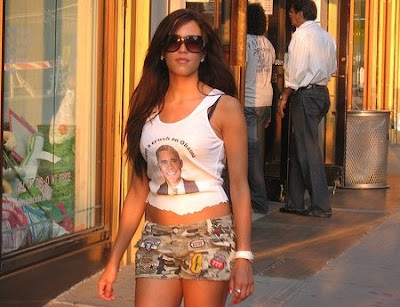

Here’s a discussion on OTM call options by Adam Warner, at Daily Options Report, referring to a study by CXO Advisory. (Maybe it’s me, I don’t exactly understand the significance of the title, or the pictures… oh, wait, it took 24 hr. but now I think I got it. – Ilene)

Obama Girl VS. OTM Puts

As usual, the Esteemed Pundit Class has misread the McCain gambit on Palin. Its not a play on some mythical disgruntled Hillary, it’s a full frontal assault on Obama Girl.

As usual, the Esteemed Pundit Class has misread the McCain gambit on Palin. Its not a play on some mythical disgruntled Hillary, it’s a full frontal assault on Obama Girl.

And yes, the Palin photo below does have a photoshop sort of feel to it.

So what’s the best way to use calls and play for a stock pop? Apparently not the OTM’s, as per this study brought to us by

CXO Advisory.Are out-of-the-money (OTM) call options a good way to speculate on spikes in the price of underlying stocks? In other words, are such options reliably underpriced or overpriced? In her August 2008 paper entitled "Stock Option Returns: A Puzzle", Sophie Xiaoyan Ni investigates one-month returns for call options on individual stocks that do not have an ex-dividend day prior to expiration. Using expiration date option price data for a broad sample of qualifying stocks during January 1996 through June 2005, she concludes that:

- Out-of-the-money calls have negative average returns over the entire sample period. Options out of the money by more than 15% yield an average return of -28%.

- The higher the strike price, the worse the average returns for call options on individual stocks.

- The overpricing of out-of-the-money call options may derive from systematic overestimation, by options sellers and buyers, of the odds of a sharp rise in the price of underlying stocks.

So maybe whats-his-name, you know, that guy who loves DEEEEEEEEEEP calls, is onto something?

OK, practically speaking, these results sound correct. OTM’s are a lottery ticket. Returns when you win are spectacular on a percentage basis. But they’re infrequent, and clearly the expected gain is pretty bad. A good rule is always to buy options at the strike you think it’s moving FROM and/or sell options where you think it’s going TO. As CXO notes about OTM’s, "selling such options may be reliably profitable."

OK, practically speaking, these results sound correct. OTM’s are a lottery ticket. Returns when you win are spectacular on a percentage basis. But they’re infrequent, and clearly the expected gain is pretty bad. A good rule is always to buy options at the strike you think it’s moving FROM and/or sell options where you think it’s going TO. As CXO notes about OTM’s, "selling such options may be reliably profitable."