Another week down the drain – literally.

Another week down the drain – literally.

Back on October 2nd, with the Dow still at 10,500 we were already looking for cover in well protected plays and I put up 3 "Option Plays That Are Better Than Cash" and I'm pleased to say that, despite a 20% decline in the Dow since then, all 3 of those plays are working (although GE is testing our lower limit). It's important to understand the mechanics of these option strategies as they allow us to stay in the markets while picking up gains that are significantly better than CDs or treasuries without having to ties money up over a specific time frame or (yikes) putting it in a bank.

Of course this wasn't our first bearish set of calls, we went bearish on the financials on Sept 8th (Dow 11,500), choosing SKF Jan $90 calls to cover the finanicals when they were way down at $22 (now $77.60) and on 9/11 we got even more bearish as the bailout seemed like a very wrong way to go and, by Sept. 15th, it was time to go short on the Russell with $700 puts – but who would have thought they could go from $16.20 to over $200 in the next 3 weeks? So there are always ways to make money by staying in the market and balancing out your virtual portfolio. Recently we've been generally looking at staying 70% bearish with 30% speculating to the upside and, while we THINK we are getting some real bargains, what we are looking for now is a proper turn signal that will let us at least shift to a neutral stance.

Have we really wiped out 35% of the Russell 2000's value in 45 days? Is a stock only worth what it's going to make next year or do we still invest for the long-haul? When the Dow was still around 10,000, on October 7th, I said that, although things seem cheap, value is an illusion in a panicked market – a point that was driven home to me as I sat through the optimistic presentations at the Value Investing Congress and I said that evening: "Bear in mind that we had a huge "rally" after the initial sell-off of 1929 and everything looked better for about 6 months but it is widely held that the government’s failure to increase the money supply is what led to the later, much worse, sell-off – along with a very unfortunate drought that hit the economy at the same time. Bank failures ground consumer spending to a halt. Recessions are a natural part of the market cycle, Depressions are a crisis of confidence."

We are now at the very edge of a depression as a recession is already obvious and, without real action that directly addresses the housing crisis at the source (the people losing their homes), the depression felt by the millions of homeowners who are becoming the new homeless will spread through society like a virus until this whole country is truly and thoroughly DEPRESSED. A depression would make our current situation seem like good times and we still need to guard against that possibility, even as we hope that we may have found a recessionary bottom at 8,000.

I do have a bullish premise and it's right here in this chart on the right – my premise has been from day one this year that the consumer is being killed by high commodity prices and, while I underestimated the extreme levels that commodity prices could be driven to, you can see from Bespoke's numbers that the effect is obvious. By July, the PER CAPITA daily cost of food and energy prices had risen $4.77 for the year. For a family of 4, that's $572.40 per month that comes directly out of the household budget. With the average American take-home paycheck at just over $600 per week, you can imagine the impact of an extra $572.40 of after tax money per month going to necessities that cannot be put off.

Pehaps if the original stimulus package had come with a freeze on commodity prices (as they jumped an additional 35%, to record highs during the stimulus period) to prevent profiteering or perhaps if money had been funneled into addressing the housing crisis rather than misdirected bailouts we'd be in better shape but it's water under the bridge now. The good news is that the same greed that drive commodities to ridiculous highs is now crashing them quickly back to the lows and what was costing the average family of 4 $572.40 per month in July is now saving them $309.60 per month in October. We went too far one way for 4 months and we need to stay down here (roughly 250 on the CRB) through the end of the year to allow consumers to catch up on their credit cards but there may be light at the end of the tunnel if we can make it through this correction without too many more job losses.

Let's not forget that this week started with over $1Tn in Central Bank bailouts, which gave us a nice pop on Monday morning but we were rightly skeptical of the rally in the morning post and Monday did give us the high for the week. It's not that we don't think the infusion of capital will work, it's simply a question of how long it will take to get going. As we can see from the chart from WeeklyTA, we are HOPEFULLY forming a double bottom in the financials as the Trillions of dollars thrown at them begins to take hold

Let's not forget that this week started with over $1Tn in Central Bank bailouts, which gave us a nice pop on Monday morning but we were rightly skeptical of the rally in the morning post and Monday did give us the high for the week. It's not that we don't think the infusion of capital will work, it's simply a question of how long it will take to get going. As we can see from the chart from WeeklyTA, we are HOPEFULLY forming a double bottom in the financials as the Trillions of dollars thrown at them begins to take hold

If we've learned one thing in the markets lately it's never to jump the gun so we'll be continuing to watch our levels for signs of real improvement (or signs of a real crash) but it is good to place our bets on the sectors we see improving first. While the financials are very speculative, UYG calls at $8 are a position that gets better every day we go by without a major bank failure and are still the best way to play the finaincials long-term, especially as you can hedge by selling $9 calls for the amazing price of $1. Another nice hedge to the upside is the flip of the RUT puts we played on the way down. We aren't expecting a recovery as dramatic as the drop was and the Dec $550 calls (RUYLJ) can be sold for $13.75 against Dec '09 $550 calls at $44.55 (YQVLK), which is a nice $31 spread in an index that is down from 750 30 days ago. It would take a 20% move up in the Russell to put the caller in the money and stops could be taken at 10% (assuming we believe in that bounce!).

We didn't believe in Monday's bounce on Tuesday morning but we did like PFE and SMH spreads, which held up well for the week. We also had a big warning flag in the UK as we noted as the BOEs borrowing rate hit alarming levels and the FTSE led the western markets lower from that point forward with a 10% drop for the week. The question on Wednesday was would we hold our levels and, sadly, we did not – but as least there was no doubt from the opening of trading that the Asian meltdown was flowing right over to our markets. I said that morning: "Without more government intervention or some truly spectacular earnings this week (not looking good on either front) there is no reason to think we will reverse this downtrend." and we had no such luck on either front.

I think I summed up the whole week on Wednesday morning saying: "This is not a day for bottom fishing, we need to just be happy to hold our levels. The speculative upside continues to be the QLDs, which we loved back at $30.50 but may not get back there, as well as puts on the QID, which we were hoping to see make a lower high than 85 (75 was yesterday’s spike high) today and that makes the puts we looked at a fun play on the way back down. While many things will look tempting, anything less than a green close today is going to indicate nothing but continued weakness and it’s doubful we’ll mount much of a rally into the weekend with next week being chock full of data as well as the Fed meeting on Wednesday (where expectations of another cut are rising)."

Thursday morning we fixed our attention in the IWMs and they confirmed a break and, as Tom2oc notes in his Friday post, not breaking back over 48 was technically poor but very hard to tell on a Friday how much of that is simply due to nervous traders. While we looked for a "short, sharp shock" of a decline on Thursday morning – we didn't really get it until Friday's open when the futures went limit down pre-market but, unfortunately, we didn't quite get the heavy volume we wanted to confirm capitulation but we did get a nice second chance at the bottom fishing plays we looked at on Thursday.

We could still go either way next week as the IMF moves to bail out entire countries (Iceland and Ukraine are first in line) while we wait for another huge round of earnings reports along with a very big data week that includes New Home Sales on Monday; Consumer Confidence Tuesday; Durable Goods and the Fed on Wednesday; the Q3 GDP and Jobless Claims on Thursday; capped off on Friday with the Employment Cost Index, Personal Income and Spending, Chicago PMI and Michigan's October Sentiment. The Fed will disappoint without a rate cut and the GDP will confirm everyone's worst fears if it comes in negative – actually, it's hard to say what's going to happen to make us feel better isn't it?

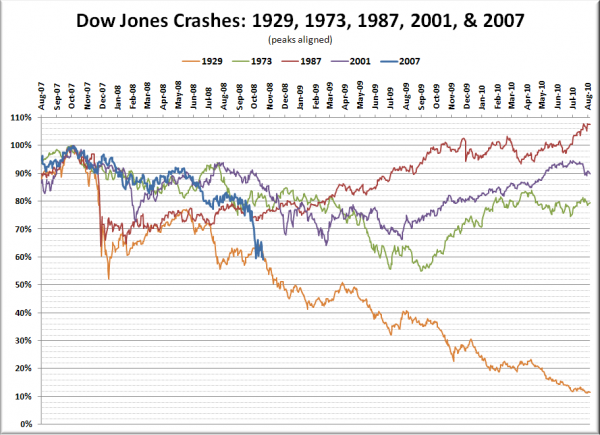

At this point we are on par for the worst market collapse in history (see above chart) as the crashes of '73 (down 18.3% after 1 year), 1987 (24.2%) and 2001 (13.6%) all showed signs of improvement after this much time. That's why the 40% off line is so critical, this is a great visual of how falling below it can start us snowballing down to truly horrific levels (as in "You ain't seen nothin' yet"). That's why we continue to favor a combination of ultra-short and ultra-long positions as well as the very well hedged, income-producing plays like the ones from October 2nd. There's no telling which way this market can go but having good balance allows us to go with the flow for now as we watch our levels very carefully.