Ah, the DEAL is back on the table and the futures are brighter (7am).

Ah, the DEAL is back on the table and the futures are brighter (7am).

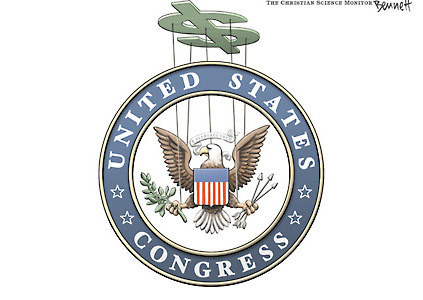

We still have the killer jobs number to get through at 8:30 but Congress has started making the right noises now that the market crashed again. My advice to buyers is to hold off until after the vote because it appears our Congressional leaders make their decisions based on the last tick of the tape or the last phone call they get from an angry voter, with no particular conviction either way.

The markets had a lot of conviction yesterday and it was all down. The nature of the selling – steady, widespread unwinding of pretty much all positions, led many to speculate that we’re seeing a boom in Hedge Fund redemptions as over $600Bn has been moved to cash in anticipation (or need) of redemptions. This massive outflow of capital is the falling tide that lowers all ships but is hitting widely held securities particularly hard, droppin INTC, for example, so low at $17.20 that their small dividend is now 3% of the stock price. AAPL hit $100, dropping it’s market cap to $88Bn, just twice as much as MSFT is spending on stock buybacks this year and less than Steve Ballmer probably spent developing the Zune – maybe MSFT should do a little shopping with that cash!

WFC went shopping this morning and snatched WB out of the clutches of C, paying $15.1Bn for something C was about to take over for $2.1Bn and they are doing it WITHOUT the FDIC, indicating they see real value there. Wells Fargo will acquire Wachovia in a stock-for-stock transaction. Included in the deal are all of Wachovia’s businesses and obligations, including its preferred equity and debt, and all its banking deposits. Under terms of the deal, Wachovia shareholders will receive 0.1991 a share of Wells Fargo. The transaction, based on Wells Fargo’s closing stock price of $35.16 on Thursday, values Wachovia at $7 a share. Shares of Wachovia closed Thursday at $3.91 a share yesterday and were trading as low at .75 on Monday. C had traded up as high as $23 on the news of a JPM-like gift from the government but is crashing all the way back to $20 pre-market.

![[commercial paper chart]](http://s.wsj.net/public/resources/images/P1-AN131_CPaper_NS_20081002230616.gif) While this is a positive sign for the banking sector, it’s the only one at the moment. There is an alarming trend in Commercial Paper loans, which are short-term loans to businesses that fund day-to-day operations and have fallen off from $2.2Tn outstanding last summer to $1.6Tn as of Wednesday. "It’s unprecedented to see the markets shut to so many firms at one time," says Peter Andersen, a virtual portfolio manager at Congress Asset Management Co. Overall, the amount of money loaned to companies in the form of "syndicated" loans (generally larger loans arranged by teams of banks) has dropped 40% in the first nine months of this year, to $2.31 trillion, according to Dealogic, a financial-data service.

While this is a positive sign for the banking sector, it’s the only one at the moment. There is an alarming trend in Commercial Paper loans, which are short-term loans to businesses that fund day-to-day operations and have fallen off from $2.2Tn outstanding last summer to $1.6Tn as of Wednesday. "It’s unprecedented to see the markets shut to so many firms at one time," says Peter Andersen, a virtual portfolio manager at Congress Asset Management Co. Overall, the amount of money loaned to companies in the form of "syndicated" loans (generally larger loans arranged by teams of banks) has dropped 40% in the first nine months of this year, to $2.31 trillion, according to Dealogic, a financial-data service.

That kind of puts the $700Bn into perspective as that 40% drop is $1.5Tn worth of loans that are not being made this month and many banking analysts predict that drop to almost double if the bailout is not passed, driving commercial lending activity down to 20% of last year. The current decline is impacting "Main Street" by about 14%, hence the lack of concern as the small banks that lend to small companies are the last to freeze up but GE was forced to go to Warren Buffett for cash as even that AAA-rated company saw the cost of insuring their swaps rise from $160,000 per $10M to $700,000 per $10M last week. If that’s happening to GE, you can imagine the torture being experienced by other companies.

Meanwhile, AIG is looking to save themselves, saying they "have been contacted by numerous parties regarding possible sales of businesses. That will include selling part of its foreign life-insurance business." The company has drawn down $61Bn of the $85Bn Federal credit line but they now feel that through asset sales and collecting a basket of private loans, that they will be able to aviod the government taking over 80% of the stock. "Our goal is to emerge from this process as a smaller but more nimble company that is solidly profitable and has good long-term growth prospects," said CEO Liddy.

China is still closed and missing all the fun. We looked at the FXP (ultra-short China) as good covers yesterday in case the bailout fails as they will lag our sell-off but may have a spectacular fall on Monday if our markets fail today. The Hang Seng did drop 528 points overnight but it was merely a gap down to the middle of Thursday’s trading range as investors had more of a wait-and-see attitude into the weekend. The Nikkei was not so complacent, with a 2% (194-point) drop and a bad finish at the week’s low of 10,938. A lot of this drop can be attributed to Japan’s $750Bn investment in US-based assets, which are not looking like a good bet as of yesterday’s close. Japan still has $954Bn in the government’s foreign reserve fund, some of which may be heading our way in the form of bond purchases to aid in the bailout program (if it passes).

China is still closed and missing all the fun. We looked at the FXP (ultra-short China) as good covers yesterday in case the bailout fails as they will lag our sell-off but may have a spectacular fall on Monday if our markets fail today. The Hang Seng did drop 528 points overnight but it was merely a gap down to the middle of Thursday’s trading range as investors had more of a wait-and-see attitude into the weekend. The Nikkei was not so complacent, with a 2% (194-point) drop and a bad finish at the week’s low of 10,938. A lot of this drop can be attributed to Japan’s $750Bn investment in US-based assets, which are not looking like a good bet as of yesterday’s close. Japan still has $954Bn in the government’s foreign reserve fund, some of which may be heading our way in the form of bond purchases to aid in the bailout program (if it passes).

Europe is flat at 8:30. Although the ECB held rates steady yesterday, Trichet signaled that a rate cut could be in the offing, perhaps sooner than the next meeting. The money continues to flow from the banks that are not backed by government guarantees to the ones that are, causing massive disruption and EU action is needed before an economic war begins over there. It turns out UBS is predicting to turn profitable in Q3 on the backs of 2,000 lay-offs as the bank cuts staff and exits several business lines. Spain looks to be the next Euro-zone economy to fall into recession as unemployment climbs to 11.3%, up from 8% last year. "Unemployment has risen in all sectors, largely the result of the end of many residential construction projects, which has a knock-on effect on other sectors," Spain’s Labor Ministry said.

Our own unemployment is no great shakes either with 159,000 jobs lost in September, giving us an unemployment rate of 6.1%. Hourly earning increased 0.2%, up 3.4% from last year indicating the workers who still have jobs feel they are lucky to have them and certainly aren’t pushing for raises. That is being interpreted as good news for the markets as it puts a Fed cut squarly on the table so it’s one of those cases where terrible news for humans is good news for business. The usual gang of expert economists had predicted just 105,000 jobs would be lost but the 50% miss is pretty much par for these guys. Although Hurricane Ike struck Texas during the payroll survey period, "we believe the storm did not substantially impact the payroll employment estimates," said Bureau of Labor Statistics Commissioner Keith Hall.

It’s all about Congress today and will the House pass the now $1Tn bailout package. If you want to know how business in Washington is done, the WSJ has an account of how Jim Ramstad’s (R-Minn.) vote was swayed. He voted against the bill on Monday but endorsed it yesterday because the senate added an amendment (don’t say earmark!) that requires health insurers to provide more generous coverage for mental illnesses. "There’s too much at stake to let the legislation fail," said Mr. Ramstad, a longtime proponent of the mental-health bill. Yeah, that’s the ticket…

It’s all about Congress today and will the House pass the now $1Tn bailout package. If you want to know how business in Washington is done, the WSJ has an account of how Jim Ramstad’s (R-Minn.) vote was swayed. He voted against the bill on Monday but endorsed it yesterday because the senate added an amendment (don’t say earmark!) that requires health insurers to provide more generous coverage for mental illnesses. "There’s too much at stake to let the legislation fail," said Mr. Ramstad, a longtime proponent of the mental-health bill. Yeah, that’s the ticket…

The question remains, as I said on Monday, is it going to be too little, too late. Now that it’s 4 days later, the too late issue looms very large and I can’t see riding positions into the weekend if we get a big rally without some serious downside hedging as our worst-case scenario remains that the bailout is passed and ends up getting a big, global "so what" from investors as $700Bn is starting to look like a drop in the market if unemployment keeps rising at these rates and housing keeps falling at these rates. Paulson’s original plan was to catch history’s largest falling knife (a term used to describe calling the bottom by making a large purchase of a rapidly falling asset) by spending $700Bn very rapidly on housing assets. The package he’s being given takes a slightly more measured approach but if housing prices decline another 20% before the bailout takes effect, another $1.5Tn would be needed to shore up the losses.

Barry Ritholtz has a great article about the credit and housing crisis, keep it in mind to keep yourself balanced in case we get a huge rally and you forget what a mess we are actually in. Hopefully, Congress will pass the bill, we’ll retake our levels and post a flat candle for the week at 11,000 but anything less than 10,800 on passage of this bill indicates more trouble is likely ahead of us and the longer Congress takes to decide, the more likely it becaomes that we don’t have time for a 500-point gain.