In the search for the root causes of the global financial crisis, Tim Iacono at The Mess That Greenspan Made, looks at the lack of sound money.

No, we need to fix the money. Literally.

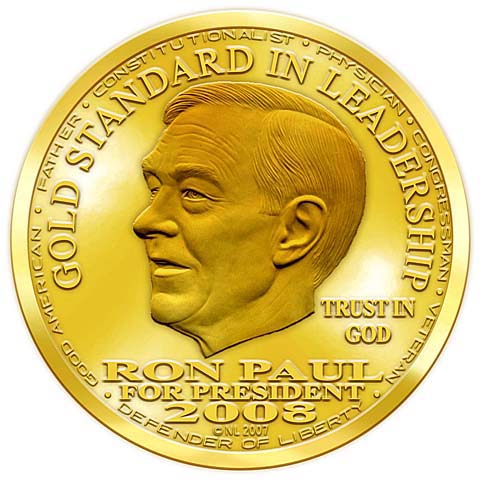

Yes, there’s a reason there are still so many Ron Paul for President signs up in peoples’ front yards even though the Texas Republican long ago gave up his bid for the Presidential nomination.

A small but growing number of individuals in this country are beginning to understand the fundamental problem the nation faces in grappling with a financial system that seems to have run amok once again and, not surprisingly, is being treated with the same palliatives as the last time it ran amok, which, of course, is what got us into the current mess.

It’s good to see items like this Wall Street Journal op-ed from last week (a piece that seems to have a renewed life on the internet this week) as it is a sure sign that more and more people are starting to understand the real root cause of the current crisis which is certainly not falling home prices.

See, there it is – right there in the title.

Loose Money And the Roots Of the Crisis

No one can believe in the omniscience of central bankers anymore.

By JUDY SHELTONThe world is not ending. Despite the wrenching turmoil in global financial markets and morbid allusions to the death throes of capitalism, it ain’t over. Not until people quit believing in themselves, not until people quit believing in a better future.

But the whimpering is real, and justified, because it hurts to have your world come crashing down. And global financial markets are definitely crashing, even when the impact is momentarily softened through massive injections of artificial money — "artificial" because the fiat money does not represent a store of genuine value but rather an airy government claim to future wealth yet to be created.

In the aftermath of this financial catastrophe, as we sort out causes and assign blame, with experts offering various solutions — More regulation! Less complex financial instruments! — let’s not lose sight of the most fundamental component of finance. No credit-default swap, no exotic derivative, can be structured without stipulating the monetary unit of account in which its value is calculated. Money is the medium of exchange — the measure, the standard, the store of value — which defines the very substance of the economic contract between buyer and seller. It is the basic element, the atom of financial matter.

It is the money that is broken.

Ms. Shelton then goes on to recite the many transgressions of former Fed Chairman Alan Greenspan, the merits of a monetary system based on something other than just faith in the issuing government, and issues a plea for sound money.

I missed this when it was originally published last Tuesday – I’m glad it’s making the rounds again this week.