Note on the AAPL buyback rumor. Courtesy of Trader Mark at Fund My Mutual Fund.

Apple (AAPL) Surging on Talk of Share Buyback

Stock buybacks have interestingly mean almost nothing in this horrid market – usually this has

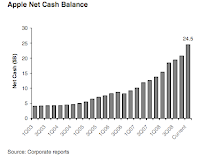

proven to be a great defense but the selloff is so relentless stocks with buybacks are punished just the same as those without. But in this respite in the market, Apple (AAPL) is surging on reports they might finally deploy their $25 billion war chest. This company is a splendid cash cow as the chart shows. Right now about 1/3rd of its market value is cash.

proven to be a great defense but the selloff is so relentless stocks with buybacks are punished just the same as those without. But in this respite in the market, Apple (AAPL) is surging on reports they might finally deploy their $25 billion war chest. This company is a splendid cash cow as the chart shows. Right now about 1/3rd of its market value is cash.- Apple is sitting on a huge cash reserve — $24.5 billion as of September and growing at the rate of $8 to $10 billion a year – that’s doing almost nothing for it.

- The money is earning about $1.55% interest after taxes, according to a report issued Wednesday by Bernstein Research’s Toni Sacconaghi, at a time when the company’s stock is trading at a unusually low (for Apple) multiple of 15 times earnings.

- “Mathematically,” he wrote “share buybacks boost EPS only if a stock’s P/E multiple is lower than the reciprocal of the after-tax interest rate earned on cash.”

- Apple has been trading at 30 to 40 times earnings in recent years, which Sacconaghi believes is one reason Apple has not initiated a stock repurchase program in the past 5 years.

- But today, according to Sacconaghi’s model, Apple is trading at about 18 times his fiscal year 2009 earnings estimate (and about 13 times earnings using non-GAAP numbers).

- Ten billion dollars spent purchasing Apple share, he estimates, would boost the company’s (GAAP) EPS about 4%. A $20 billion buyback program would boost it about 9%. And if the $20 billion program were front-loaded — completed in the first fiscal quarter of 2009 — the company’s EPS could jump as much as 15% (or $0.75 a share).

- According to Sacconaghi, better than the alternatives: making a major acquisition, paying a substantial dividend or continuing to let its cash horde grow

- A big dividend — say, 5% — would consume only about half Apple’s cash flow, and a special dividend would dilute Apple’s earnings growth too much to please shareholders.

Some combination of a dividend and buyback would be nice, but again this is an analyst speculation – nothing else.

Long Apple in fund; no personal position