Mish discusses Obama’s view on the economy and his tax proposal, in comparison with McCain’s.

Obama’s Dueling Views on Economy

The United States remains a fabulously prosperous country, relative to almost any other country, at any point in history. Yet Americans seem to realize that something has gone wrong. In recent polls, about 80 percent of respondents say the economy is in bad shape, and almost 70 percent say it’s going to get worse. Together, these answers make for the most downbeat assessment since at least the early 1980s, and underscore that the next president will be inheriting a set of domestic problems as serious as any the country has faced in a long time.

John McCain’s economic vision, as he has laid it out during the campaign, amounts to a slightly altered version of Republican orthodoxy, with tax cuts at the core. Obama, on the other hand, has more-detailed proposals but a less obvious ideology.Well before this point on the presidential calendar, it’s usually clear where a candidate fits within the political spectrum of his party. With Obama, there is vast disagreement about just how liberal he is, especially on the economy. My favorite example came in mid-June, shortly after Obama named Jason Furman, a protégé of Robert Rubin, the centrist former Treasury secretary, as his lead economic adviser. Labor leaders recoiled, and John Sweeney, the head of the A.F.L.-C.I.O., worried aloud about “corporate influence on the Democratic Party.” Then, the following week, Kimberley Strassel, a member of The Wall Street Journal editorial board, wrote a column titled, “Farewell, New Democrats,” concluding that Obama’s economic policies amounted to the end of Clintonian centrism and a reversion to old liberal ways.

Some of the confusion stems from Obama’s own strategy of presenting himself as a postpartisan figure. A few weeks ago, I joined him on a flight from Orlando to Chicago and began our conversation by asking about his economic approach. He started to answer, but then interrupted himself. “My core economic theory is pragmatism,” he said, “figuring out what works.”

This, of course, is not the whole story. Invoking pragmatism doesn’t help the average voter much; ideology, though it often gets a bad name, matters, because it offers insight into how a candidate might actually behave as president. I have spent much of this year trying to get a handle on what is sometimes called Obamanomics and have come away thinking that Obama does have an economic ideology. It’s just not a completely familiar one. Depending on how you look at it, he is both more left-wing and more right-wing than many people realize.

Labor unions, in particular, would prefer more trade barriers than many other Democrats. During the primaries Obama nodded, and at times pandered, in this direction. Since then, he has disavowed that rhetoric, to almost no one’s surprise. Yet his zig-zagging on the issue did highlight the biggest weak spot in his, and his party’s, economic agenda. He still hasn’t quite figured out how to sell it. For all his skills as a storyteller and a speaker, he has not settled on a compelling message about how to put the economy on the right path. ….

The article is 8 pages long and well worth the read in entirety.

It’s often hard to predict what either candidate is for or against, when both candidates resort to the theme of the moment on oil, taxes, and union jobs at GM. See GM, Ford Seek Taxpayer Bailout for McCain’s surprising support for bailing out GM.

Both candidates appear to be zig-zagging and I am happy Obama has zigged rather than zagged on free trade, dropping calls for more trade barriers.

It’s no secret that Obama has squandered his significant lead in the polls, and arguably all this posturing is not helping. What I thought was going to be a blowout, and still could be, just does not seem to be shaping up that way at the moment.

It’s no secret that Obama has squandered his significant lead in the polls, and arguably all this posturing is not helping. What I thought was going to be a blowout, and still could be, just does not seem to be shaping up that way at the moment.

There is also an interesting dichotomy at play including "Republicans for Obama" and "Democrats For McCain". Let’s take a look at both.

Republicans for Obama

Please consider Leach, Chafee start ‘Republicans for Obama’.

Former Republican Rep. Jim Leach (Iowa) and former GOP Sen. Lincoln Chafee (R.I.) touted Barack Obama as the presidential candidate who represents the traditional conservatism that they feel has been forgotten under President Bush.

In an Obama campaign conference call Tuesday, during which Leach announced his endorsement of Sen. Obama (D-Ill.), the two former lawmakers tied presumptive Republican nominee Sen. John McCain (Ariz.) to Bush’s positions, particularly on the war in Iraq and spending.

Leach, who served 15 terms in the House, said that there’s real Republican concern “about the occurrence of current philosophy of government and prospect that we’ll have more of the same.”

Chafee, who served as a Republican in the Senate but has become an Independent, criticized McCain for voting against the Bush tax cuts and domestic offshore oil drilling but supporting those measures while campaigning for president.

“Seeing the two different John McCains is a fracture to his credibility,” said Chafee.

Also see ‘Republicans for Obama’ take fight to McCain.

Democrats For McCain

Newsweek points out in Chasing the Mythical ‘Obamacan’ Masses that Republicans for Obama and Democrats for McCain effectively cancel each other out.

The latest numbers from CBS News show Obama at 11 percent crossover support and McCain at 10 (and tied among Independents); FOX News puts the pair at six percent and seven percent, respectively–a result that closely matches where George W. Bush (nine percent crossover) and John Kerry (seven percent crossover) stood at this point in 2004.

Obama vs. McCain Tax Proposals

The Tax Policy Center, a research group run by the Brookings Institution and the Urban Institute, has done the most detailed analysis of the Obama and McCain tax plans. Inquiring minds may wish to consider An Updated Analysis of the 2008 Presidential Candidates’ Tax Plans: Revised August 15, 2008.

Comparison of the Two Plans

If enacted, the Obama and McCain tax plans would have radically different effects on the distribution of tax burdens in the United States. The Obama tax plan would make the tax system significantly more progressive by providing large tax breaks to those at the bottom of the income scale and raising taxes significantly on upper-income earners. The McCain tax plan would make the tax system more regressive, even compared with a system in which the 2001–06 tax cuts are made permanent. It would do so by providing relatively little tax relief to those at the bottom of the income scale while providing huge tax cuts to households at the very top of the income distribution.

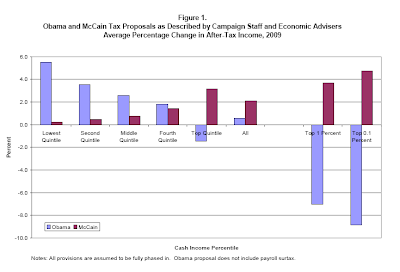

2009 Effect

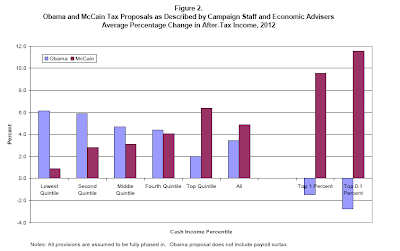

2012 Effect

Measured against current law in 2009, Senator Obama’s plan raises after-tax incomes by 5.5 percent for those in the bottom quintile and also provides more modest increases for those in the next three quintiles (figure 1). The top quintile would experience an average tax increase because of the hikes in the tax rates on capital gains and the increases in the top two individual income tax rates. The increase in taxes would be dramatic for those at the very top of the income scale, representing 7 percent of after-tax income for the top 1 percent of households and 8.9 percent of income for the richest 1 in 1,000.

In contrast, the McCain plan would provide virtually no benefit to households in the bottom quintile, and very modest benefits to those in the next three quintiles. The top quintile would receive a tax cut of more than 3 percent of after-tax income. Within the top quintile, the richest 1 percent of households would receive an average tax cut of 3.7 percent. That figure rises to almost 4.7 percent for the top 0.1 percent of the income distribution.

The difference in the distributional effects of the two plans is just as stark when measured against current law in 2012 (figure 2).

The Obama plan would still provide the largest tax breaks, measured as a percentage of after-tax income, to those in the bottom quintile. Each quintile would, on average, receive a tax cut but those at the very top of the income scale would receive tax increases. On average, the top 1 percent would receive a tax increase equal to 1.5 percent of income; that figure would rise to nearly 3 percent of income for the richest 1 in 1,000 households.

As in 2009, the McCain tax plan provides very little benefit to households at the bottom of the income distribution in 2012. Households in the lowest quintile receive tax cuts averaging about 1 percent of income. Because McCain’s plan extends all of the 2001–06 tax cuts for higher income earners and recipients of capital gains and dividends (other than complete repeal of the estate tax) and cuts corporate taxes, those in the top 1 percent receive average cuts representing 9.5 percent of income; that figure is 11.6 percent for the top 0.1 percent of households.

There you have it. Is Obama some sort of quasi free-market half-conservative "Chicago School" pragmatist in favor of more regulation, handouts, and redistribution of wealth schemes? If so, then how does one classify McCain?

Obama vs. McCain

Was this the best we could do?

Being the ever-optimist that I am, I am looking on the bright side. This was not the worst possible pairing. Obama vs. McCain is a distinct improvement over the alternative Hillary vs. McCain or the absolute worst possible choice of Hillary vs. Giuliani. The latter is arguably the worst possible choice voters could possibly have had to make.