Yesterday was a real wild one!

I called it "Testy Tuesday" in the morning post and we tested both our upside (3 times) and downside (once) levels during a wild trading session. Our patience paid off as we got to our 8,200 goal where we did a little more bottom fishing, including a perfect flip to short on the SKFs right at our $200 goal on that ETF. In the morning post, I said to watch Dow 8,400, S&P 860, Nas 1,500, NYSE 5,400 and 455 on the Russell as the levels we wanted to break over for the day – while we touched those levels around noon, we were skeptical, even as we played the upside as I had told members that the mythical Plunge Protection Team would try to make Paulson look good during his testimony (and here's the CNBC clip discussing it yesterday).

Sure enough, once Paulson was done we finally got our dip and we played the market like a fiddle in our intra-day chat – hitting pretty much every turn on the nose as we stayed predictably range-bound all day. At 11:56, as the Dow and the Nasdaq tested our levels, I warned members: "Do not forget to ignore the Dow and focus on the NYSE, RUT and S&P in that order as they are less manipulated than the Dow and the Nas, we need real breakouts across the board for it to be real(ish)" and, an hour later, we went bearish again as I said: "Now if the Dow doesn’t get back over 8,400 soon we are likely to head back to at least 8,250 and the S&P and RUT and Qs would have me leaning that way. If anything, I would say that the volatility of this market is underpriced."

It seems crazy to predict up and down 100, 200 and 300 point market moves all during the same session – it's something we used to predict for the month! We are still in an amazingly profitable day-trading environment and, while It was depressing to give up 300 points off the morning rally (even though it was BS), we stuck to our plan and I listed 15 stocks at 1:21 for our bottom fishing expedition (following our hedged entries, of course).

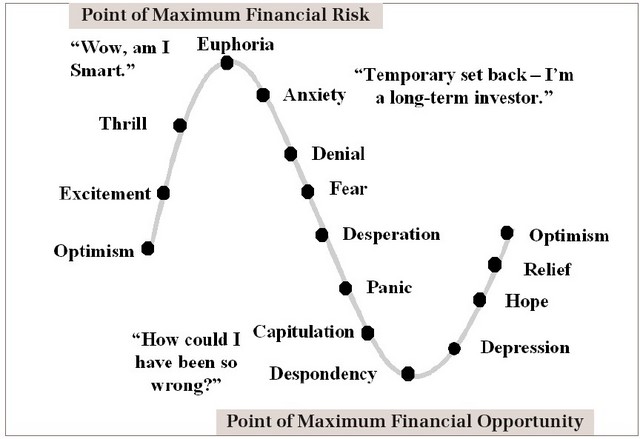

This market has really beaten a lot of people up and the sentiment of our members was getting very negative after lunch, so I gave one of my motivational speeches at 2:19, answering Fab's question as to whether it's good to buy into the flush, saying: "Buying the flush/Fab – That’s kind of the whole point. Our goal was to turn from 60/40 bearish to 60/40 bullish at 8,000 so around here (8,200) the idea is to start cashing in some successful short-side plays and picking up some more calls (hedging, of course). If we don’t turn back up around here, we won’t be over-committed to the upside but if it does hold and we head back to 9,000 – then it couldn’t be more perfect."

Of course we picked up our usual QLDs and UYGs at the bottom and we hit the turn on the nose at 2:56 as the S&P held the 2.5% rule at 830 and then we ran with the bulls BUT… BUTBUTBUT – we did NOT break out past our levels so that left me saying at the close: "Still no GOOG $300 and no AAPL $90 so what kind of rally is this?" Today could go either way – I noted yesterday that we have a lot of data points to look at today and tomorrow and we got the slight downside follow-through in Asia with both the Hang Seng and the Nikkei looking like they are trying to put in a bottom, each down about half a point.

Shanghai bounced back 6.3%, regaining all but a point of what it lost Tuesday. China was led higher by oil refiners on hopes that a fuel tax would help improve refining margins so I'm not sure how great that news is. The really great news in Asia is that the Baltic Dry Index finally seems to have bottomed out above 800, down 95% from it's June high. While it may not seem like much, the index is not a stock but rather an indication of the cost of moving dry cargo around the World and I echo the very simple observation of Howard Simons: "People don't book freighters unless they have cargo to move." We'll be watching this closely as this may be our second indicator that global markets are thawing (LIBOR is already successfully down).

Shanghai bounced back 6.3%, regaining all but a point of what it lost Tuesday. China was led higher by oil refiners on hopes that a fuel tax would help improve refining margins so I'm not sure how great that news is. The really great news in Asia is that the Baltic Dry Index finally seems to have bottomed out above 800, down 95% from it's June high. While it may not seem like much, the index is not a stock but rather an indication of the cost of moving dry cargo around the World and I echo the very simple observation of Howard Simons: "People don't book freighters unless they have cargo to move." We'll be watching this closely as this may be our second indicator that global markets are thawing (LIBOR is already successfully down).

Europe is trending down over 2% ahead of our open as BASF announces it will temporarily close 80 plants and cut production at 100 more while warning on profits. One would think this would hurt XOM too but that stock is ridiculously holding on to $75 despite the fact that the main product they sell is now 1/3 of what it was in June, when the stock was at $90. The collapse of XOM and CVX to realistic levels is my biggest remaining Dow fear as they are 2 of the 3 largest components (IBM is holding $80) and can knock the Dow down 1,000 points if they fall back to the $50s.

In the US, our CPI showed the biggest drop in 61 years and home construction made record lows. This is nothing we didn't expect so we'll see how low they can take the markets this morning as it would still be nice to see a spike down with some volume conviction to put in a proper bottom as these sudden runs up don't leave us feeling good at all, especially when they can't even take out our technical levels. Another build in oil may send XOM reeling so they are my short of the day at $76-$77 range and the Dec $70 puts are just $3.10 and were $4.30 yesterday afternoon so if we get into those looking for $1+ with a stop at $2.50, that's a fun day trade. This trade can also be watched along the $55 line in oil after today's inventory report.

Bad news for the Big Three automakers as Senator Shelby favors bankruptcy over bailout but don't expect Congress to really let it happen. Paulson still has his magic checkbook and is saving some cash for just such an occasion. Until this issue is resolved, the markets will remain uncertain and we will remain uncommitted as we watch our levels as we ride the waves up and down, looking for a real trend!