Adam Warner, of Daily Options Report, explains a little more about VIX and the caution needed in trading it, particularly when buying options. Thank you, Adam! – Ilene

VIX Vs. VIX

Another warning about trading the VIX. Tradable VIX products NEVER move as much or as swiftly as the VIX itself, with the possible exception of the day before they expire.

Another warning about trading the VIX. Tradable VIX products NEVER move as much or as swiftly as the VIX itself, with the possible exception of the day before they expire.

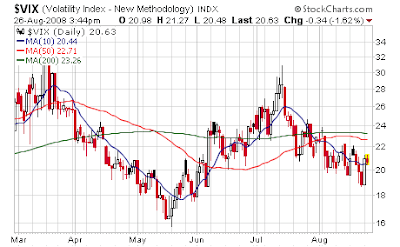

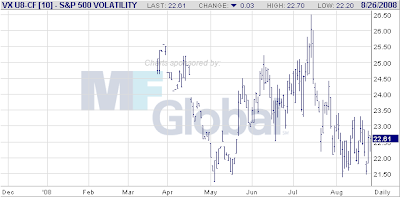

The upper chart shows the VIX over the past 6 month’s, while the lower chart shows the VIX Sep. futures (thank you

Bill). To line they up, you have to mentally stretch the bottom one. And as you can see, they pretty much move in lockstep directionally.But if you look closely, they don’t come close to trading in lockstep in terms of magnitude. When the VIX went down to 16 in May, the VIX future only went to 21.5. Likewise the pop back to 31 only saw a VIX Sep lift to 26.50. And those were the extremes, so 15 point lift in the VIX, a near double in about 10 weeks, saw only a 5 pt., or 25% lift in something you could have actually traded. And keep in mind of you bought VIX calls to play for it, results may have been even more mediocre depending on whether you timed it with the correct cycle (June calls for example would have gone to wallpaper before panning out).

I reiterate these points over and over and over again, mainly because this is a very poorly understood product. The VIX is a statistic replete with noise, whereas tradable VIX products smoothe out that noise and assume the inevitable mean reverting tendencies. Now "mean" assumptions of course are not static, so my grander point here would be to always remember if you trade the VIX, you are betting more on where the mean assumptions will go, NOT where the actual VIX might fluctuate to, except very near expiration.

Follow up comment: "As to the VIX coverage, whatever. Apologies to all Najerians, but it was a terrible product to list in that few actually understand it. It’s predominantly small fish making misguided directional volatility bets that they truly don’t need, up against Big Fish with large variance risk that have a better sense how to price everything. Not to mention that the VIX itself has gotten wildly more popular as some sort of Fear measurement, and as such more misrepresented and mistinterpretted than ever. If I over-cover it, so be it. I dropped my requirement that everyone read every post, so just look at the pictures.

Anyway, I do agree though, the VIX is getting a bit tired." – Adam