Whee that was fun!

I won't go so far as to say "let's do it again" but we are already doing it again as I had pointed out to members yesterday that this is not even as bad as our Wednesday wipe-out of October 15th, when the Dow dipped 733 points to 8,577 or Wednesday Oct 22nd, when the Dow fell , 526 point to 8,519 or Wednesday, Nov. 5th, when the Dow fell 486 points to 8,695 or even last Wednesday, when the Dow fell 411 points to 8,282. Sometimes you need to be a market historian to get perspective.

Last Wednesday I talked about the official global recession and yesterday the Fed made it officially official in the US but there really wasn't anything in the minutes that was very surprising: They are ready to cut rates further (0% anyone?) and do not expect a rebound until Q3 and are bringing down their growth forecast to next year to 0.3% (from 1.3%). The Fed does seem out of touch with an unemployment forecast of just 6.5% and that worries me but none of this is new so we will see how well our bottom tests out today but I'm expecting us to at least test back to 8,200 – anything less than that will be a real disappointment.

It was hard to buy things yesterday, even though we planned to be more bullish between 8,200 and 8,000, actually seeing that 8,000 mark fall is simply depressing! Of course the XOM puts from yesterday's morning post did as expected with a $3.10 entry and a $4.40 finish (as I said, a fun day trade!) but our attempts to pick a bottom with DRYS and SKF puts have not gone well at all so far and the only stocks I could bear (oops, don't say bear!) to pick in yesterday's member chat were AA, BTU, TXN and X – none of which looked too good into the close but we're using our patented discount entry system that protects us all the way to Dow 7,000 at this point and our DIA puts are already past a double, making the bull side of our 50/50 mixture a free ride. There is an extensive discussion about virtual portfolio balancing at the end of yesterday's post and I urge members to read it as this is exactly the turning point we've been looking for.

Let's keep in mind though that this is a bottom test and there's a big difference between a test and an actual bottom (see David Fry's chart left), so we will continue to mind our levels but I'd rather go 50/50 here (from 60/40 bearish) in preparation of going 60/40 bullish and take the hit if we fail here than miss this opportunity to cash out the wildly successful short plays at what we pray, for the sake of the world, is a bottom in the US markets. Just this Monday, I mentioned the DXD and SKFs as good downside protection, the DXD's jumped from $82 Monday morning to $89.79 yesterday and the SKFs went from $170 all the way to $222 in the same 3 days – even if you are not leveraging with options that is a nice gain! Unfortunately, we gave up on them at $200 as that was over 100% gain on the options and now we're short on them but they broke right through the all-time highs as the financials dropped 10% yesterday alone.

FXPs are another very successful play we got out of a day too early as our $80 goal was shattered yesterday as the FXP's finished at $86.23. I think the FXPs are too dangerous to short but I do like the FXIs now that they are back near $20 where we had a very successful buy point 3 weeks ago (it was a quick 30% gain). The premiums have gotten extreme on the FXIs and you can buy the stock for $21.50 and sell the Dec $22 calls for $2.50 and also sell the Dec $21 puts for $2.50 which lowers your entry basis to $16.50. If you are called away (FXI finishes over $22 on Dec 19th), you make a 33% profit and if the stock is put to you (FXI finishes below $21), you will have an average entry of $18.75, which is 13% lower than we are today so, again, you are protected down to (assuming global markets trade in sync) Dow 7,000. Very simply, if the governments cannot effectively intervene to prop up the markets before this happens then the short side of our virtual portfolios will more than double and we'll be the last people on the planet with any money left so not so bad either way!

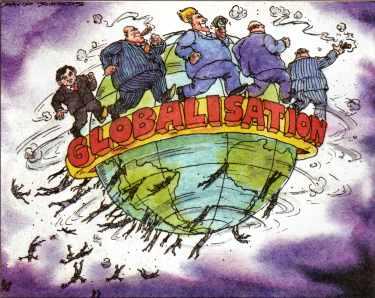

The planet is indeed in very dire straits with the Nikkei dropping 6.9% and the Hang Seng off 4% on the day. The Shanghai somehow held on and lost "just" 1% , holding up at 207, 65% off the top but (to look on the bright side of something this morning) 20% off the 10/27 bottom of 172 and holding just above the 50 DMA. As I said earlier in the week, the good news about these rapid declines is we're lowering our technical break-out points rapidly and we can mount a rally off some very low expectations from down here at some point. The entire MSCI World Index lost 2.1% this morning, the lowest level since April, 2003 with emerging markets falling 5% and Russia falling yet another 9% before trading was halted there. “We're seeing a total collapse of trust in everything fundamental,'' said Espen Furnes, an Oslo-based fund manager at Storebrand Asset Management, which has the equivalent of $48 billion. “There are no buyers in sight. This year will go down in history.''

The planet is indeed in very dire straits with the Nikkei dropping 6.9% and the Hang Seng off 4% on the day. The Shanghai somehow held on and lost "just" 1% , holding up at 207, 65% off the top but (to look on the bright side of something this morning) 20% off the 10/27 bottom of 172 and holding just above the 50 DMA. As I said earlier in the week, the good news about these rapid declines is we're lowering our technical break-out points rapidly and we can mount a rally off some very low expectations from down here at some point. The entire MSCI World Index lost 2.1% this morning, the lowest level since April, 2003 with emerging markets falling 5% and Russia falling yet another 9% before trading was halted there. “We're seeing a total collapse of trust in everything fundamental,'' said Espen Furnes, an Oslo-based fund manager at Storebrand Asset Management, which has the equivalent of $48 billion. “There are no buyers in sight. This year will go down in history.''

$32 Trillion dollars have been lost in global equities this year, over $40 Trillion off the highs of last year. Most analysts are pinning the blame on the administration as Paulson took the $700Bn authorized by Congress to stabilize the mortgage market and instead handed it out as loans, doing nothing at all to fix the CDO issue. “Changing the terms of the TARP as suddenly as he did undermined investor confidence,'' said Richard Schlanger of Pioneer Investments. “It's a frightening situation.'' Gee, who'd have ever thought that this administration would tell Congress they were going to do one thing and then turn around and do something else – we never could have seen that coming…

Europe is trading down around the 2.5% rule, which isn't bad considering and oil is down at $50. The energy sector, as I mentioned yesterday, has yet to capitulate and that by itself can take us down to 7,000 if some other sectors don't begin to pick up the slack. As we expected the Dollar continues to rise as money flies into the relative safety of US bonds and TBills, which are moving lower every day despite the multi-Trillion dollar money dump by the global Central Banks. Gold bugs aren't fooled, deflation now and hyper-inflation later is my outlook as commodities come back to reality. The dollar is up 20% since July and gold is down 22% over that period so, globally, gold is flat at what was $950 at the time.

While we made a new low on the S&P in dollars, in Euros we are not there yet with 3% left to go so let's keep a very firm eye on our 2.5% rules today as I predicted a bad open and it looks like we're going to get it (546,000 jobs lost last week!) but, if we can bounce off here back over 8,000, especially if we get back to 8,200 without a big pullback, then it may finally be time to rebalance just a little more bullish. If not, DIA puts and DXD calls can still go a long, long way for us.