Rob Hanna comments on the technical condition of the market and gives an update on his system for choppy market trading (posted at the end of August). Courtesy of Rob Hanna, at Quantifiable Edges.

Tests Of Strength

A few weeks ago I wrote about the propensity of upside gaps of 2% or more to pull back at some point in the following few days. There are currently 2 upside gaps of 2% or more that have yet to close below the opening gap price. They are the 10/28 and the 10/30 gaps. It appears unlikely that the 10/28 level of $87.34 will be threatened in the next day or so. Should the 10/30 opening gap also hold that could be viewed as a significant sign of strength for this early attempt at a rally.

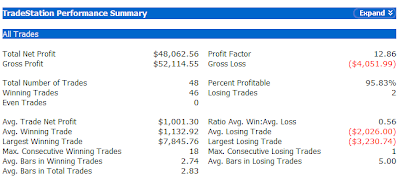

Another possible sign of strength will also be challenged in the next few days. In my August 28th post I showed a system that took advantage of the choppy, downward trading that had existed over the last year plus up to that point. Below are updated statistics of this simple system:

Sell short if the S&P 500 closes higher 2 days in a row. Cover on close below entry price – up to 4 days later. If still not profitable on day 4, close anyway. $100k/trade. June 1, 2007 – present.

Amazingly, the system has not triggered since 9/26/08. Therefore, the 48% profits generated were all achieved prior to the big October selloff. The system is also in an 18-trade winning streak, dating back to April.

The market is reaching short-term overbought conditions that over the last year and a half have led to at least short-term pullbacks. Whether it is able to rally in the face of such conditions or whether it pulls back sharply in the next few days could be a telling sign of strength or weakness, and whether a character change could be in order.