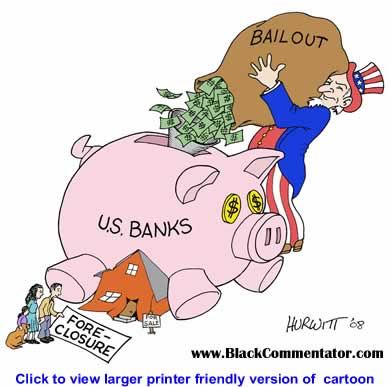

The draft proposal for the bailout plan is not encouraging; following are a few opinions, starting with Mish’s.

Weep For The Unites States of America

The New York Times has the Text of Draft Proposal for Bailout Plan. Given this is legislation, under fair use terms, here is the complete draft. My thoughts follow.

LEGISLATIVE PROPOSAL FOR TREASURY AUTHORITY

TO PURCHASE MORTGAGE-RELATED ASSETS

Section 1. Short Title.

This Act may be cited as ____________________.

Sec. 2. Purchases of Mortgage-Related Assets.

(a) Authority to Purchase.–The Secretary is authorized to purchase, and to make and fund commitments to purchase, on such terms and conditions as determined by the Secretary, mortgage-related assets from any financial institution having its headquarters in the United States.

(b) Necessary Actions.–The Secretary is authorized to take such actions as the Secretary deems necessary to carry out the authorities in this Act, including, without limitation:

(1) appointing such employees as may be required to carry out the authorities in this Act and defining their duties;

(2) entering into contracts, including contracts for services authorized by section 3109 of title 5, United States Code, without regard to any other provision of law regarding public contracts;

(3) designating financial institutions as financial agents of the Government, and they shall perform all such reasonable duties related to this Act as financial agents of the Government as may be required of them;

(4) establishing vehicles that are authorized, subject to supervision by the Secretary, to purchase mortgage-related assets and issue obligations; and

(5) issuing such regulations and other guidance as may be necessary or appropriate to define terms or carry out the authorities of this Act.

Sec. 3. Considerations.

In exercising the authorities granted in this Act, the Secretary shall take into consideration means for–

(1) providing stability or preventing disruption to the financial markets or banking system; and

(2) protecting the taxpayer.

Sec. 4. Reports to Congress.

Within three months of the first exercise of the authority granted in section 2(a), and semiannually thereafter, the Secretary shall report to the Committees on the Budget, Financial Services, and Ways and Means of the House of Representatives and the Committees on the Budget, Finance, and Banking, Housing, and Urban Affairs of the Senate with respect to the authorities exercised under this Act and the considerations required by section 3.

Sec. 5. Rights; Management; Sale of Mortgage-Related Assets.

(a) Exercise of Rights.–The Secretary may, at any time, exercise any rights received in connection with mortgage-related assets purchased under this Act.

(b) Management of Mortgage-Related Assets.–The Secretary shall have authority to manage mortgage-related assets purchased under this Act, including revenues and portfolio risks therefrom.

(c) Sale of Mortgage-Related Assets.–The Secretary may, at any time, upon terms and conditions and at prices determined by the Secretary, sell, or enter into securities loans, repurchase transactions or other financial transactions in regard to, any mortgage-related asset purchased under this Act.

(d) Application of Sunset to Mortgage-Related Assets.–The authority of the Secretary to hold any mortgage-related asset purchased under this Act before the termination date in section 9, or to purchase or fund the purchase of a mortgage-related asset under a commitment entered into before the termination date in section 9, is not subject to the provisions of section 9.

Sec. 6. Maximum Amount of Authorized Purchases.

The Secretary’s authority to purchase mortgage-related assets under this Act shall be limited to $700,000,000,000 outstanding at any one time

Sec. 7. Funding.

For the purpose of the authorities granted in this Act, and for the costs of administering those authorities, the Secretary may use the proceeds of the sale of any securities issued under chapter 31 of title 31, United States Code, and the purposes for which securities may be issued under chapter 31 of title 31, United States Code, are extended to include actions authorized by this Act, including the payment of administrative expenses. Any funds expended for actions authorized by this Act, including the payment of administrative expenses, shall be deemed appropriated at the time of such expenditure.

Sec. 8. Review.

Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.

Sec. 9. Termination of Authority.

The authorities under this Act, with the exception of authorities granted in sections 2(b)(5), 5 and 7, shall terminate two years from the date of enactment of this Act.

Sec. 10. Increase in Statutory Limit on the Public Debt.

Subsection (b) of section 3101 of title 31, United States Code, is amended by striking out the dollar limitation contained in such subsection and inserting in lieu thereof $11,315,000,000,000.

Sec. 11. Credit Reform.

The costs of purchases of mortgage-related assets made under section 2(a) of this Act shall be determined as provided under the Federal Credit Reform Act of 1990, as applicable.

Sec. 12. Definitions.

For purposes of this section, the following definitions shall apply:

(1) Mortgage-Related Assets.–The term “mortgage-related assets” means residential or commercial mortgages and any securities, obligations, or other instruments that are based on or related to such mortgages, that in each case was originated or issued on or before September 17, 2008.

(2) Secretary.–The term “Secretary” means the Secretary of the Treasury.

(3) United States.–The term “United States” means the States, territories, and possessions of the United States and the District of Columbia.

Weep For The Taxpayer

Notice that this bill raises the national debt. Notice that the bill is supposed to take into consideration "protecting the taxpayer".

The reality is this bill does not and cannot protect the taxpayer. Rather this bill only promises to take the taxpayer into consideration. The Treasury will indeed take the taxpayer into consideration, then immediately discard any such ideas.

Inquiring minds are also noting "The Secretary’s authority to purchase mortgage-related assets under this Act shall be limited to $700,000,000,000 outstanding at any one time."

The idea behind the above statement is to allow for a continual dumping ground such that there will always be $700 billion in toxic garbage held under this program. As soon as any asset can be unloaded by the Treasury at cost, another toxic loan is eligible to be assumed on the books of the Treasury. This process can last for as long as two years.

Unconstitutional Provisions

Pay particular attention to section 8.

Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.

Essentially the law will state that whatever the Treasury does it is above the law. Such a provision is undoubtedly unconstitutional.

My comment – doesn’t sound constitutional to me.

Weep For The Free Market

It’s time to Weep For The Free Market (or rather what little free market the US had left).

It’s time to Weep For The Free Market (or rather what little free market the US had left).

Weep For The Unites States of America

At taxpayer expense, Bernanke and Paulson are willing to bail out their banking buddies at enormous expense to the average taxpayer of this country. Bernanke and Paulson both should be fired. Instead Congressional sheep will baa yes to this bailout and Bush will baa yes when he signs it. It is a sickeningly sad that day for America that Congress will go along with this proposal that makes the US Taxpayer A Giant Dumpster For Illiquid Assets.

$700 billion will be wasted by this program and it is $700 billion the US does not have to waste. I ask that everyone vote against any congressman who votes for the passage of this bill.