the "Hedge Fund Model" of investment will, over the coming-year, prove to be broken beyond repair.

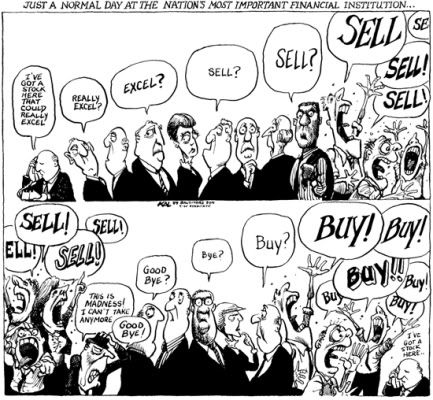

What precisely does he mean? In a nutshell, he means that the majority of Hedge Fund performance will not be able to weather the volatility caused by the continuing de-leveraging and the catastrophic blow-up of so-called crowded trades that this will cause – something that is, and will continue to be exacerbated by the lack actual liquidity in many of the instruments and positions currently favored or stuck like chewing gum to bottoms of their respective portfolios.

The hedge fund model of stewarding money for one or two-and-twenty is, he suggests, predicated upon reasonably low volatility and above average returns. Yet like young unskilled schoolboys playing football (tank you Charles of IBEX Salads for the image), there are obvious trades and simply far-too-many participants chasing the same returns causing the trades to be intensely crowded. These over-exploited trades (in the short-term) are prone to massive bouts of short-covering necessitated by the very hedge fund model itself, for few funds, managers have the confidence (or the investors) that will forgive 20% to 30% monthly drawdowns for riding shorter-term aberrations in exchange for the eventually larger kill in having the right ultimately correct position. Strangely enough, no one’s behaviour is illogical. It is just another example of a local optimization problem.

If this sounds to readers like the accident that initially availed itself in the Quant implosion of Aug 2007, then you are correct. And if this sounds like what is happening to unfortunate longs in the energy and commodity complexes, you are also right. Goldman believes that this will manifest itself in an near-unending decimation of funds pursuing the simplest model. He makes exception for the prescient funds, with the actual lock on capital (permanent exchange -traded vehicles or 3 to 5 year locks a-la- the Private Equity model) who also have the conviction, and strength of constitution to make high conviction bets and hold them despite the itinerant volatility of the positions and consequential vicissitudes of mark-to-market. Verbatim, he says:

"…with everyone forced to take the same trade, the volatility, intra-month, is so great, those investors committed to a month-to-month Sharpe-ratio low volatility strategy will be forced to redeem and you will get wild swings, illiquidity, and an inability to liquidate positions.

So I think we are going to have a serial catastrophe of hedge funds, particularly the kind of funds that thought that it was a great idea to buy loans at $0.90 on the dollar and won’t be able to sell them at $0.80 later in the year.

Note that he is not bearish on opportunism, nor speculation. He thinks people like TPG did great trades buying assets "cheap" with something resembling matched, non-recourse funding. He simply thinks that doing the same thing (and there is no shortage of managers pursuing such spread returns in part or in whole) without the surety of similar investor commitment horizons on the equity capital side OR committed facilities on the finance side is a recipe for disaster, or at least an unwind cascade of ghoulish proprtions.

To some extent the Fed (like the BoJ before it) can put the brakes on the systemic point-in-time unwind cascades. It can cajole institutions to hold off, it can nationalize banks and make for a more organized liquidation of duff collateral and assets, i.e. whatever it takes to prevent the institutions at the system’s core from selling position to make position – something that has little actual utility in fact. But the authorities have little control over hedge funds’ investors, and hence the their resulting demands for liquidity.

To some extent the Fed (like the BoJ before it) can put the brakes on the systemic point-in-time unwind cascades. It can cajole institutions to hold off, it can nationalize banks and make for a more organized liquidation of duff collateral and assets, i.e. whatever it takes to prevent the institutions at the system’s core from selling position to make position – something that has little actual utility in fact. But the authorities have little control over hedge funds’ investors, and hence the their resulting demands for liquidity.

I personally find such a continued evolution quite plausible. And it won’t be undeserved. For other market participants have had ample time to prepare after witnessing the quant-related meltdown. I do wonder whether investors will, as a result, force the Darwinian HF survivors, to accept long-term incentives with clawbacks that manage to incorporate liquidity discounts and incentive payments based upon realizations – a sorely needed interest alignment tool. Maybe I’ve been a tad unfair to the PE guys by comparison…