The markets are already celebrating an Obama victory.

It is, of course, well known that Democratic administrations are better for the markets and the past year's performance under Bush has sunk the Republicans reputation for being good for business perhaps as much as Hoover did in the 30s. Like it or not, redistributing wealth from the rich to the poor allows the poor to be consumers and we are a consumer-based society that does well when people (as in "we the people") have a little bit of money to spend. Another tax on the poor that has been lifted is oil, as crude slipped back below $65 per barrel in yesterday's trading bringing America's daily oil expenditures down from $80Bn a month in June to a rate of $37Bn a month in October. On an annualized basis, that's a $516Bn stimulus package that goes directly back into the pockets of consumers on a daily basis.

A lot is being made about Obama being a socialist and redistributing wealth but that is not how the rest of the world (where Socialism isn't a dirty word, but a widely accepted form of government) sees it. Money is pouring back into US markets from overseas and the futures are up considerably as even Barron's points out that Obama is viewed as the fiscal conservative of the two candidates. Cutting through the rhetoric, here's how the redistribution of wealth actually breaks down under Obama vs. McCain:

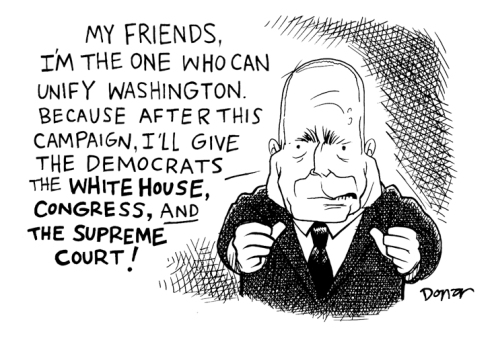

With McCain's tax plan weighing a 4.4% tax break to the 0.1% of families making over $2.8M a year and another 3.4% break to those 3M American families struggling to get by on just $600,000 a year in income while cutting US tax revenues by 2% to pay for it (and that, of course, assumes income is steady from last year), it's no wonder the countries who lend us money and who, for the most part, pay significantly higer taxes than we do, have been hesitant to invest in the US. Even the top 1% are realizing this year that they aren't going to make their $600,000+ if they can't do something to reenergize the bottom 80% of the consuming public.

Most companies make money selling lots of things to lots of people and most of the top 1% own those companies or invest in those companies. The 90M (out of 110M) American families who make less than $110,000 a year have been rocked by $75 fill-ups and mortgages that have adjusted from an average of $1,850 a month to $2,670 per month. When you are taking home "just" $50,000 a year, an extra $5,000 in gas and $10,000 in mortgage payments is going to eat into your discretionary spending isn't it?

Most companies make money selling lots of things to lots of people and most of the top 1% own those companies or invest in those companies. The 90M (out of 110M) American families who make less than $110,000 a year have been rocked by $75 fill-ups and mortgages that have adjusted from an average of $1,850 a month to $2,670 per month. When you are taking home "just" $50,000 a year, an extra $5,000 in gas and $10,000 in mortgage payments is going to eat into your discretionary spending isn't it?

5M of those families currently have foreclosure notices so it is unlikely they'll be heading off to the mall to do some early holiday shopping and we've already seen the horrendous restaurant and retail numbers that are NOT going to be turning around by giving a 4% tax credit to 1.1M families and less than 1% to the other 109M families. As I said, lower oil prices will help tremendously but again, Obama seems to be slightly less pro Big Oil than McCain and the prospect of a Democratic House and Senate is already terrifying the energy speculators who ran wild under Bush.

So, like it or not, change is clearly in the air and we need to look ahead and invest accordingly. Tech has always done well under the Democrats and we've been picking up a lot of tech plays along with the ultra-long QLDs since they were down below $30 (now $35). We saw solar make a strong move yesterday as solar energy is a cornerstone of Obama's energy policy The Dow in general tends to do well under the democrats and we can expect housing to bottom out over time but for now, we'll be concentrating on tech, especially well-capitalized companies that do not need to borrow to survive as money is still very, very tight.

So, like it or not, change is clearly in the air and we need to look ahead and invest accordingly. Tech has always done well under the Democrats and we've been picking up a lot of tech plays along with the ultra-long QLDs since they were down below $30 (now $35). We saw solar make a strong move yesterday as solar energy is a cornerstone of Obama's energy policy The Dow in general tends to do well under the democrats and we can expect housing to bottom out over time but for now, we'll be concentrating on tech, especially well-capitalized companies that do not need to borrow to survive as money is still very, very tight.

We did a Big Chart review in last night's post and there is certainly some encouraging news there but we need to see that critical 6,232 level broken and held on the NYSE and, if the market takes off, I still like the SMH as a lagging mover. That ETF is still down at $20.20, down from $30 in August. If, like many undecided voters in this nation, you fear making a commitment, the Dec $19 puts can be sold for $1.05, giving you an instant 10% discount if the stock is put to you at the 5-year low of $18! We also need to keep an eye on the CAC today, as that index is still below the 3,701 40% level and is holding the EU markets back at the moment. Europe is up 2% overall this morning as are our pre-market numbers. Of course, Thursday we are expecting an ECB rate cut of half a point…

Asia was led higher by the Nikkei, which gained 6% as the yen pulled back, boosting exporters, who had been acting like the yen was heading back to 90. Of course, bouncing off 100 doesn't prove that it isn't so let's be careful but yesterday morning's call on the EWJ was a pretty good one! The Australian Central Bank made a .75 rate cut but the Baltic Dry Index fell another 3% and that kept a lid on most of Asia and the Shanghai actually gave up another 1.2% on the day while the Hang Seng held flat.

We'll see if we can hold these exciting pre-market gains today as our already very Socialist government indicates they will be expanding the list of corporations they will be taking ownership of beyond the the banking and insurance sectors. GE and CIT are rumored to be on Paulson's shopping list along with various bond insurers according to the WSJ. Of the original $700 billion made available to Treasury, officials set aside $250 billion for equity investments. It has already invested $163 billion in a range of banks including some of the nation's largest, such as GS and BAC. That number will likely expand at the expense of the asset-purchase plan, but by exactly how much is unknown.

We'll see if we can hold these exciting pre-market gains today as our already very Socialist government indicates they will be expanding the list of corporations they will be taking ownership of beyond the the banking and insurance sectors. GE and CIT are rumored to be on Paulson's shopping list along with various bond insurers according to the WSJ. Of the original $700 billion made available to Treasury, officials set aside $250 billion for equity investments. It has already invested $163 billion in a range of banks including some of the nation's largest, such as GS and BAC. That number will likely expand at the expense of the asset-purchase plan, but by exactly how much is unknown.

Still nothing is being done to bail out the actual homeowners and I continue to maintain that we cannot effect a real economic recovery without addressing the main cause of consumers' pain. The White House has failed to come together with the FDIC, who have a proposal to help between 2 and 3 Million homeowners by encouraging banks to reward troubled loans with a partial Federal guarantee but they can't get a commitment from the Administration to begin actually helping people. "Anyone telling you that they know the White House position on any of the various foreclosure mitigation plans — plural — that we are reviewing is a liar," White House spokesman Tony Fratto said.

Foreclosures tend to worsen the spiral of falling house prices because they depress the values of neighboring properties. They are also a central source of the problems undermining the financial system and the broader economy. "Even an ambitious program of mortgage modifications will not prevent a further decline in house prices," said Douglas Elmendorf, a senior fellow at the Brookings Institution and a former Clinton economic adviser. "It might prevent an overshooting of house prices on the downside. But houses still look overvalued relative to people's rents or incomes, and it's going to be very difficult to sustain house prices at their current level."

Let's keep that in mind – no matter who wins today, there are no quick fixes. We moved to 50/50 bullish last week and we have no reason to get more bullish until we take back and hold our NYSE levels and, of course, we need to see those 40% lines hold across the board.