We are still on shaky ground.

We are still on shaky ground.

Last night’s Big Chart Review clearly shows that. We failed to hold the levels we set yesterday morning and we are at or below the 25% line in the Transports and on the NYSE and the Nasdaq as well with the SOX still more like 40% off the highs, dipping close to Hang Seng territory. There was a lot of pre-market euphoria around Buffett’s investment in GS but, at the rate of return Buffett is getting, there are not many financials that can afford to take money under those terms and sentiment is fading a bit as we get closer to the open.

We still have a lot of Congressional testimony to get through and a lot of Congresspeople are concerned about the rush to give Paulson a blank check and sweeping authority. How sweeping? Included in the language of Paulson’s proposal is the following: “Decisions by the Treasury pursuant to the Authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.” Cool right, not only can Paulson do anything he wants but he can’t be held accountable after the fact!

"This is eerily similar to the rush to war in Iraq," said Rep. Mike McNulty (D., N.Y.), voicing deep skepticism. "We have been told repeatedly by this administration that the economy is fundamentally sound, and then all of the sudden they say the economy is going to collapse. That is unacceptable." This is all tough talk and it’s spooking the markets but the reality is that we do have our backs against the wall and will probably have to end up giving Paulson most of what he wants. I imagine it will end up with Congress approving a smaller amount with sweeping powers that will be reviewed in January. If $300Bn in 3 months can’t save us, I don’t think approving the additional $400Bn is going to make much difference. If this were such a smart deal then surely the US could find some equity partners at a certain price…

![[Commercial fisherman Richard Jacobson, locates one of his fishing nets as a workman clean up debris from Hurricane Ike Tuesday in Galveston, Texas. Texas expects costs from Ike to be $27 billion to $35 billion.]](http://s.wsj.net/public/resources/images/NA-AS716_FEMA_D_20080923180327.jpg) All this talk of $400Bn here and $700Bn there must really be ticking off voters in Texas and Louisiana, who face $60Bn worth of Gustav and Ike related clean-up. Houston Mayor Bill White told senators on a special homeland-security panel monitoring disaster response. "We need help from the federal government to get back on our feet. The Wall Street credit crunch not only hampers Houston’s ability to get loans," he said, "but it could distract lawmakers from the needs of residents recovering from Ike and Gustav, which, unlike Katrina, didn’t produce dramatic scenes of people being rescued off rooftops."

All this talk of $400Bn here and $700Bn there must really be ticking off voters in Texas and Louisiana, who face $60Bn worth of Gustav and Ike related clean-up. Houston Mayor Bill White told senators on a special homeland-security panel monitoring disaster response. "We need help from the federal government to get back on our feet. The Wall Street credit crunch not only hampers Houston’s ability to get loans," he said, "but it could distract lawmakers from the needs of residents recovering from Ike and Gustav, which, unlike Katrina, didn’t produce dramatic scenes of people being rescued off rooftops."

Speaking of Paulson, Goldman Sachs and trust: The SEC is fining GS for actions taken under CEO Hank Paulson in because "it allowed customers to profit illegally by selling shares short just before public offerings." You can’t get more naked short than that as the shares haven’t been issued yet so it’s not even remotely possible that they were available to borrow! The London Times reports (this story has been buried in the US media, even though it’s a landmark ruling) that there was at GS: "a pattern of illegal trading ahead of share offerings from March 2000 to May 2002 that went undetected but should have been investigated by the brokerage firm."

Meanwhile the FBI is conducting a mortgage fraud investigation into FRE, FNM, LEH and AIG and 22 other companies as pressure is building for the FBI and regulators to hold top executives accountable for the crisis that has crippled the nation’s finance sector. In meetings on Capitol Hill, some lawmakers raised concerns with Treasury Secretary Henry Paulson that by taking large stakes in some financial firms, the government may be limiting its ability to exact penalties for wrongdoing, according to people familiar with the matter.

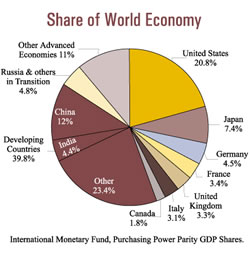

Global leaders are calling for global oversight of the US markets. At this week’s UN General Assembly meeting, France’s Sarkozy said: "Let us rebuild together a regulated capitalism in which whole swathes of financial activity are not left to the sole judgment of market operators." He called for more oversight of international banks and credit agencies so that the "transparency of transactions replaces opacity." Brazilian President Luiz Inacio said the current global financial crisis was fueled by the "boundless greed" of speculators and bankers whose mistakes were being "borne by the masses." In response, he said the global community must create a "new foundation" for the world economic system to prevent future abuses and to ensure greater equality between rich and poor. You know you are in trouble when Brazil is questioning your banking system!

Global leaders are calling for global oversight of the US markets. At this week’s UN General Assembly meeting, France’s Sarkozy said: "Let us rebuild together a regulated capitalism in which whole swathes of financial activity are not left to the sole judgment of market operators." He called for more oversight of international banks and credit agencies so that the "transparency of transactions replaces opacity." Brazilian President Luiz Inacio said the current global financial crisis was fueled by the "boundless greed" of speculators and bankers whose mistakes were being "borne by the masses." In response, he said the global community must create a "new foundation" for the world economic system to prevent future abuses and to ensure greater equality between rich and poor. You know you are in trouble when Brazil is questioning your banking system!

Asia did not have a very exciting morning with most indexes ending the day up slightly. The Bank of East Asia fell 11% on a rumor that they were unstable but recovered half the loss by the day’s end. Financial firms did well in Japan as companies like Nomura scoop up US assets, presumably on the cheap. India’s economic problems are turning violent as a mob of laid off auto workers murdered the CEO. A police spokesman said: “Only a few people were called inside. About 150 people were waiting outside when they heard someone from inside shout for help. They rushed in and the two sides clashed. The company staff were heavily outnumbered.” This follows an incident in which construction was halted at Tata Motors’ new auto plant three weeks ago because violent protests there left the company unable to guarantee the safety of the workers.

Markets in Europe have also been flat to down ahead of our open as very little is likely to get done until we see something solid coming out of Washington. Financials are playing strong in early trading and EDF paid $23Bn for British Energy, boosting that sector. Miners were weak but gold is heading back up as is oil ahead of the US inventory report that is expected to show draw-downs due to the hurricane last week.

I mentioned last night that the NYMEX trading on Monday had finally gotten so blatantly outrageous that it was indictable and the CTFC has now sent out dozens of subpoenas. This is such a serious issue that it ground NYMEX churning to a halt with just 41,000 contracts traded yesterday, 85% less than the 280,000 contract average. Meanwhile the Senate passed an energy bill by a 93-2 margin that will double the tax incentives for wind and solar and also includes incentives to build more refineries and extends investment tax credits on solar projects through 2016. The breaks will be paid for by curtailing a tax break oil companies get for job creation and for overseas production and ending the ability of hedge-fund managers to defer taxes on profits earned in offshore funds. It will be very hard for Bush to veto this bill with such a wide passage in the Senate.

I mentioned last night that the NYMEX trading on Monday had finally gotten so blatantly outrageous that it was indictable and the CTFC has now sent out dozens of subpoenas. This is such a serious issue that it ground NYMEX churning to a halt with just 41,000 contracts traded yesterday, 85% less than the 280,000 contract average. Meanwhile the Senate passed an energy bill by a 93-2 margin that will double the tax incentives for wind and solar and also includes incentives to build more refineries and extends investment tax credits on solar projects through 2016. The breaks will be paid for by curtailing a tax break oil companies get for job creation and for overseas production and ending the ability of hedge-fund managers to defer taxes on profits earned in offshore funds. It will be very hard for Bush to veto this bill with such a wide passage in the Senate.

SPWR is probably the best straight solar play but a lot of their stock was recently distributed to CY shareholders and may keep prices low as they take some profits. That means that March $75s at $21.10 are not a bad way to play as long as you make sure you sell the Nov $90s for no less than $8 (now $10) if the stock heads down. That would put you in the March $75s for net $13.10 with a $15 position advantage on the caller. Hopefully the stock will run up and then the Oct $95s can be sold for $10 for a very nice spread.

Parts of Microsoft’s new ad campaign was designed on a Macintosh, and you can tell the company is trying hard to fight the tide as they pull out a lot of big guns in their new ad spots and, typical of Microsoft – they steal the very opening of the ad from Apple’s campaign. It’s a lack of creativity that has been killing the company and this commercial only serves to drive the point home. I like the musical version best.

Without Dow 11,000 and S&P 1,200 we are still in a dangerous downtrend so be very careful out there.