Well yesterday was an interesting day.

Well yesterday was an interesting day.

Financials once again opened low and closed high, today going from down 4% to up 1.7% at the close. The market in general opened sharply lower, with every index but the Dow testing the lows of the week but we caught the sharp turn in the SKF's right at 9:36 and then the airlines took off, led by UAUA, who we tried to grab on Monday's dip and by 10:02 I said: "Whole Nasdaq picking up now – dare we hope?"

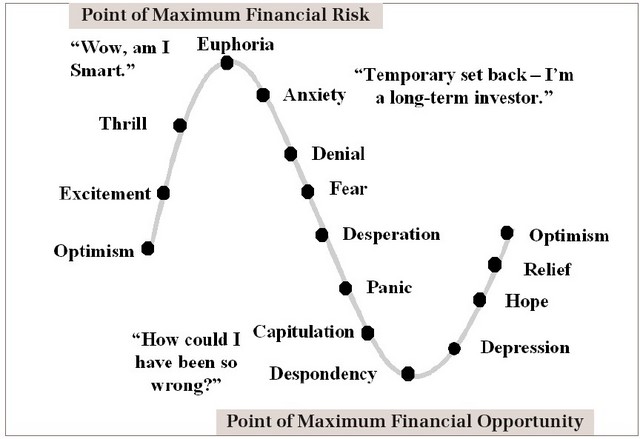

The Nasdaq didn't quite lead but it did fight it's way back to just about Friday's close but 2.5% below Monday's open, as is everything but the Dow (1% off) and the S&P (1.5% off). So we are happy but not thrilled so far, we need to see much more from the market but my overall premise was that we would flatline (and it's been a hell of a choppy flatline) into the last 10 trading days of the month and flat it is so far – it's next week that we were hoping to see something. As I noted in yesterday's comments, the market is capable of making spectacular recoveries off a bottom but we need to be sure we have some kind of real bottom before we get too excited.

Our Big Chart does not paint a very exciting picture, especially in Asia, where all the indices are firmly below the 25% level (off their highs) led down by India's 323-point decline last night.

|

|

|

Week's |

25% |

20% |

Feeling |

50 |

|

Index |

Current |

Move |

Terror |

Horror |

Better |

DMA |

| Dow | 11,433 | 245 | 10,644 | 11,354 | 11,808 | 11,415 |

| Transports | 2,389 | 23 | 2,336 | 2,491 | 2,591 | 2,413 |

| S&P | 1,249 | 13 | 1,182 | 1,261 | 1,311 | 1,265 |

| NYSE | 8,011 | 3 | 7,790 | 8,310 | 8,642 | 8,457 |

| Nasdaq | 2,258 | -1 | 2,146 | 2,289 | 2,380 | 2,323 |

| SOX | 323 | -1 | 419 | 447 | 465 | 351 |

| Russell | 719 | 1 | 642 | 684 | 712 | 713 |

| Hang Seng | 19,352 | -1,004 | 24,000 | 25,600 | 26,624 | 21,530 |

| Nikkei | 12,214 | -343 | 13,725 | 14,640 | 15,226 | 12,962 |

| BSE (India) | 14,000 | -899 | 15,900 | 16,960 | 17,638 | 14,294 |

| DAX | 6,193 | -86 | 6,088 | 6,494 | 6,753 | 6,368 |

| CAC 40 | 4,283 | -21 | 4,626 | 4,934 | 5,132 | 4,347 |

| FTSE | 5,370 | 8 | 5,066 | 5,403 | 5,619 |

5,414 |

We're still getting leadership from the Russell, which is interesting considering how bad things are supposed to be. You would think $100 oil yesterday would perk up the Transports and it sure did yesterday with a 2.5% rule gain but that was barely enough to reverse a tough week of declines. Hurricane Ike makes next week's oil prices very uncertain… Also uncertain is the future of LEH, but we are now told to expect them to be purchased over the weekend, probably with another round of government incentives to the buyer.

Asian markets are simply catastrophic and they are dragging the global indices lower with the DJ World Index (chart on right) now 27% off its hights of last November. clearly the US markets are outperforming and holding up the rest but the fall of the CAC below the 25% line is a big concern as the DAX is not far above their line and our own SOX said goodbye to 25% long ago (down 40% from last summer's high of 540). While 40% is a good spot for a bounce on any sell-off, the SOX would have to get well over the 50 dma at 369 before they even look like they are in a recovery. Without the SOX, it's very hard for the Nasdaq to gather steam.

The Semis are suffering along with the Telcom sector with YTD declines among the major carriers Q -45%, S -30%, T -24%, and VZ -20%. DSL growth has not proceeded as advertised, held down by a tough economy and over 1M unsold homes and another 2M emptied by foreclosure, not to mention heavy competition from the cable industry. Broadband is still considered a luxury to much of the country and a lot of luxury spending was put off this year as the cost of feeding a family and heating a home took precedent over downloading things faster.

I really like VZ down here as the FIOS system rolls out and begins to pay back billions in development. Fiber has such an inherant advantage over cable that VZ already has 1.8M broadband subscribers and 1.2M TV subscribers in their second year (as of Q1). Under $35 is a great entry point for the stock, which pays a 5.3% dividend and a Sept $35 call can be sold against them for .55, which is like a 1.5% dividend by next Friday! The leaps are also cheap with the 2010 $30 calls at $6.70, with just $2 in premium.

Overall, the Retail Sales environment is very messy, down 0.9% in August on the headlines but that was very much due to a significant fall in gasoline sales and came in at -0.3% ex-auto flat including autos, which jumped 0.7% on strong incentive sales. Consumers cutting back on driving plus lower prices is, of course, a deadly combination for gasoline retailers and you can't expect spending to perk right up after a terrible July, which has been revised down to a 0.5% decrease from 0.1% so you can see how silly it is to rely on the Commerce Department's numbers anyway. Consumer spending makes up about 70% of the GDP so it should be disturbing to people that our government can be off 400% on the figures they give us. That last Retail Sales report was 0.1% below flat expectations on 8/13 and the market did not like it one bit though – on a Friday, caution will almost probably win out and rob us of a good finish.

That's a shame because the PPI dropped 0.9% in August, the biggest monthly drop since August '06 but the annualized level remains high at 9.6% as wholesale prices are slow to come down. Even the core PPI is up 3.6%, much higher than the Fed can comfortably tolerate it but a rate hike at next week's meeting is pretty much impossible given the state of the financial markets. Tuesday we get the CPI, which should also show inflation easing but, is it enough to give us a boost or more fuel for the bears, who are pointing to a global economic slowdown.

Energy prices in the PPI dropped 4.6% in August with wholesale gasoline down 3.5% and raw material costs came down 11.9% – the biggest drop in 5 years. We are having a very hard time adjusting to the pop in the commodity bubble and that's an important lesson to learn. Just like the pop in the housing bubble made sense but the aftermath was devastating, it looks like the collapsing commodity bubble is wreaking it's own havoc making it difficult for the broader markets to stage a comeback.

Energy prices in the PPI dropped 4.6% in August with wholesale gasoline down 3.5% and raw material costs came down 11.9% – the biggest drop in 5 years. We are having a very hard time adjusting to the pop in the commodity bubble and that's an important lesson to learn. Just like the pop in the housing bubble made sense but the aftermath was devastating, it looks like the collapsing commodity bubble is wreaking it's own havoc making it difficult for the broader markets to stage a comeback.

A scary WSJ poll today shows 75% of the people more gloomy than bright in their economic outlook (or maybe gloomy people get up earlier, we'll see how the day goes) another indication of the lack of leadership we talked about yesterday. Of course, it's small wonder that these are the poll results when the poll is taken at the bottom of this article, which says: "At some point, that flow of capital to financial institutions will dry up, and we'll still have most of the issues for regional banks, in terms of defaults and credit problems, still ahead of us," Blackstone President Tony James said last month. The recent government rescues may have backfired by making investors more wary of investing in capital-hungry firms. In the cases of Bear Stearns, Fannie and Freddie, federal officials' strategy was to protect debtholders. But their interventions were also clearly designed to not bail out stock investors.

The test for the markets this morning is to see if they can hold the pre-crazy highs that we finished at on yesterday's last minute buying spree. While the open may look shocking (Dow looks to be down 70), we topped out around 11,370 at 3pm and would have been quite happy to close there. The S&P needs to hold 1,240 as usual and the Nasdaq would be pathetic at 2,440 but it beats the alternative.