Yesterday was very exciting.

We finally hit the tipping point at which enough Trillions were dumped into the markets to inflate stock prices. The question remains: Was it enough to avoid a severe recession? We've been training ourselves to take the emotion out of the trades by watching our levels and all day yesterday in member chat we kept raising the bar but the indexes kept on hitting them so we pretty much stayed bullish into the close (with a few new covers, just in case) but the levels I called for in the morning post: "Dow 8,400, S&P 950, NYSE 6,300, Nasdaq 1,725, Russell 515" were all beaten and held and even the SOX and Transports made good progress to our goals.

At 11:03, we were holding our 5% line so I amended our targets, saying: "S&P 950, Dow 9,000, Nas 1,750, NYSE 6,000 (already there), Russell 550 – that would be a bullish set of numbers." There is no point in discussing our bullish calls. It was, what I like to call, a "monkey with a dart board" kind of rally, you had to work really hard to find a stock that wasn't working (and we did with GE!). As I said on Friday, when we were bottom fishing – you know things are way too low when I start picking XOM and CVX as value plays…

The target we set in the afternoon was for the indices to get back to Wednesday's lows and that's pretty much where we finished. It is very important to keep in mind that we were very unhappy last Wednesday, where the market whipsawed up and down 1,500 points during the day. Our pivot point on Wednesday was the 9,500 line on the Dow and we should be gapping over it this morning so holding it today will be critical in order for us to remain bullish. It is literally 10,000 or bust for the week as anything less than 10,325 (last Monday's open) gives us nothing more than a harami candle pattern on the weekly chart that may do nothing more than solidify the upside resistance.

Still, resistance is indeed futile as the government opens up their checkbook and starts spending. There's an old saying that "you can't fight the Fed" but how about Congress, Treasury AND the Fed along with the ECB, BOE, BOJ, BOC and IMF (henceforth to be called "the collective")? Mere hints of this plan were enough to rocket the markets into yesterday's close, something we caught at 2:55, when I said to members: "This is good to see now, buyers coming in and supporting our 2.5% levels each time, a very big difference from last week so we can hopefully get at least a 50% retrace of the drop now."

The plan (let's call this Plan 9 from the Oval Office) as of this morning's version is for the government to take Buffett-like preferred equity stakes in 9 "top" financial institutions: GS (of course!), MS, JPM, BAC, C, WFC, STT, BK and one unnamed so far (unless they are including MER). Additionally, the Treasury will spend $250Bn to take equity stakes in "thousands" of banks using part of that $700Bn that Congress gave them. The FDIC will guarantee pretty much all bank deposits in a new PDRYM Program ("Please Don't Remove Your Money") along with "temporary" loan guarantees aimed to help banks borrow money from other banks. In other words, the government is pretty much backing up everything EXCEPT the people who are unable pay their mortgage – those are still being allowed to fail at a rate of close to 150,000 per month…

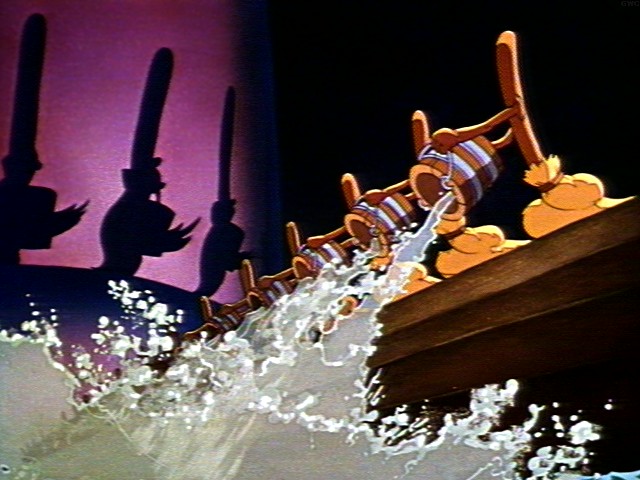

This is still, at the core, very much like having a burst water pipe in the basement and the government's solution is to keep buying more paper towels to soak up the water. The water keeps coming and the government keeps buying more towels, which is not enough to keep the furniture from being destroyed. After a while, the basement becomes full of soaking wet paper towels and the leak is still going and the foundations are rotting – at which point the government announces they are out of paper towels and you are on your own. Right about then, someone may suggest calling a plumber to stop the leak but, unfortunately, all the money was spent on paper towels so a plumber is no longer a viable option!

This is still, at the core, very much like having a burst water pipe in the basement and the government's solution is to keep buying more paper towels to soak up the water. The water keeps coming and the government keeps buying more towels, which is not enough to keep the furniture from being destroyed. After a while, the basement becomes full of soaking wet paper towels and the leak is still going and the foundations are rotting – at which point the government announces they are out of paper towels and you are on your own. Right about then, someone may suggest calling a plumber to stop the leak but, unfortunately, all the money was spent on paper towels so a plumber is no longer a viable option!

The UK is already running low on paper towels, the price of insuring $10M of UK government debt against default for 5 years went from $71,750 on Friday to $82,250 yesterday. That impacts the cost the government has to pay to borrow all the money they are spending on paper towels! Additionally, blanket guarantees might inspire banks to take unnecessary risks, warned Frederic Mishkin, a Columbia University economist who stepped down as Fed governor in August. "You don't want to give a guarantee to banks that are in trouble" that might try to gamble their way out of problems, he said.

![[bailout plans]](http://s.wsj.net/public/resources/images/NA-AT144_EBANKS_NS_20081013203614.gif) But shhhhh, this is not a day to discuss problems – the Dow is up another 300 points ahead of Bush speaking at 8 am and the global markets are flying so let's just enjoy the ride and keep watching our levels, who knows how far this train can go before we run out of tracks. I have been saying since 11,500 that we have a crisis of confidence – it would not be all that surprising to see the restoration of confidence take us back to that level but it's going to be all about earnings and economic data after today.

But shhhhh, this is not a day to discuss problems – the Dow is up another 300 points ahead of Bush speaking at 8 am and the global markets are flying so let's just enjoy the ride and keep watching our levels, who knows how far this train can go before we run out of tracks. I have been saying since 11,500 that we have a crisis of confidence – it would not be all that surprising to see the restoration of confidence take us back to that level but it's going to be all about earnings and economic data after today.

There's an expression that goes "In for a penny, in for a pound" a pound being the UK currency that was the equivalent of 240 pennies at the time. The EU governments in the chart on the left are already in for 200 Trillion pennies of firm commitments and they will certainly have to go in for the whole pound should this round of bail-outs not prove to be enough.

We took an opportunity to get some more gold yesterday as the GLD ETF fell all the way to $82 and hyper-inflation is still one possible outcome of all this economic tinkering, something I wrote about back in February and maybe that is the plan – you won't be upside down on your mortgage if your home inflates from $300,000 to $3M over the next few years, right? Silver is actually down more than gold and I really like SLW, who are down at $5.50 and there are plenty of covers to sell, like the Nov $5s at $1.40 but I like it better just speculating to the upside (of course selling the Nov $7.50s for .50 is a 10% return right there!).

Those EWJs I mentioned in yesterday's morning post will be exploding out of the gate today as the Nikkei jumps an astounding 14% in today's trading. That should rocket that ETF to about $10, and not at least covering those calls with the Nov $10s at $1+ is just greedy at this point. Unlike the Nikkei, the Hang Seng was open yesterday and tacked on a more modest 3% in today's trading. The Shanghai, for it's part, added 0.4% and the finish at 212 is not at all impressive. Hong Kong put blanket guarantees on their banks as well, as did Japan.

LIBOR remains critically high and all these efforts are for nothing if the banks don't start lending to each other again. As with the UK, the issue is now whether or not the banks can trust the government guarantees that are backing the banks that need to borrow the money and, so far, the answer is – not quite yet. Despite those underlying fundamentals and despite record UK inflation (Already? We're just getting started!) and despite a 4% jump in oil prices, the European markets are up another 5% this morning (8:15).

15% seems to be the magic 2-day global number and that would give us about 9,775 on the Dow, 1,035 on the S&P, 6,555 on the NYSE, 1,900 on the Nasdaq and 600 on the Russell. We will still be looking for the Transports to retake the 40% off the top level of 1,868 and the SOX to retake 329, which would require another day like yesterday for both of them. If we can get there, at least we are on the road to recovery and we can get back to analyzing some actual data for a change.

Once all the government action moves below the fold of the newspapers, focus will shift to economics and earnings. We have a joke of a Treasury Budget report today, PPI, Retail Sales and Business Inventories tomorrow (and oil, of course) along with the Beige Book – which should be interesting. Thursday is the always terrifying Jobless Claims along with Net Foreign Purchases, which are very important because we just added $1Tn to our debt, along with Industrial Production and Cap Utilization and the Philly Fed, which might suck. Friday is housing, not usually a ray of sunshine along with Michigan Consumer Sentiment, which would be amazing if it’s only poor.

I still love the UYGs as a long play. They are ultra-long financials and money is just pouring into that sector. The UYGs are already up 30% from our initial entry but, so what? They are still DOWN 85% from last year's levels and you can buy the ETF for $12 and sell the Nov $12 calls for $2.50, which is a 26% one-month return if you are called away there. You can also just pick up the March $16s for $2.25 and, if the UYGs recover just 20% of the $60 they've lost by then, those calls will be $5 in the money. Never in history has a massive, globally coordinated effort been undertaken to rescue an economy and THE FOCUS of this rescue is directly aimed at the financial sector and you have the opportunity to pick up this Financial ETF 85% off its highs. Chances like this do not come along very often. Of course, if we fall below yesterday's close ($11 on the UYG) – something is wrong and you can stop out but if this rally starts to fly, this ETF can post some stunning gains.

Now (8:45) Paulson is laying out the above plan and our pre-markets are up 400 points. He just turned it over to Bernanke, who is saying that the massive action being undertaken is both necessary and timely. Sheila Blair of the FDIC is rolling out her message too – this is really an amazing thing, well coordinated and, dare I say, confidence-inspiring. We'll have to wait and see how all this is absorbed, and how well we hold up against the earnings and data but what an exciting week this is!

On the hedging side, it's a shame not to pick up some ultra-short Dow DXDs at the open, just in case things do not go as well as the futures are indicating. The DXD Jan $70s (DXWAR) should open around $14 and were trading at $32.50 on Friday. There are great premiums on the Oct $75s, which closed at $5 yesterday or the Nov $80s, which were $8.55 at yesterday's close and either could be sold if the Dow does break over 9,700. Not reaching 10,000 this week will be a bad thing and you ARE going to want some good protection into the weekend so initiating something here that you can sell premium against ahead of Friday's expiration is not a bad way to begin covering the downside – just in case the basement is still flooding!