Adam Warner at Daily Options Report makes the case for owning options rather than stocks in this unusually volatile environment.

Skinny Steve And The Case for Owning Rising Volatility

So I’m looking at this pic. of Steve Jobs saluting his acolytes at yesterday’s AAPL event and wondering how he didn’t beat the "whisper" number on his weight.

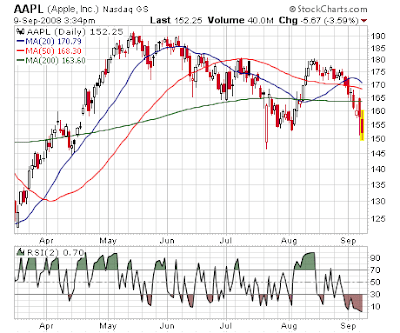

Well, whatever. That long awaited volatility pop in AAPL? Finally here as the stock challenges 5 month lows. With an RSI(2) of under 1.

We’re seeeing volatility explosions everywhere. And conventional wisdom counterintuitively says you want to be a net owner of options during volatility melt ups. But with extreme caution. I’m talking short term plays and I’m not talking Meltups Times 100 like LEH.

What does it mean? Well, it suggests options are the best alternative right now. Instead of "bottom fishing" with stock, the theory says your best play is to buy calls instead. Likewise put buys make more sense than short sales right now.

Why?

Well situations like this do not tend to resolve peacefully. Emotion is getting extreme, particularly in the energy/mining complex and former momo darlings like The Four Tech Horsemen, the ags, solars, et. al. The risks are massive in both directions, which is precisely when you want to own options.

So while I don’t do recommendations or bottom calls here (although I should do what they all do on TV and just keep calling them), I AM saying that if you are so inclined, do it with nearer term calls.